Adjusted Present Value (APV) Overview

APV is often used in situations where the capital structure of a company is expected to change over time, such as in mergers and acquisitions or when considering the effects of leverage on a project’s value. By incorporating the tax benefits of debt financing and the costs associated with it, APV provides a more accurate valuation of the project.

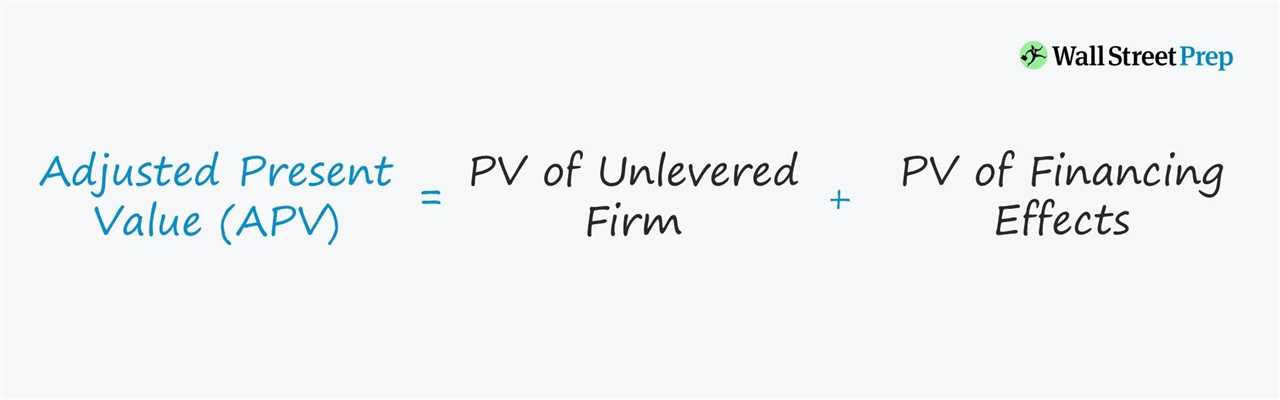

Formula

The formula for calculating APV is as follows:

APV = NPV + PV(Tax Shields)

Where:

- APV is the Adjusted Present Value

- NPV is the Net Present Value of the project’s cash flows

- PV(Tax Shields) is the present value of the tax shields associated with debt financing

Example

Let’s consider a project with an initial investment of $1,000,000 and expected cash flows of $200,000 per year for 5 years. The cost of debt financing is 5% and the tax rate is 30%. The discount rate used to calculate the present value of the cash flows is 10%.

To calculate the APV, we first calculate the NPV of the project’s cash flows:

NPV = $1,000,000

Next, we calculate the present value of the tax shields:

PV(Tax Shields) = (Debt * Tax Rate) / Discount Rate

PV(Tax Shields) = ($1,000,000 * 5% * 30%) / 10%

PV(Tax Shields) = $150,000

Finally, we calculate the APV:

APV = NPV + PV(Tax Shields)

APV = $1,000,000 + $150,000

APV = $1,150,000

Therefore, the Adjusted Present Value of the project is $1,150,000.

Adjusted Present Value (APV) Formula and Example

The Adjusted Present Value (APV) is a financial valuation method used to evaluate the value of a project or investment by considering the impact of financing decisions. It takes into account the tax benefits and costs associated with different financing options.

The formula for calculating the Adjusted Present Value (APV) is as follows:

- Calculate the present value (PV) of the expected cash flows generated by the project or investment without considering any financing effects.

- Calculate the tax shield value (TSV) by multiplying the tax rate by the tax-deductible expenses, such as interest payments on debt financing.

- Calculate the present value (PV) of the tax shield value (TSV) by discounting it at the appropriate discount rate.

- Calculate the adjusted present value (APV) by adding the present value (PV) of the cash flows and the present value (PV) of the tax shield value (TSV).

Here is an example to illustrate the calculation of the Adjusted Present Value (APV):

- Initial investment: $1,000,000

- Expected cash flows: $200,000 per year for 5 years

- Tax rate: 30%

- Discount rate: 10%

- Interest expense on debt financing: $50,000 per year for 5 years

Step 1: Calculate the present value (PV) of the expected cash flows without considering any financing effects:

PV = $200,000 / (1 + 0.10)^1 + $200,000 / (1 + 0.10)^2 + $200,000 / (1 + 0.10)^3 + $200,000 / (1 + 0.10)^4 + $200,000 / (1 + 0.10)^5 = $1,486,322.31

Step 2: Calculate the tax shield value (TSV) by multiplying the tax rate by the tax-deductible expenses:

TSV = 0.30 * $50,000 + 0.30 * $50,000 + 0.30 * $50,000 + 0.30 * $50,000 + 0.30 * $50,000 = $75,000

Step 3: Calculate the present value (PV) of the tax shield value (TSV) by discounting it at the appropriate discount rate:

PV = $75,000 / (1 + 0.10)^1 + $75,000 / (1 + 0.10)^2 + $75,000 / (1 + 0.10)^3 + $75,000 / (1 + 0.10)^4 + $75,000 / (1 + 0.10)^5 = $349,938.43

Step 4: Calculate the adjusted present value (APV) by adding the present value (PV) of the cash flows and the present value (PV) of the tax shield value (TSV):

APV = $1,486,322.31 + $349,938.43 = $1,836,260.74

Therefore, the Adjusted Present Value (APV) of the project or investment is $1,836,260.74.

The Adjusted Present Value (APV) method is useful in evaluating projects or investments that involve significant financing decisions, such as debt financing or tax benefits. It provides a more accurate valuation by considering the impact of these financing factors on the project’s value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.