Activity Ratios: Definition, Formula, Uses, and Types

Activity ratios are financial ratios that measure a company’s efficiency in managing its assets. They provide insights into how well a company is utilizing its resources to generate sales and profits. By analyzing activity ratios, investors and analysts can assess a company’s operational efficiency and identify potential areas for improvement.

Formula: The formula for calculating activity ratios varies depending on the specific ratio being measured. However, most activity ratios involve dividing a relevant measure of activity or sales by a corresponding measure of assets. Some common activity ratios include inventory turnover ratio, accounts receivable turnover ratio, and total asset turnover ratio.

Uses: Activity ratios are used by investors, analysts, and managers to assess a company’s operational efficiency and financial health. These ratios can help identify areas of improvement and potential risks. For example, a low inventory turnover ratio may indicate poor inventory management, while a high accounts receivable turnover ratio may suggest effective credit and collection policies.

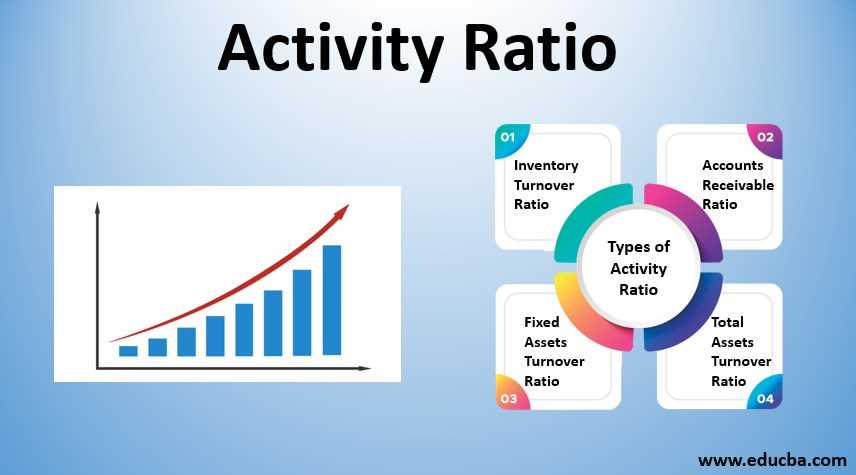

Types: There are several types of activity ratios that focus on different aspects of a company’s operations. Some common types include inventory turnover ratio, accounts receivable turnover ratio, fixed asset turnover ratio, and total asset turnover ratio. Each ratio provides insights into a specific area of a company’s operations and helps in evaluating its efficiency.

What are Activity Ratios?

Importance of Activity Ratios

Types of Activity Ratios

There are several types of activity ratios that measure different aspects of a company’s operations. Some common types of activity ratios include:

- Inventory turnover ratio: measures how quickly a company sells its inventory and replenishes it.

- Accounts receivable turnover ratio: measures how quickly a company collects payments from its customers.

- Fixed asset turnover ratio: measures how efficiently a company utilizes its fixed assets to generate sales.

- Total asset turnover ratio: measures how efficiently a company utilizes all its assets to generate sales.

- Working capital turnover ratio: measures how efficiently a company utilizes its working capital to generate sales.

These ratios provide different perspectives on a company’s operational efficiency and can be used to compare a company’s performance to industry benchmarks or competitors.

Activity Ratios Formula

There are several types of activity ratios, each focusing on a specific aspect of a company’s operations. However, all activity ratios are calculated using a similar formula:

Activity Ratio = (Revenue / Average Total Assets)

This formula compares the company’s revenue to its average total assets over a specific period, such as a year. The result is expressed as a ratio, which indicates how efficiently the company is using its assets to generate revenue.

By analyzing activity ratios, investors and analysts can gain insights into various aspects of a company’s operations. For example, the inventory turnover ratio measures how quickly a company sells its inventory and can indicate the efficiency of its supply chain management. The accounts receivable turnover ratio measures how quickly a company collects payments from its customers and can indicate the effectiveness of its credit policies.

Uses of Activity Ratios

Activity ratios are important financial tools that help assess a company’s operational efficiency and effectiveness. These ratios provide insights into how well a company is utilizing its assets to generate revenue and manage its operations. Here are some key uses of activity ratios:

1. Performance Evaluation:

Activity ratios are used to evaluate a company’s performance by comparing its operational efficiency with industry benchmarks or historical data. By analyzing these ratios, investors and stakeholders can determine whether a company is utilizing its assets effectively and generating sufficient revenue.

2. Identifying Operational Issues:

Activity ratios can highlight operational inefficiencies or issues within a company. For example, a high inventory turnover ratio may indicate that a company is selling its products too quickly, potentially leading to stockouts or lost sales. On the other hand, a low inventory turnover ratio may suggest that a company is holding excessive inventory, tying up capital and increasing storage costs.

3. Assessing Working Capital Management:

4. Analyzing Asset Utilization:

Activity ratios also help analyze how effectively a company is utilizing its assets to generate revenue. For example, the fixed asset turnover ratio measures how efficiently a company is using its fixed assets, such as property, plant, and equipment, to generate sales. A higher ratio indicates better asset utilization and productivity.

5. Comparing Companies:

Activity ratios allow for the comparison of different companies within the same industry. By comparing these ratios, investors and analysts can identify companies that are more efficient in utilizing their assets and generating revenue. This information can be useful for making investment decisions or assessing a company’s competitive position.

Overall, activity ratios provide valuable insights into a company’s operational efficiency, working capital management, and asset utilization. By analyzing these ratios, investors, analysts, and stakeholders can make informed decisions and assess a company’s financial health and performance.

Types of Activity Ratios

1. Inventory Turnover Ratio

The inventory turnover ratio measures how quickly a company is able to sell its inventory and replace it with new stock. It is calculated by dividing the cost of goods sold by the average inventory. A high inventory turnover ratio indicates that a company is effectively managing its inventory and generating sales.

2. Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio measures how quickly a company is able to collect payments from its customers. It is calculated by dividing the net credit sales by the average accounts receivable. A high accounts receivable turnover ratio indicates that a company is efficient in collecting payments and managing its credit policies.

3. Accounts Payable Turnover Ratio

The accounts payable turnover ratio measures how quickly a company is able to pay off its suppliers. It is calculated by dividing the cost of goods sold by the average accounts payable. A high accounts payable turnover ratio indicates that a company is effectively managing its cash flow and paying off its suppliers in a timely manner.

4. Fixed Asset Turnover Ratio

The fixed asset turnover ratio measures how efficiently a company is able to generate sales using its fixed assets. It is calculated by dividing the net sales by the average fixed assets. A high fixed asset turnover ratio indicates that a company is effectively utilizing its fixed assets to generate revenue.

5. Total Asset Turnover Ratio

The total asset turnover ratio measures how efficiently a company is able to generate sales using all of its assets. It is calculated by dividing the net sales by the average total assets. A high total asset turnover ratio indicates that a company is effectively utilizing all of its assets to generate revenue.

By analyzing these activity ratios, investors and analysts can gain valuable insights into a company’s operational efficiency and effectiveness. These ratios can help identify areas of improvement and potential risks, allowing for better decision-making and financial planning.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.