What Is a W-9 Form

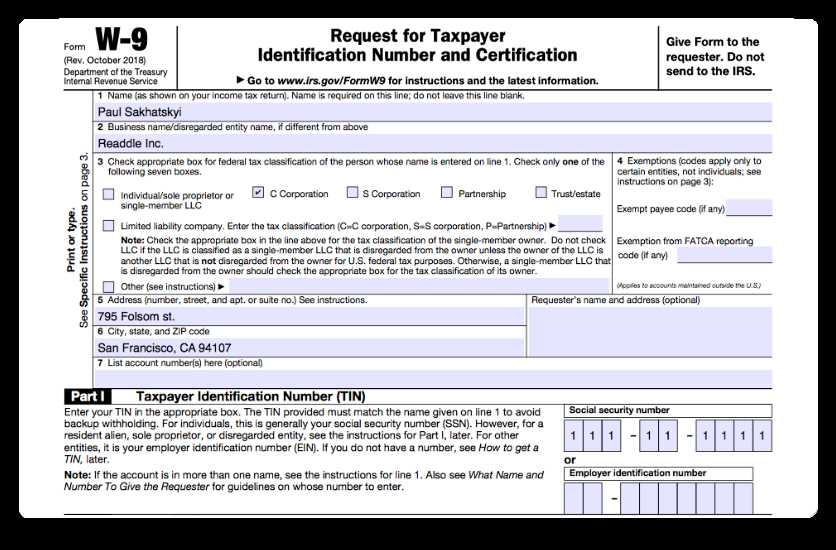

A W-9 form is an Internal Revenue Service (IRS) document used to collect information from individuals or businesses that are required to report income to the IRS. The form is officially titled “Request for Taxpayer Identification Number and Certification.”

The purpose of the W-9 form is to gather the taxpayer’s identification number, which can be either a social security number (SSN) or an employer identification number (EIN). This information is necessary for the IRS to accurately match income reported by the taxpayer with their tax return.

Completing a W-9 form involves providing basic personal or business information, including name, address, and taxpayer identification number. The form also includes a certification statement, where the taxpayer certifies that the information provided is correct and that they are not subject to backup withholding.

It is important to note that the W-9 form is not used to report income or calculate taxes owed. Its primary purpose is to provide the necessary information for the payer to report the income to the IRS. The taxpayer will still need to report the income on their tax return and pay any applicable taxes.

A Guide to Filing and Completing [INCOME TAX FORMS catname]

1. Obtain the form: The first step in completing a W-9 form is to obtain the form itself. You can download a copy of the W-9 form from the Internal Revenue Service (IRS) website or request a physical copy from the IRS.

2. Provide your personal information: The W-9 form requires you to provide your personal information, including your name, address, and Social Security number (SSN) or taxpayer identification number (TIN). Make sure to double-check your information for accuracy before proceeding.

3. Indicate your tax classification: The W-9 form requires you to indicate your tax classification. This includes options such as individual, sole proprietor, corporation, partnership, or disregarded entity. Select the appropriate tax classification that applies to you.

4. Certification and signature: The W-9 form requires you to certify that the information you have provided is correct. You must also sign and date the form. By signing the form, you are legally confirming that the information you have provided is accurate to the best of your knowledge.

5. Submitting the form: Once you have completed and signed the W-9 form, you can submit it to the appropriate party. This may be an employer, client, or other entity that requires your tax information. Make sure to keep a copy of the completed form for your records.

It is important to note that the information provided on a W-9 form is used for tax reporting purposes. If you are unsure about any aspect of the form or have questions about your tax obligations, it is recommended to consult with a tax professional or the IRS.

By following these steps and completing the W-9 form accurately, you can ensure that your tax information is properly reported and that you are in compliance with tax regulations.

The W-9 form is an important document used by the Internal Revenue Service (IRS) in the United States to gather information about individuals or entities that are required to report income to the IRS. The purpose of the W-9 form is to provide the IRS with the necessary information to ensure accurate reporting and withholding of taxes.

What is the W-9 Form?

Why is the W-9 Form Important?

The W-9 form is important because it helps the IRS track income and ensure that individuals and businesses are accurately reporting their earnings. By collecting the TIN of the payee, the IRS can match the income reported by the payer with the income reported by the payee on their tax return. This helps to prevent underreporting of income and tax evasion.

Completing the W-9 Form

Completing the W-9 form is a relatively simple process. The form itself consists of a series of boxes and lines where you can enter your name, address, and TIN. You will also need to indicate whether you are exempt from backup withholding, which is a form of tax withholding that applies to certain types of payments.

It is important to ensure that the information you provide on the W-9 form is accurate and up to date. If the information is incorrect or outdated, it could lead to errors in reporting and withholding of taxes. If you are unsure about how to complete the form, you may want to consult with a tax professional or the IRS for guidance.

Why You Need to Fill Out a W-9 Form

What is a W-9 Form?

Why Do You Need to Fill Out a W-9 Form?

There are several reasons why you may need to fill out a W-9 form:

| Reason | Explanation |

|---|---|

| Payment for Services | If you provide services to a company or individual and receive compensation, they may request you to fill out a W-9 form. This is to ensure they have the necessary information to report the payments made to you to the IRS. |

| Interest or Dividend Income | If you earn interest or receive dividends from a financial institution or investment account, they may require you to provide a W-9 form. This is to comply with IRS reporting requirements. |

| Real Estate Transactions | When buying or selling real estate, the parties involved may request a W-9 form. This is to report the transaction to the IRS and ensure proper tax reporting. |

| Partnerships and LLCs | If you are a partner in a partnership or a member of a limited liability company (LLC), the entity may require you to fill out a W-9 form. This is to gather the necessary information for tax reporting purposes. |

By filling out a W-9 form, you are providing the necessary information to the requesting party, allowing them to fulfill their tax reporting obligations. It is important to ensure the accuracy and completeness of the information provided to avoid any potential issues with the IRS.

Steps to Complete a W-9 Form

Completing a W-9 form is a straightforward process that requires attention to detail. By following these steps, you can ensure that you provide accurate and complete information:

1. Obtain the W-9 Form

The first step is to obtain a copy of the W-9 form. You can download the form from the Internal Revenue Service (IRS) website or request a physical copy from the organization that requires it.

2. Provide Your Name and Business Entity

On the form, you will need to provide your full legal name and the type of business entity you represent. This could be an individual, sole proprietorship, partnership, corporation, or other legal entity.

3. Enter Your Taxpayer Identification Number (TIN)

The next step is to enter your taxpayer identification number (TIN). For most individuals, this will be their Social Security Number (SSN). If you are a business entity, you will need to provide your Employer Identification Number (EIN).

4. Indicate Exemptions, if Applicable

If you are exempt from backup withholding or are exempt from FATCA reporting, you will need to indicate this on the form. Otherwise, you can leave these sections blank.

5. Provide Your Address

You will need to provide your mailing address on the form. This should be the address where you receive your mail and can be different from your business address.

6. Sign and Date the Form

Finally, you will need to sign and date the form to certify that the information you provided is accurate. By signing the form, you are also confirming that you are not subject to backup withholding.

Once you have completed all the necessary sections, you can submit the form to the organization that requested it. Make sure to keep a copy of the completed form for your records.

Completing a W-9 form is an important step in establishing your tax reporting status and ensuring that you receive the appropriate tax documents. By following these steps, you can confidently complete the form and provide accurate information to the necessary parties.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.