What is a Limit Order Book?

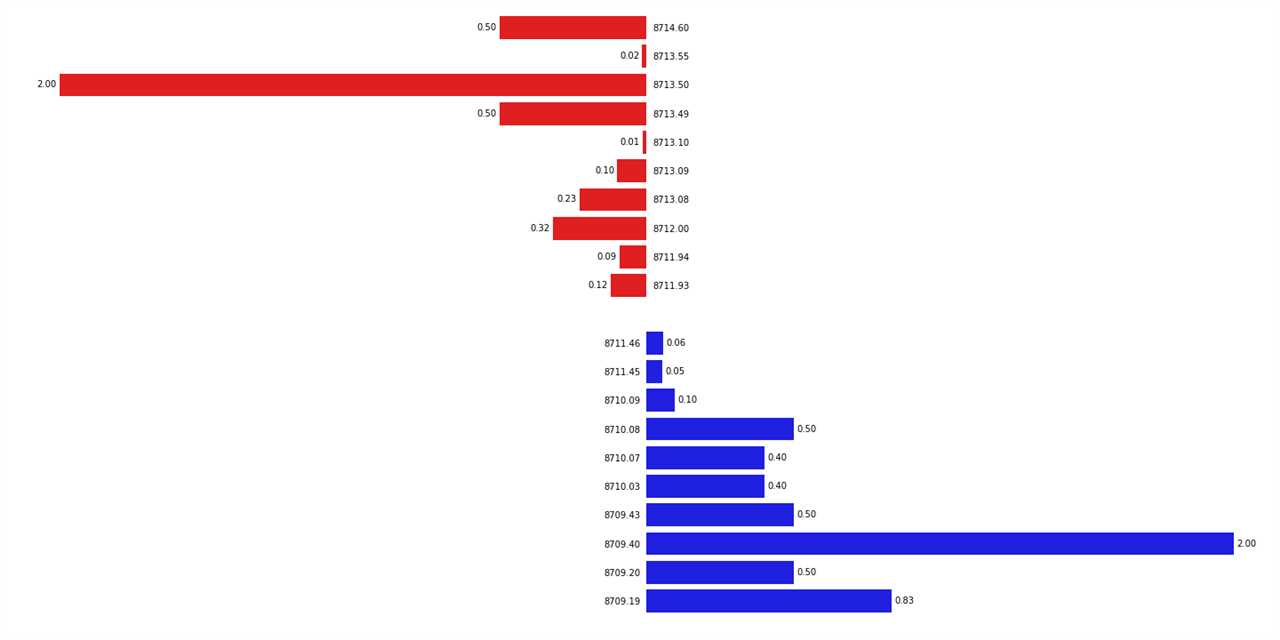

A limit order book is a record of all the buy and sell orders for a particular financial instrument, such as a stock or cryptocurrency, at various price levels. It is a crucial component of the trading infrastructure and provides transparency and liquidity to the market.

When traders want to buy or sell a financial instrument, they can place a limit order, which specifies the price at which they are willing to buy or sell. These limit orders are then added to the limit order book, which organizes them by price and time. The buy orders are typically listed on the “bid” side of the book, while the sell orders are listed on the “ask” side.

The limit order book allows traders to see the current supply and demand for a particular financial instrument. By analyzing the order book, traders can make informed decisions about when to buy or sell. For example, if there are more buy orders than sell orders at a certain price level, it indicates that there is strong demand and the price may increase. Conversely, if there are more sell orders than buy orders, it indicates that there is strong supply and the price may decrease.

Furthermore, the limit order book provides important data for market participants and researchers. It can be used to analyze market trends, identify patterns, and develop trading strategies. By studying the order book, traders can gain insights into market dynamics and make more informed trading decisions.

The Importance of Data in Limit Order Books

What is a Limit Order Book?

Before delving into the importance of data in limit order books, it is essential to understand what a limit order book is. A limit order book is a record of all the buy and sell orders for a particular financial instrument, such as stocks or cryptocurrencies, at various price levels. It displays the current supply and demand for the asset and helps traders determine the best price at which to buy or sell.

Now, let’s explore why data is crucial in limit order books:

1. Market Analysis:

2. Liquidity Assessment:

Limit order book data provides insights into the liquidity of a market. Traders can assess the depth of the order book to determine the availability of buyers and sellers at different price levels. This information is crucial for executing trades efficiently and avoiding slippage. Traders can also monitor the order book to identify large buy or sell orders that may impact the market.

3. Order Flow Analysis:

By analyzing the data in a limit order book, traders can gain insights into the order flow, which refers to the sequence of buy and sell orders entering the market. Order flow analysis helps traders understand the motivations and intentions of other market participants, such as institutional investors or high-frequency traders. This information can be used to anticipate market movements and make more accurate trading decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.