Fixed-Charge Coverage Ratio: Examples, Formula, Meaning

The fixed-charge coverage ratio is a financial ratio that measures a company’s ability to cover its fixed charges, such as interest expenses and lease payments, with its earnings before interest and taxes (EBIT). It is an important indicator of a company’s financial health and its ability to meet its financial obligations.

Formula

The formula for calculating the fixed-charge coverage ratio is:

Fixed-Charge Coverage Ratio = (EBIT + Fixed Charges) / (Fixed Charges + Interest Expenses)

Where:

- EBIT is the company’s earnings before interest and taxes

- Fixed Charges include lease payments, preferred stock dividends, and other fixed obligations

- Interest Expenses are the company’s interest payments on its debt

The higher the fixed-charge coverage ratio, the better the company’s ability to cover its fixed charges with its earnings. A ratio of 1 or higher indicates that the company is generating enough earnings to cover its fixed charges, while a ratio below 1 indicates that the company may have difficulty meeting its financial obligations.

Examples

Let’s look at a couple of examples to better understand the fixed-charge coverage ratio.

Example 1:

Company A has an EBIT of $500,000, fixed charges of $200,000, and interest expenses of $50,000.

Fixed-Charge Coverage Ratio = ($500,000 + $200,000) / ($200,000 + $50,000) = 2.5

This means that Company A’s earnings are 2.5 times its fixed charges and interest expenses, indicating a strong ability to cover its financial obligations.

Example 2:

Company B has an EBIT of $200,000, fixed charges of $300,000, and interest expenses of $100,000.

Fixed-Charge Coverage Ratio = ($200,000 + $300,000) / ($300,000 + $100,000) = 1.5

This means that Company B’s earnings are 1.5 times its fixed charges and interest expenses, indicating a moderate ability to cover its financial obligations.

Overall, the fixed-charge coverage ratio is an important financial ratio that helps investors and creditors assess a company’s ability to meet its fixed financial obligations. It provides valuable insights into a company’s financial health and its ability to generate sufficient earnings to cover its fixed charges.

What is Fixed-Charge Coverage Ratio?

The fixed-charge coverage ratio is a financial ratio that measures a company’s ability to cover its fixed charges, such as interest expenses and lease payments, with its operating income. It is an important indicator of a company’s financial health and its ability to meet its financial obligations.

The fixed-charge coverage ratio is calculated by dividing the company’s earnings before interest and taxes (EBIT) by its fixed charges. Fixed charges include interest expenses, lease payments, and other fixed obligations that the company must pay on a regular basis.

A higher fixed-charge coverage ratio indicates that the company has a greater ability to cover its fixed charges with its operating income. This is generally seen as a positive sign, as it suggests that the company is financially stable and can meet its financial obligations.

On the other hand, a lower fixed-charge coverage ratio indicates that the company may have difficulty covering its fixed charges with its operating income. This could be a sign of financial distress and may indicate that the company is at risk of defaulting on its financial obligations.

The fixed-charge coverage ratio is often used by investors, creditors, and analysts to assess a company’s financial health and its ability to service its debt. It is also used by lenders to evaluate the creditworthiness of a company and determine the interest rate and terms of a loan.

Fixed-Charge Coverage Ratio Formula

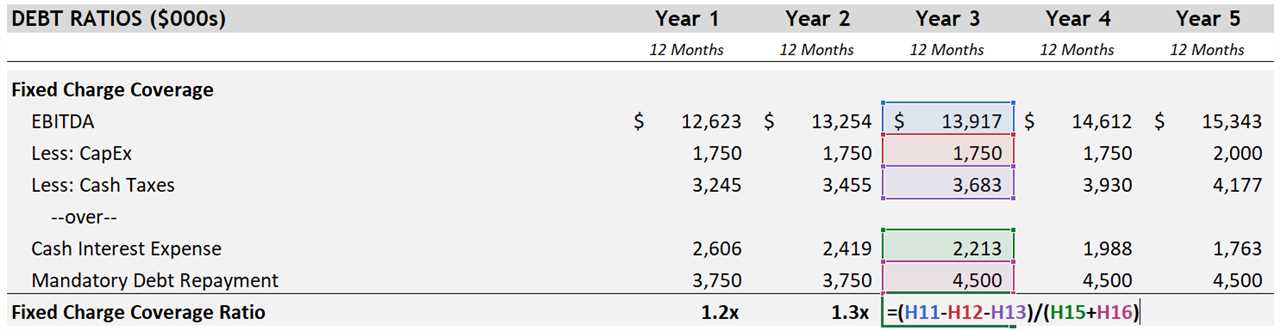

The fixed-charge coverage ratio is a financial metric used to assess a company’s ability to cover its fixed charges, such as interest expenses and lease payments, with its earnings before interest, taxes, depreciation, and amortization (EBITDA). It is an important indicator of a company’s financial health and its ability to meet its financial obligations.

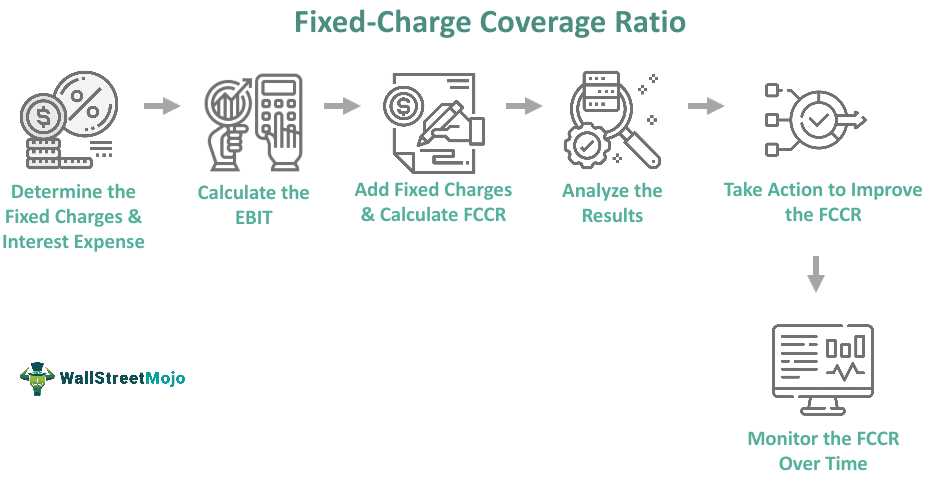

The formula to calculate the fixed-charge coverage ratio is:

Fixed-Charge Coverage Ratio = (EBITDA + Fixed Charges) / (Fixed Charges + Interest Expenses)

Where:

- EBITDA refers to earnings before interest, taxes, depreciation, and amortization. It represents a company’s operating profitability.

- Fixed Charges include fixed expenses such as lease payments, rental expenses, and other contractual obligations.

- Interest Expenses refer to the interest payments on the company’s debt obligations.

The fixed-charge coverage ratio provides insight into a company’s ability to generate enough cash flow to cover its fixed expenses and interest payments. A ratio greater than 1 indicates that the company has sufficient earnings to cover its fixed charges, while a ratio less than 1 suggests that the company may struggle to meet its financial obligations.

Investors and lenders often use the fixed-charge coverage ratio to assess the creditworthiness and financial stability of a company. A higher ratio indicates a lower risk of default and a stronger financial position.

Examples of Fixed-Charge Coverage Ratio

The fixed-charge coverage ratio is a financial metric that measures a company’s ability to cover its fixed charges, such as interest expenses and lease payments, with its operating income. It provides insight into a company’s financial health and its ability to meet its financial obligations.

Here are a few examples to help illustrate the calculation and interpretation of the fixed-charge coverage ratio:

Example 1:

Company ABC has an operating income of $500,000 and fixed charges of $200,000, which include interest expenses and lease payments. The fixed-charge coverage ratio can be calculated as:

Fixed-Charge Coverage Ratio = (Operating Income + Fixed Charges) / Fixed Charges

= ($500,000 + $200,000) / $200,000

= 2.5

A fixed-charge coverage ratio of 2.5 indicates that Company ABC is generating enough operating income to cover its fixed charges 2.5 times over. This suggests that the company is in a strong financial position and has a good ability to meet its financial obligations.

Example 2:

Company XYZ has an operating income of $300,000 and fixed charges of $400,000. The fixed-charge coverage ratio for Company XYZ can be calculated as:

Fixed-Charge Coverage Ratio = (Operating Income + Fixed Charges) / Fixed Charges

= ($300,000 + $400,000) / $400,000

= 1.75

A fixed-charge coverage ratio of 1.75 indicates that Company XYZ is generating enough operating income to cover its fixed charges 1.75 times over. While this ratio is lower than the ideal ratio of 2 or higher, it still suggests that the company has some ability to meet its financial obligations. However, it may be at a higher risk of defaulting on its fixed charges compared to a company with a higher ratio.

Example 3:

Company DEF has an operating income of $800,000 and fixed charges of $600,000. The fixed-charge coverage ratio for Company DEF can be calculated as:

Fixed-Charge Coverage Ratio = (Operating Income + Fixed Charges) / Fixed Charges

= ($800,000 + $600,000) / $600,000

= 2.33

A fixed-charge coverage ratio of 2.33 indicates that Company DEF is generating enough operating income to cover its fixed charges 2.33 times over. This suggests that the company is in a strong financial position and has a good ability to meet its financial obligations.

Overall, the fixed-charge coverage ratio is an important financial ratio that helps investors and creditors assess a company’s ability to meet its fixed financial obligations. A higher ratio indicates a stronger financial position, while a lower ratio may suggest a higher risk of default. It is important for companies to regularly monitor and improve their fixed-charge coverage ratio to maintain financial stability.

Meaning and Importance of Fixed-Charge Coverage Ratio

The fixed-charge coverage ratio is a financial metric that measures a company’s ability to cover its fixed charges, such as interest expenses and lease payments, with its operating income. It is an important indicator of a company’s financial health and its ability to meet its financial obligations.

The fixed-charge coverage ratio is calculated by dividing the company’s earnings before interest and taxes (EBIT) by its fixed charges. A higher ratio indicates that the company has a greater ability to cover its fixed charges, while a lower ratio suggests that the company may be at a higher risk of defaulting on its financial obligations.

Investors and creditors use the fixed-charge coverage ratio to assess a company’s creditworthiness and financial stability. A high ratio indicates that the company is financially strong and can easily meet its fixed obligations, making it more attractive to lenders and investors. On the other hand, a low ratio may raise concerns about the company’s ability to generate sufficient cash flow to cover its fixed expenses.

The fixed-charge coverage ratio is particularly important for companies with high levels of debt or lease obligations. It provides insight into whether the company has enough cash flow to service its debt and lease payments, which are fixed obligations that must be paid regardless of the company’s profitability.

Furthermore, the fixed-charge coverage ratio can also be used to compare a company’s financial performance with its industry peers. By benchmarking the ratio against industry averages, investors and analysts can evaluate how well the company is managing its fixed charges relative to its competitors.

In summary, the fixed-charge coverage ratio is a crucial financial metric that helps assess a company’s ability to meet its fixed financial obligations. It provides valuable insights into a company’s financial health, creditworthiness, and ability to generate sufficient cash flow. Investors, creditors, and analysts rely on this ratio to make informed decisions about investing in or lending to a company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.