What Are Guaranteed Payments to Partners?

Guaranteed payments to partners are a common feature in partnerships and are an important aspect of the partnership agreement. These payments are made to partners who provide services to the partnership and are intended to compensate them for their contributions.

Definition

A guaranteed payment is a specific amount of money that is paid to a partner regardless of the partnership’s profits or losses. It is a fixed payment that is agreed upon in the partnership agreement and is typically made on a regular basis, such as monthly or annually.

Unlike a distribution of profits, which is based on the partnership’s financial performance, guaranteed payments are not dependent on the partnership’s profitability. This means that partners who receive guaranteed payments will receive the agreed-upon amount even if the partnership incurs losses.

Tax Considerations

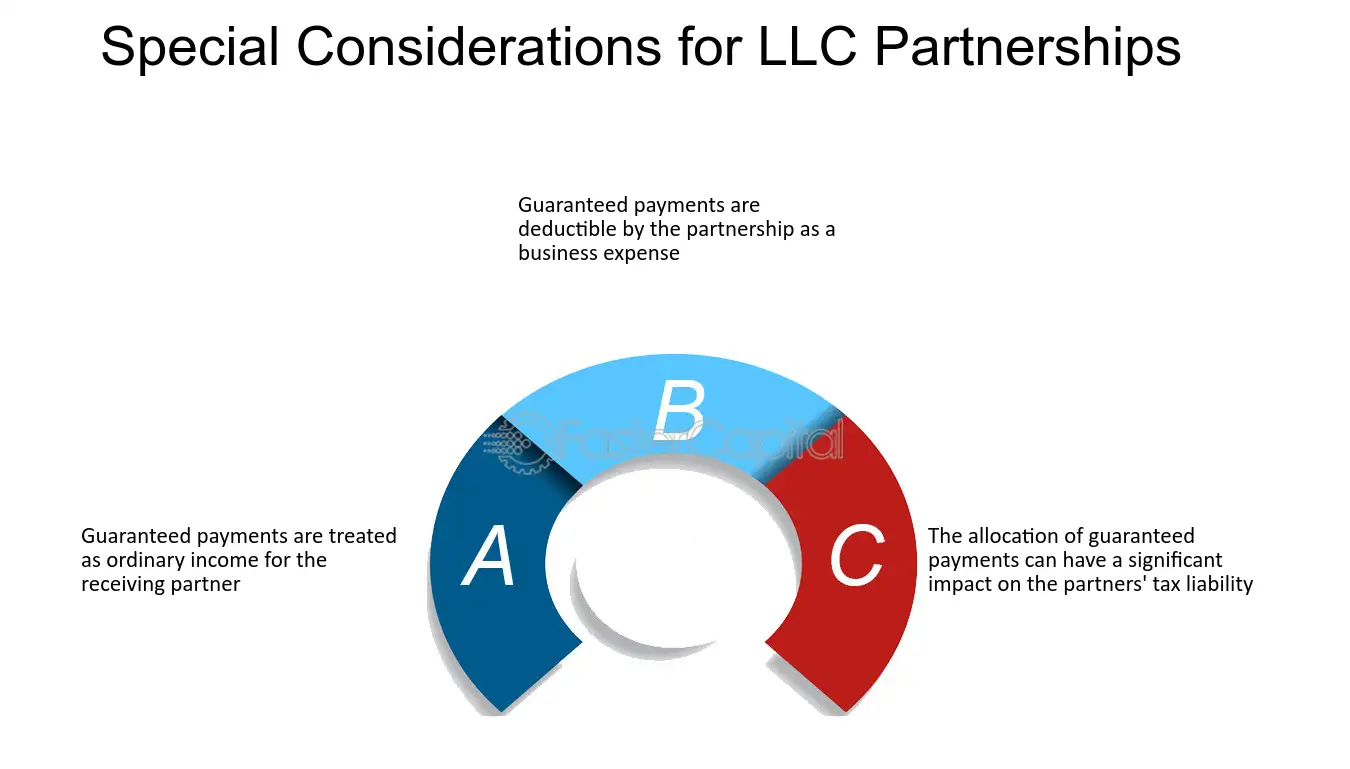

From a tax perspective, guaranteed payments are treated as a deductible expense for the partnership. This means that the partnership can deduct the guaranteed payments from its taxable income, reducing its overall tax liability.

On the other hand, partners who receive guaranteed payments must report them as ordinary income on their personal tax returns. This income is subject to self-employment taxes, including Social Security and Medicare taxes.

Partnerships must carefully consider the tax implications of guaranteed payments and consult with a tax professional to ensure compliance with tax laws and regulations.

Tax Considerations and Definition

Guaranteed payments are considered a form of compensation for services rendered by the partner. As such, they are subject to self-employment taxes, including Social Security and Medicare taxes. This means that both the partner and the partnership must pay their respective portions of these taxes.

The amount of guaranteed payments is determined by the partnership agreement. It can be a fixed amount or a percentage of the partnership’s profits. The agreement should clearly outline the terms and conditions of the guaranteed payments, including when and how they will be made.

It’s also important to distinguish guaranteed payments from other types of partner distributions. While guaranteed payments are considered compensation for services, partnership distributions are typically based on the partner’s share of profits and losses. These distributions may be subject to different tax treatment.

Definition of Guaranteed Payments

Guaranteed payments are payments made by a partnership to its partners that are not dependent on the partnership’s profits or losses. Unlike regular partnership distributions, which are based on the partners’ ownership interests, guaranteed payments are fixed amounts agreed upon in the partnership agreement.

These payments are typically made to compensate partners for their services or capital contributions to the partnership. They provide a way to ensure that partners receive a fair return on their investment or compensation for their work, regardless of the partnership’s financial performance.

Tax Considerations

From a tax perspective, guaranteed payments are treated differently than partnership distributions. While partnership distributions are generally considered a share of the partnership’s profits and are subject to self-employment taxes, guaranteed payments are treated as ordinary income and are subject to income taxes.

Partners receiving guaranteed payments must report them as income on their individual tax returns. The partnership, on the other hand, can deduct these payments as business expenses, reducing its taxable income. This distinction allows partners to separate their compensation from their share of the partnership’s profits or losses.

Importance for Businesses

Guaranteed payments play a crucial role in partnerships by providing a mechanism for partners to receive compensation for their contributions. They help ensure that partners are fairly rewarded for their work or investment, regardless of the partnership’s financial performance.

Guaranteed payments to partners are a common feature in partnership agreements. They are a form of compensation that partners receive for their services or capital contributions to the partnership. Unlike regular partnership distributions, guaranteed payments are not dependent on the partnership’s profits or losses.

Definition of Guaranteed Payments

Guaranteed payments are payments made by a partnership to its partners that are fixed and determinable. They are typically agreed upon in the partnership agreement and are paid out regardless of the partnership’s financial performance. These payments are considered a deductible expense for the partnership and are taxable income for the receiving partner.

Guaranteed payments are often used to compensate partners for their time, effort, and expertise in managing the partnership’s operations. They can also be used to provide a return on a partner’s capital investment in the partnership.

Tax Considerations for Guaranteed Payments

From a tax perspective, guaranteed payments are treated differently than regular partnership distributions. While regular partnership distributions are treated as a share of the partnership’s profits and are subject to self-employment taxes, guaranteed payments are treated as ordinary income and are subject to income taxes.

Partners who receive guaranteed payments must report them on their individual tax returns and pay income taxes on the amount received. The partnership, on the other hand, can deduct the guaranteed payments as a business expense on its tax return.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.