Variable Death Benefit: Meaning, Pros and Cons, Example

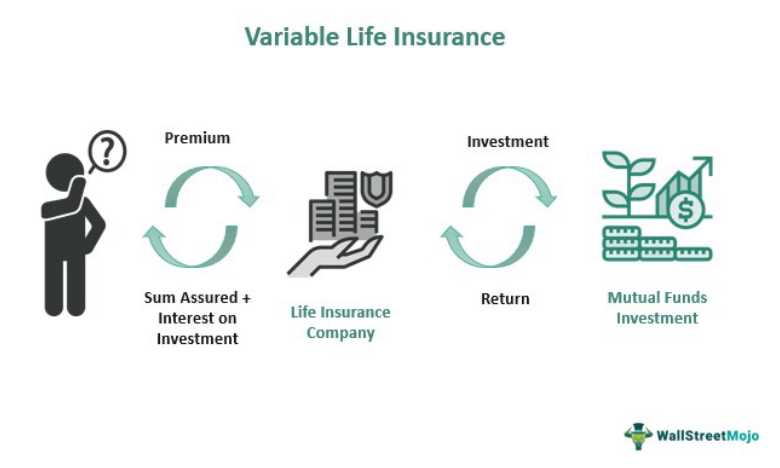

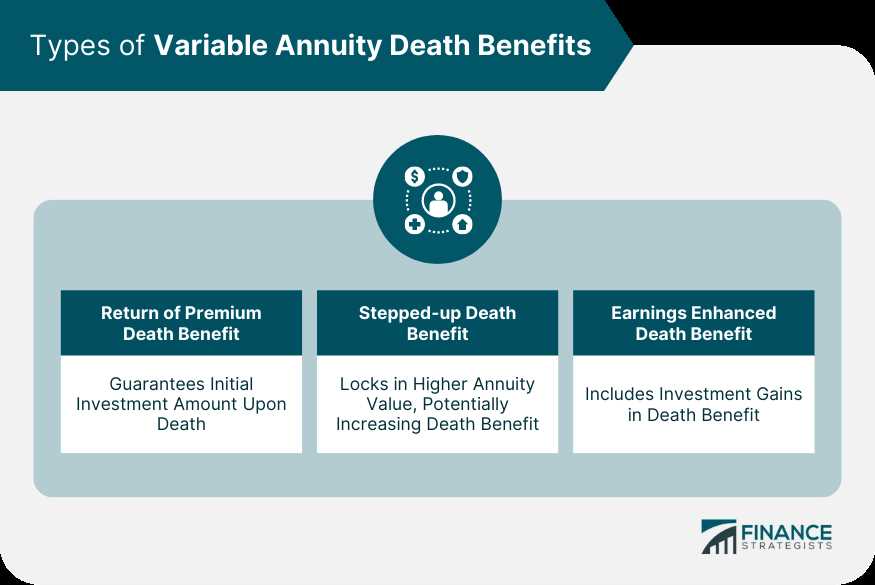

The variable death benefit is a term used in the insurance industry to describe a type of life insurance policy that provides a death benefit that can fluctuate based on the performance of the policy’s underlying investments. Unlike traditional life insurance policies that offer a fixed death benefit, a variable death benefit policy allows the policyholder to potentially increase or decrease the amount of the death benefit based on the performance of the investments within the policy.

On the other hand, one of the main disadvantages of variable death benefit policies is the potential for lower returns. If the investments within the policy perform poorly, the death benefit can decrease, potentially leaving the beneficiary with a smaller payout than expected. This can be a significant drawback for individuals who are relying on the life insurance policy as a source of financial security for their loved ones.

An example of a variable death benefit policy is as follows: Let’s say an individual purchases a variable death benefit policy with an initial death benefit of $500,000. The policyholder chooses to invest the premiums in a portfolio of stocks and bonds. Over time, if the investments perform well, the death benefit can increase to $600,000. However, if the investments perform poorly, the death benefit can decrease to $400,000. This example illustrates how the death benefit can vary based on the performance of the underlying investments.

Definition of Variable Death Benefit

The variable death benefit is a feature offered by certain life insurance policies that allows the policyholder to choose how the death benefit will be paid out to the beneficiaries upon their passing. Unlike a traditional life insurance policy with a fixed death benefit, a variable death benefit gives the policyholder more flexibility and control over how the funds are distributed.

How Does Variable Death Benefit Work?

Additionally, the policyholder can choose to have the death benefit paid out as a fixed amount or as a percentage of the policy’s cash value. This allows the policyholder to take advantage of any potential growth in the policy’s investments and increase the overall payout to their beneficiaries.

Pros and Cons of Variable Death Benefit

Like any financial product, variable death benefit comes with its own set of advantages and disadvantages.

Pros:

- Flexibility: The variable death benefit provides flexibility in how the death benefit is distributed, allowing the policyholder to tailor it to their specific needs and goals.

- Potential for higher payout: By allocating the death benefit as a percentage of the policy’s cash value, the policyholder can potentially increase the overall payout to their beneficiaries if the policy’s investments perform well.

- Control: With a variable death benefit, the policyholder has more control over how the funds are distributed, which can be beneficial in certain situations.

Cons:

- Market risk: Since the variable death benefit is tied to the performance of the policy’s investments, there is a risk of loss if the investments underperform.

- Complexity: Compared to a traditional life insurance policy with a fixed death benefit, a variable death benefit can be more complex to understand and manage.

- Higher costs: Variable death benefit policies may have higher fees and expenses compared to traditional life insurance policies.

Example of Variable Death Benefit

However, if the policy’s investments perform well and the cash value increases to $150,000, the annual payout will also increase to $7,500. On the other hand, if the investments underperform and the cash value decreases to $75,000, the annual payout will decrease to $3,750.

This example illustrates how the variable death benefit can provide flexibility and potential for higher payouts, but also carries the risk of market fluctuations.

Pros and Cons of Variable Death Benefit

Pros of Variable Death Benefit

1. Flexibility: One of the main advantages of a variable death benefit is the flexibility it provides. Policyholders have the option to customize how the death benefit is distributed to their beneficiaries. They can choose to receive a lump sum payment, regular installments, or a combination of both. This flexibility allows policyholders to tailor the death benefit to meet the specific needs of their beneficiaries.

2. Investment Potential: Another advantage of a variable death benefit is the potential for investment growth. With this type of death benefit, the policyholder’s beneficiaries have the opportunity to invest the death benefit proceeds. This can potentially lead to higher returns over time, providing additional financial security for the beneficiaries.

3. Tax Benefits: Variable death benefits may also offer tax advantages. In some cases, the death benefit proceeds may be tax-free for the beneficiaries. This can help to minimize the tax burden on the beneficiaries and ensure that they receive the full benefit amount.

Cons of Variable Death Benefit

1. Uncertainty: One of the main disadvantages of a variable death benefit is the uncertainty it presents. Unlike a fixed death benefit, which guarantees a specific payout amount, a variable death benefit is subject to market fluctuations. The actual amount received by the beneficiaries may vary depending on the performance of the underlying investments.

2. Investment Risk: With a variable death benefit, the beneficiaries assume the investment risk. If the underlying investments perform poorly, the death benefit proceeds may be lower than expected. This can result in financial hardship for the beneficiaries, especially if they were relying on the death benefit for their financial security.

| Pros | Cons |

|---|---|

| Flexibility | Uncertainty |

| Investment Potential | Investment Risk |

| Tax Benefits | Complexity |

Overall, a variable death benefit can offer greater flexibility and investment potential for policyholders and beneficiaries. However, it also comes with the risk of uncertainty and investment volatility. It is important for individuals considering a variable death benefit to carefully weigh the pros and cons and consult with a financial advisor to determine if it is the right option for their specific needs and goals.

Example of Variable Death Benefit

Let’s consider an example to understand how a variable death benefit works.

Suppose you have a life insurance policy with a variable death benefit. The policy has a death benefit amount that can fluctuate based on the performance of the underlying investments.

Initially, the policy may have a death benefit of $500,000. However, if the investments perform well and the policy’s cash value increases, the death benefit may also increase. On the other hand, if the investments perform poorly, the death benefit may decrease.

For instance, let’s say the investments perform exceptionally well, and the policy’s cash value grows to $600,000. As a result, the death benefit may increase to $600,000 as well. This means that if the policyholder passes away, their beneficiaries will receive the higher death benefit amount of $600,000.

The variable death benefit provides flexibility and the potential for higher payouts if the investments perform well. However, it also carries the risk of lower payouts if the investments perform poorly.

It is important to note that the specific terms and conditions of a variable death benefit may vary depending on the insurance policy and the insurance company. Therefore, it is crucial to carefully review the policy documents and consult with a financial advisor before making any decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.