What is VAD&D Insurance?

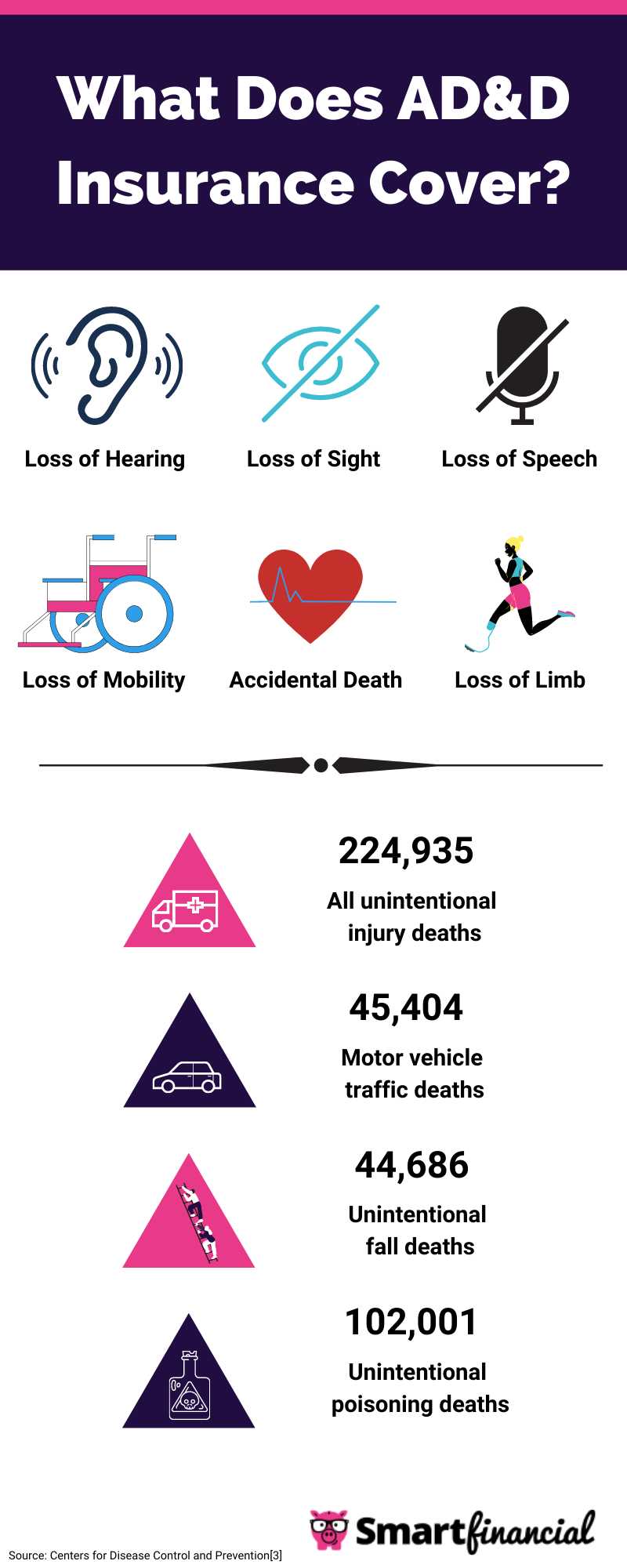

Voluntary Accidental Death and Dismemberment Insurance (VAD&D) is a type of insurance policy that provides financial protection in the event of accidental death or dismemberment. It is designed to provide coverage for unexpected accidents that result in death or the loss of a limb, sight, hearing, or speech.

VAD&D insurance is different from traditional life insurance because it specifically covers accidents rather than natural causes of death. It can provide a lump sum payment to the insured or their beneficiaries in the event of a covered accident.

This type of insurance can be particularly beneficial for individuals who work in high-risk professions or engage in activities that carry a higher risk of accidents, such as construction workers, athletes, or frequent travelers.

While VAD&D insurance cannot prevent accidents from happening, it can provide financial support to the insured or their loved ones during a difficult time. It can help cover medical expenses, funeral costs, and provide financial stability in the face of a tragic event.

It is important to carefully review the terms and conditions of a VAD&D insurance policy to understand what is covered and what is not. Some policies may have exclusions or limitations, so it is crucial to read the fine print and ask questions if anything is unclear.

Overall, VAD&D insurance offers peace of mind and financial protection in the event of an accidental death or dismemberment. It can provide a safety net for individuals and their families, ensuring that they are taken care of in the event of a tragic accident.

Benefits of VAD&D Insurance

Voluntary Accidental Death and Dismemberment Insurance (VAD&D) provides a range of benefits that can help protect you and your loved ones in the event of an accident resulting in death or dismemberment. Here are some key benefits of VAD&D insurance:

- Financial Protection: VAD&D insurance provides a lump sum payment to your designated beneficiaries in the event of your accidental death. This can help provide financial stability and support during a difficult time.

- Accidental Dismemberment Coverage: In addition to coverage for accidental death, VAD&D insurance also provides benefits in the event of accidental dismemberment. This can include the loss of limbs, eyesight, or hearing. The insurance payout can help cover medical expenses, rehabilitation costs, and other financial needs that may arise due to the accident.

- Worldwide Coverage: VAD&D insurance typically provides coverage worldwide, giving you peace of mind no matter where you are. Whether you’re traveling for work or pleasure, you can rest assured knowing that you and your loved ones are protected.

- Flexible Coverage Options: VAD&D insurance offers flexible coverage options to suit your individual needs. You can choose the coverage amount and duration that works best for you and your family. This allows you to customize your policy to fit your budget and specific requirements.

- No Medical Exam: Unlike some other types of insurance, VAD&D insurance often does not require a medical exam. This means that you can obtain coverage quickly and easily, without the need for extensive paperwork or medical appointments.

- Additional Benefits: Depending on the policy, VAD&D insurance may also offer additional benefits such as coverage for transportation expenses, child education benefits, and accidental death benefits for spouses or dependents. These additional benefits can provide further financial security and support in the event of an accident.

Overall, VAD&D insurance provides valuable protection and peace of mind for you and your loved ones. It offers financial security in the face of unexpected accidents and can help alleviate the financial burden that may arise from such events. Consider obtaining VAD&D insurance to ensure that you and your family are protected in the event of an accident.

How to Choose the Right VAD&D Policy

Choosing the right Voluntary Accidental Death and Dismemberment Insurance (VAD&D) policy is an important decision that can provide financial protection for you and your loved ones in the event of an accident. Here are some key factors to consider when selecting a VAD&D policy:

- Coverage Amount: Determine the amount of coverage you need based on your personal circumstances. Consider factors such as your income, debts, and financial obligations.

- Policy Options: Review the policy options available to you. Look for features such as accidental death benefits, dismemberment benefits, and additional coverage for specific activities or occupations.

- Cost: Compare the cost of different policies and consider your budget. Keep in mind that cheaper policies may offer less coverage or have higher deductibles.

- Claims Process: Research the claims process of the insurance provider. Look for reviews and feedback from other policyholders to ensure that the company has a smooth and efficient claims process.

- Provider Reputation: Consider the reputation and financial stability of the insurance provider. Look for a company with a strong track record and positive customer reviews.

- Additional Benefits: Some VAD&D policies may offer additional benefits such as emergency medical assistance, funeral expenses coverage, or travel assistance. Consider these additional benefits when making your decision.

By carefully considering these factors, you can choose the right VAD&D policy that provides the coverage you need and gives you peace of mind in case of an accident.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.