Definition of Minimum Monthly Payment

The minimum monthly payment is the smallest amount of money that a credit card holder is required to pay each month in order to keep their account in good standing. It is typically a percentage of the total balance owed on the credit card, usually around 2-3%.

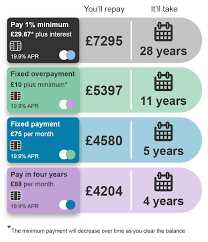

The minimum monthly payment is calculated by the credit card issuer and is designed to cover the interest charges on the balance as well as a small portion of the principal. It is important to note that paying only the minimum monthly payment will result in a longer repayment period and significantly higher interest charges.

For example, if you have a credit card balance of $1,000 and the minimum monthly payment is 2%, you would be required to pay at least $20 each month. However, if you only pay the minimum, it will take you much longer to pay off the balance and you will end up paying much more in interest over time.

It is recommended to pay more than the minimum monthly payment whenever possible in order to reduce the overall debt and save on interest charges. By paying more than the minimum, you can pay off your credit card balance faster and save money in the long run.

Remember, the minimum monthly payment is just the minimum requirement set by the credit card issuer. It is always in your best interest to pay as much as you can afford each month to avoid accumulating unnecessary debt and to improve your financial health.

Importance of Paying More than the Minimum

1. Avoiding Accumulating Debt

One of the main reasons why it is important to pay more than the minimum is to avoid accumulating debt. When you only pay the minimum, you are essentially only covering the interest charges and a small portion of the principal balance. This means that the majority of your payment is not actually reducing your debt, but rather going towards interest fees.

By paying more than the minimum, you can make a significant dent in your outstanding balance and reduce the amount of interest you will have to pay over time. This can help you pay off your credit card debt faster and save money in the long run.

2. Improving Your Credit Score

Another important reason to pay more than the minimum is to improve your credit score. Your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, is an important factor in determining your credit score.

When you only make the minimum payment, your credit utilization ratio remains high, which can negatively impact your credit score. However, by paying more than the minimum, you can lower your credit utilization ratio and demonstrate responsible credit management. This can help improve your credit score over time.

3. Saving Money on Interest

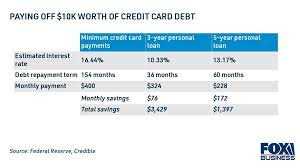

Perhaps the most compelling reason to pay more than the minimum is the potential savings on interest charges. Credit card interest rates can be high, and by only paying the minimum, you are essentially prolonging the amount of time it takes to pay off your debt.

By paying more than the minimum, you can reduce the overall interest charges you will have to pay. This can save you a significant amount of money in the long run and allow you to become debt-free faster.

Factors Affecting the Minimum Monthly Payment

1. Outstanding Balance

The outstanding balance on your credit card is one of the primary factors that determine the minimum monthly payment. The higher your balance, the higher your minimum payment will be. This is because the credit card issuer wants to ensure that you are making progress towards paying off your debt.

2. Interest Rate

The interest rate on your credit card is another crucial factor affecting the minimum monthly payment. If you have a high-interest rate, your minimum payment will be higher. This is because a higher interest rate means that more of your payment goes towards interest charges rather than reducing the principal balance.

3. Credit Card Terms

The terms and conditions of your credit card also play a role in determining the minimum monthly payment. Different credit card issuers may have varying requirements for calculating the minimum payment. Some issuers may use a percentage of the outstanding balance, while others may use a fixed amount or a combination of both.

4. Late Payment History

Your payment history can also impact the minimum monthly payment. If you have a history of late payments or missed payments, the credit card issuer may increase your minimum payment as a way to mitigate the risk of non-payment. It is crucial to make your payments on time to avoid any unnecessary increases in your minimum payment.

5. Credit Score

Your credit score is another factor that can affect the minimum monthly payment. If you have a low credit score, the credit card issuer may consider you a higher risk borrower and increase your minimum payment. On the other hand, if you have a high credit score, you may be eligible for lower minimum payments or even promotional offers with reduced interest rates.

| Factor | Impact on Minimum Monthly Payment |

|---|---|

| Outstanding Balance | Higher balance leads to a higher minimum payment |

| Interest Rate | Higher interest rate leads to a higher minimum payment |

| Credit Card Terms | Issuer-specific requirements for calculating the minimum payment |

| Late Payment History | History of late payments may result in increased minimum payment |

| Credit Score | Lower credit score may result in increased minimum payment |

Tips for Managing Credit Card Payments

Managing credit card payments is essential for maintaining a healthy financial life. Here are some tips to help you effectively manage your credit card payments:

- Create a budget: Start by creating a budget that outlines your monthly income and expenses. This will help you understand how much you can afford to pay towards your credit card debt each month.

- Pay on time: Make sure to pay your credit card bill on time to avoid late payment fees and negative impacts on your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Pay more than the minimum: While the minimum monthly payment is the minimum amount required to avoid late fees, it is always advisable to pay more than the minimum. By paying more, you can reduce your overall debt faster and save on interest charges.

- Prioritize high-interest debt: If you have multiple credit cards with varying interest rates, prioritize paying off the cards with the highest interest rates first. This will help you save money on interest charges in the long run.

- Avoid unnecessary spending: Try to avoid unnecessary spending on your credit cards. Only use your credit card for essential purchases and avoid impulse buying. This will help you keep your credit card balances low and manageable.

- Monitor your credit card statements: Regularly review your credit card statements to ensure there are no unauthorized charges or errors. If you notice any discrepancies, contact your credit card issuer immediately.

- Seek professional help if needed: If you are struggling to manage your credit card payments or find yourself in a cycle of debt, consider seeking professional help. Credit counseling agencies can provide guidance and assistance in creating a debt repayment plan.

By following these tips, you can effectively manage your credit card payments and work towards financial stability and freedom.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.