Key Concepts

1. Ownership Percentage: Non-controlling interest refers to the ownership stake in a company that is held by individuals or entities other than the controlling shareholders. It represents the percentage of ownership that is not controlled by the majority shareholders.

2. Minority Shareholders: Non-controlling interest is often held by minority shareholders who do not have the power to influence the decision-making process or strategic direction of the company. These shareholders typically have limited voting rights and may not have representation on the board of directors.

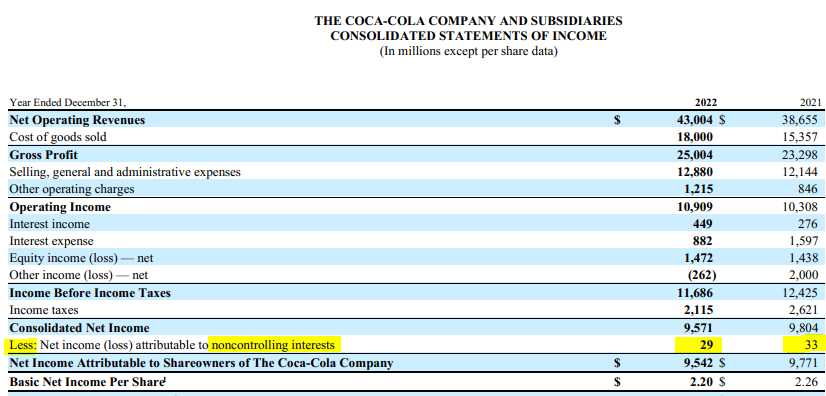

3. Equity Method: The equity method is used to account for non-controlling interest in the financial statements. Under this method, the non-controlling interest is reported as a separate line item on the balance sheet and the income statement, reflecting the proportionate share of the net assets and earnings of the subsidiary company.

4. Consolidation: When a company holds a controlling interest in another company, it is required to consolidate the financial statements of both entities. This means that the assets, liabilities, revenues, and expenses of the subsidiary company are combined with those of the parent company. The non-controlling interest is reported as a separate line item to reflect the portion of the subsidiary’s equity that is not owned by the parent company.

5. Dilution of Ownership: Non-controlling interest can be diluted when additional shares are issued by the company, resulting in a decrease in the percentage of ownership held by the non-controlling shareholders. This can occur through stock offerings, stock splits, or the issuance of stock options to employees.

Implications of Non-Controlling Interest

The implications of non-controlling interest can vary depending on the specific circumstances and the agreements in place between the controlling and non-controlling shareholders. However, there are several common implications that are important to understand:

- Financial Reporting: Non-controlling interest is typically reported as a separate line item on the balance sheet and income statement. This allows investors and stakeholders to see the portion of the company’s assets, liabilities, revenues, and expenses that are attributable to the non-controlling shareholders.

- Consolidation: When a company has a non-controlling interest in another entity, it is required to consolidate the financial statements of both entities. This means that the financial statements of the non-controlling interest are combined with those of the controlling shareholder to provide a comprehensive view of the overall financial position and performance of the company.

- Dividends: Non-controlling shareholders are entitled to receive a portion of the company’s profits in the form of dividends. The amount of dividends received by non-controlling shareholders is typically based on their ownership stake in the company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.