Definition of Market Cycles

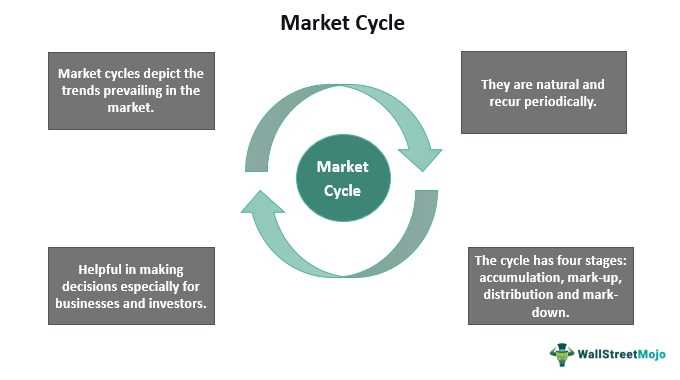

A market cycle refers to the recurring pattern of ups and downs in the financial markets. It is characterized by periods of expansion, peak, contraction, and trough. These cycles can occur in various timeframes, ranging from short-term fluctuations to long-term trends.

Market cycles are driven by a combination of factors, including economic conditions, investor sentiment, and market psychology. They are influenced by a wide range of variables, such as interest rates, inflation, corporate earnings, geopolitical events, and technological advancements.

During a contraction phase, the market experiences a decline in prices and economic activity. This is often accompanied by increased investor pessimism and a bearish sentiment. The market may reach a trough, which represents the lowest point of the cycle, before starting to recover.

Market cycles can vary in duration and magnitude. Some cycles may be short-lived and relatively mild, while others can be prolonged and severe. The length and intensity of market cycles can be influenced by a variety of factors, including the strength of the underlying economy, government policies, and external shocks.

It is important to note that market cycles are not perfectly predictable, and there is always a degree of uncertainty involved. However, by analyzing historical data, economic indicators, and market trends, investors can gain insights into the potential direction of the market and adjust their investment strategies accordingly.

Mechanics of Market Cycles

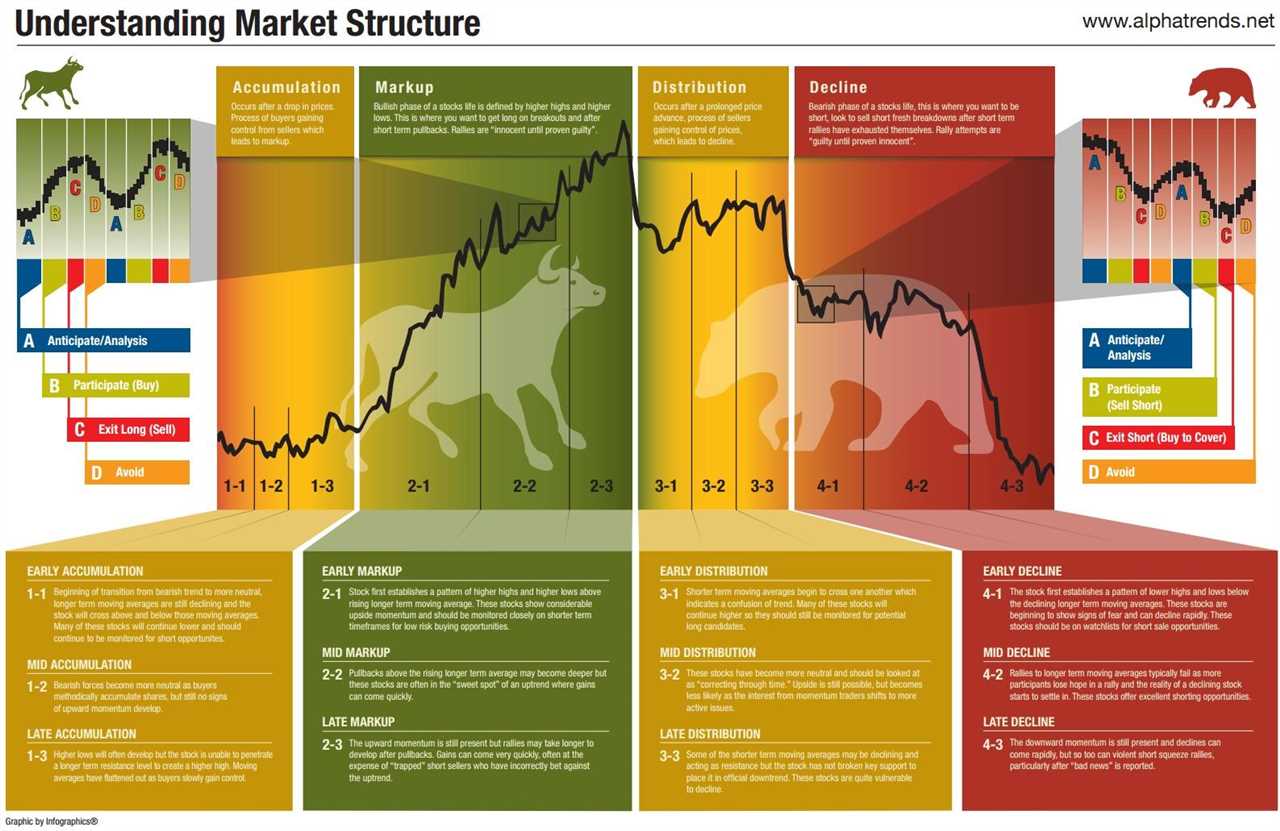

1. Phases of Market Cycles:

Market cycles typically go through four main phases: expansion, peak, contraction, and trough.

– Expansion: During this phase, the economy is growing, and investor confidence is high. Stock prices rise, and there is an increase in economic activity.

– Peak: The peak phase occurs when the market reaches its highest point. Investor optimism is at its peak, and stock prices are at their highest. However, this phase is often followed by a decline.

– Contraction: In the contraction phase, economic growth slows down, and investor sentiment becomes more cautious. Stock prices start to decline, and there is a decrease in economic activity.

– Trough: The trough phase is the lowest point of the market cycle. Investor pessimism is high, and stock prices are at their lowest. However, this phase is often followed by a recovery.

2. Factors Influencing Market Cycles:

Several factors can influence the duration and intensity of market cycles:

– Economic Indicators: Economic indicators such as GDP growth, inflation rates, and employment data can provide insights into the health of the economy and impact market cycles.

– Investor Sentiment: Investor sentiment, including emotions like fear and greed, can drive market cycles. Positive sentiment can lead to market expansions, while negative sentiment can trigger contractions.

– Monetary Policy: Central banks play a crucial role in influencing market cycles through their monetary policy decisions. Interest rate changes and quantitative easing measures can impact investor behavior and market trends.

– Geopolitical Events: Geopolitical events like wars, political instability, and trade disputes can have a significant impact on market cycles. These events can create uncertainty and volatility in the market.

3. Market Timing:

Timing the market is a challenging task, as market cycles can be unpredictable. However, some investors try to identify the phases of market cycles to make strategic investment decisions.

– Buying Low, Selling High: Investors aim to buy stocks during the trough phase when prices are low and sell during the peak phase when prices are high.

– Diversification: Diversifying investments across different asset classes and sectors can help reduce the impact of market cycles on a portfolio.

– Long-Term Investing: Taking a long-term approach to investing can help mitigate the effects of short-term market cycles. By focusing on the fundamentals of companies and the economy, investors can ride out market fluctuations.

4. Risk Management:

– Asset Allocation: Allocating assets across different investment categories, such as stocks, bonds, and cash, can help manage risk during different phases of market cycles.

– Stop Loss Orders: Setting stop loss orders can help limit potential losses by automatically selling a stock if it reaches a predetermined price.

– Diversification: Diversifying investments across different sectors, industries, and geographic regions can help spread risk and reduce the impact of market cycles.

– Regular Monitoring: Regularly monitoring investments and staying informed about market trends can help identify potential risks and opportunities.

Variations in Market Cycles

Market cycles are not always predictable or consistent. There are various factors that can cause variations in the length, amplitude, and timing of market cycles. These variations can have a significant impact on investment strategies and outcomes.

1. Economic Factors: Economic conditions play a crucial role in determining the variations in market cycles. Factors such as GDP growth, inflation rates, interest rates, and government policies can influence the length and intensity of market cycles. For example, during periods of high economic growth, market cycles may be shorter and more volatile.

2. Investor Sentiment: Investor sentiment can greatly affect market cycles. Emotions such as fear and greed can drive investors to buy or sell, leading to exaggerated market movements. When investor sentiment is positive, market cycles may be longer and characterized by bullish trends. Conversely, during periods of pessimism, market cycles may be shorter and marked by bearish trends.

3. Technological Advancements: Technological advancements can also impact market cycles. Innovations in communication and information technology have made it easier for investors to access and analyze market data. This has led to faster and more efficient markets, potentially shortening the duration of market cycles.

4. Global Events: Global events, such as geopolitical tensions, natural disasters, or pandemics, can disrupt market cycles. These events can create uncertainty and volatility in the markets, leading to shorter or more erratic market cycles. For example, the global financial crisis of 2008 caused a significant contraction in market cycles worldwide.

5. Sector-Specific Factors: Different sectors of the economy can experience variations in market cycles. Industries such as technology and healthcare may have shorter and more frequent cycles due to rapid innovation and changing consumer demands. On the other hand, sectors such as utilities and consumer staples may have longer and more stable cycles due to their essential nature.

It is important for investors to understand and adapt to these variations in market cycles. By recognizing the factors that influence market cycles, investors can develop strategies to navigate through different market conditions and optimize their investment outcomes.

Impact of Market Cycles on Investments

During different phases of a market cycle, investments can experience significant fluctuations in value. It is important for investors to recognize these patterns and adjust their strategies accordingly.

During a bull market, characterized by rising prices and optimism, investments tend to perform well. Investors may choose to allocate more capital to riskier assets, such as stocks, in order to take advantage of the upward momentum. However, it is important to remain cautious and not get carried away by market euphoria.

On the other hand, during a bear market, characterized by falling prices and pessimism, investments may face significant declines. In such situations, investors may choose to reallocate their assets to safer options, such as bonds or cash, to protect their capital. It is crucial to remain patient and avoid making impulsive decisions based on short-term market movements.

Market cycles also have an impact on the performance of specific sectors and industries. Certain sectors, such as technology or healthcare, may outperform others during certain phases of the market cycle. Investors can capitalize on these trends by diversifying their portfolios and investing in sectors that are expected to perform well in the current market environment.

Moreover, market cycles can influence the timing of investment decisions. Buying assets at the bottom of a market cycle and selling at the peak can result in substantial gains. However, accurately timing the market is extremely challenging, and even experienced investors often struggle to consistently make profitable trades based on market cycles.

Therefore, it is important for investors to focus on long-term strategies and not get swayed by short-term market movements. Diversification, asset allocation, and regular portfolio rebalancing are key principles that can help mitigate the impact of market cycles on investments.

Strategies for Navigating Market Cycles

Market cycles can be unpredictable and volatile, making it challenging for investors to navigate and make informed decisions. However, by implementing effective strategies, investors can mitigate risks and maximize opportunities during different phases of the market cycle.

1. Diversification

Diversification is a key strategy for navigating market cycles. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of market volatility on their portfolio. Diversification helps to minimize losses during downturns and capture gains during upswings.

2. Asset Allocation

Asset allocation involves determining the optimal mix of asset classes based on an investor’s risk tolerance, financial goals, and market conditions. During different phases of the market cycle, the performance of asset classes can vary. By rebalancing the portfolio periodically, investors can adjust their asset allocation to take advantage of opportunities and manage risks.

3. Active Management

Active management involves actively monitoring and adjusting investment holdings based on market trends and conditions. During different phases of the market cycle, certain sectors or industries may outperform others. By actively managing the portfolio, investors can capitalize on these trends and make strategic investment decisions.

4. Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money into a particular investment, regardless of its price. This strategy helps to reduce the impact of market volatility on investment returns. By consistently investing over time, investors can take advantage of market downturns and benefit from lower prices.

5. Risk Management

By implementing these strategies, investors can navigate market cycles more effectively and increase the likelihood of achieving their financial goals. It is important to note that market cycles are influenced by various factors, and no strategy can guarantee success. Therefore, it is essential for investors to stay informed, seek professional advice, and continuously monitor and adapt their investment strategies.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.