The Concept of Limited Liability

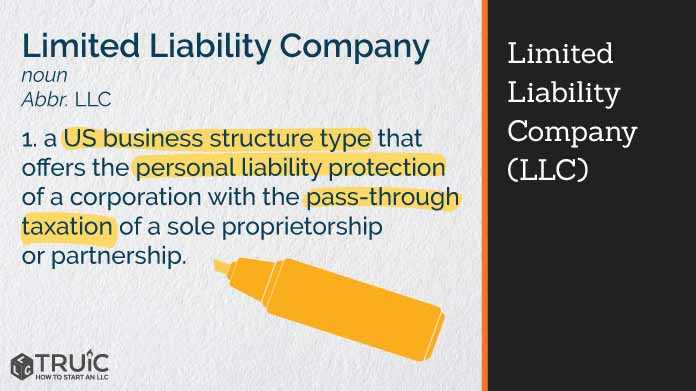

Limited liability is a legal concept that provides protection to the owners and shareholders of a corporation or business. It ensures that their personal assets are not at risk in the event of financial difficulties or legal issues faced by the company.

Under limited liability, the liability of the owners or shareholders is limited to the amount of their investment in the company. This means that if the company faces bankruptcy or is sued, the personal assets of the owners or shareholders cannot be seized to satisfy the company’s debts or legal obligations.

This concept is particularly beneficial for entrepreneurs and investors who want to start or invest in a business without risking their personal wealth. It encourages entrepreneurship and investment by providing a level of financial security.

Limited liability also promotes economic growth and innovation. It allows businesses to take calculated risks and pursue new opportunities without the fear of losing everything. This fosters a favorable environment for business development and expansion.

In addition, limited liability provides a clear separation between the company and its owners or shareholders. This separation allows the company to enter into contracts, own property, and engage in legal transactions in its own name. It also ensures that the company’s obligations and liabilities are distinct from those of its owners or shareholders.

However, it is important to note that limited liability does not protect against all types of liabilities. In certain circumstances, such as fraud or illegal activities, the concept of limited liability may be disregarded, and the owners or shareholders may be held personally liable.

Advantages of Limited Liability for Corporations

1. Protection of Personal Assets

This protection allows business owners to take calculated risks without the fear of losing everything they own. It provides a sense of security and encourages entrepreneurship and investment.

2. Attracting Investors

Another advantage of limited liability for corporations is its ability to attract investors. Investors are more likely to invest in a corporation that offers limited liability because it reduces their personal risk. They know that their liability is limited to the amount they have invested in the company, and they will not be held personally responsible for the corporation’s debts or legal obligations.

This increased investor confidence can lead to more capital being injected into the business, allowing for growth and expansion. It also opens up opportunities for partnerships and joint ventures, as potential partners are more likely to engage with a corporation that offers limited liability.

3. Continuity of the Business

Limited liability also ensures the continuity of the business. In the event of the death or departure of one of the owners, the corporation can continue to operate without significant disruption. The ownership shares can be transferred or sold without affecting the company’s operations or legal standing.

This advantage is particularly important for corporations that have multiple owners or shareholders. It provides stability and allows for long-term planning and growth.

Benefits of Limited Liability for Businesses

Limited liability is a legal concept that provides significant benefits for businesses. It allows business owners to protect their personal assets from being used to satisfy business debts and liabilities. This protection is particularly important for small businesses and entrepreneurs who may have limited resources and are at a higher risk of facing financial difficulties.

1. Asset Protection

For example, if a business is sued and ordered to pay a significant amount of money, the owners’ personal assets cannot be used to satisfy the judgment. This provides peace of mind to business owners and allows them to take risks and invest in their businesses without the fear of losing everything they own.

2. Separate Legal Entity

Another advantage of limited liability is that it allows businesses to be treated as separate legal entities. This means that the business is responsible for its own debts and liabilities, and the owners are not personally liable for them. The business can enter into contracts, borrow money, and engage in other financial transactions in its own name.

This separation of the business entity from its owners also allows for easier transfer of ownership. If a business owner wants to sell their interest in the business or bring in new partners, it can be done without disrupting the operations of the business. The business can continue to exist and operate even if there are changes in ownership.

3. Attracting Investors

Additionally, limited liability allows businesses to issue shares of stock, which can be an effective way to raise capital. By selling shares, businesses can attract investors and raise funds to grow and expand their operations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.