Definition of Hard Loans

Key Characteristics of Hard Loans

There are several key characteristics that distinguish hard loans from traditional loans:

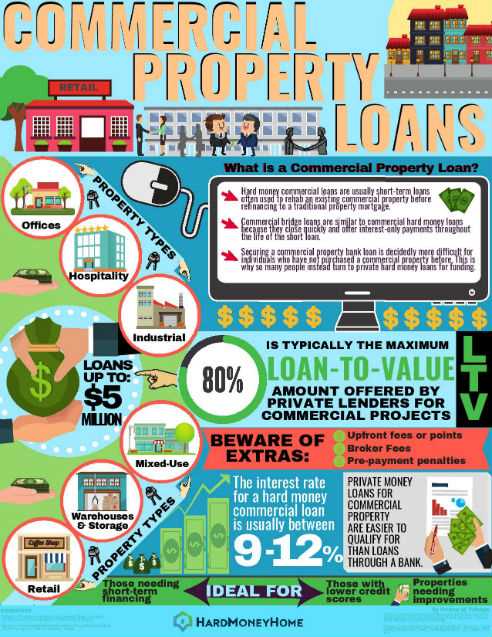

- Short-term: Hard loans typically have a term of 6 months to 5 years, although some lenders may offer longer terms. This short-term nature allows borrowers to quickly acquire financing and repay the loan within a relatively short period of time.

- Higher interest rates: Due to the higher risk associated with hard loans, lenders charge higher interest rates compared to traditional loans. These rates can range from 10% to 15% or even higher, depending on the lender and the borrower’s creditworthiness.

- Quick approval process: Unlike traditional loans that may take weeks or months to be approved, hard loans have a faster approval process. This is because the loan is based primarily on the value of the property rather than the borrower’s credit history or income.

- Flexible repayment terms: Hard loans often offer flexible repayment terms, allowing borrowers to customize their repayment schedule based on their financial situation. This can be particularly beneficial for real estate investors who may need to sell the property quickly to repay the loan.

Overall, hard loans provide an alternative financing option for individuals who are unable to qualify for traditional loans. While they may come with higher interest rates and shorter terms, they can be a valuable tool for those in need of quick financing or who have unique borrowing circumstances.

Process of Obtaining a Hard Loan

1. Research and Identify Potential Lenders

The first step in obtaining a hard loan is to research and identify potential lenders who offer hard loans. Hard money lenders can be found through online searches, local directories, or by asking for recommendations from real estate professionals. It is important to compare different lenders and their terms to find the one that best suits your needs.

2. Submit Loan Application

Once you have identified a potential lender, the next step is to submit a loan application. The application process may vary depending on the lender, but generally, it will require providing personal and financial information, as well as details about the property you intend to use as collateral.

3. Property Appraisal

4. Underwriting and Due Diligence

Once the property appraisal is complete, the lender will conduct underwriting and due diligence to assess the borrower’s creditworthiness and the viability of the loan. This may involve verifying the borrower’s income, employment history, credit score, and reviewing any outstanding debts or liens.

5. Loan Approval and Terms

If the lender determines that the borrower meets their criteria, they will approve the loan and provide the borrower with the loan terms. These terms will include the interest rate, loan amount, repayment period, and any fees or penalties associated with the loan.

6. Loan Closing

Once the borrower agrees to the loan terms, the loan closing process begins. This involves signing the necessary documents, paying any closing costs or fees, and transferring the title of the property to the lender as collateral. The borrower will then receive the loan funds, typically in the form of a lump sum or in installments.

7. Repayment

After the loan closing, the borrower is responsible for repaying the loan according to the agreed-upon terms. This typically includes making monthly payments of principal and interest until the loan is fully repaid. It is important for borrowers to budget and plan for these payments to avoid defaulting on the loan.

Overall, obtaining a hard loan involves thorough research, careful consideration of loan terms, and adherence to the lender’s requirements. By following these steps, borrowers can successfully obtain a hard loan to finance their real estate ventures.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.