What is Half Year Convention?

The Half Year Convention is a method used in accounting to calculate depreciation expenses for assets. It assumes that an asset is used evenly throughout its useful life and divides the depreciation expense equally over the asset’s life, regardless of when it was acquired.

Under the Half Year Convention, the first year of an asset’s life is considered to be half a year, regardless of when the asset was purchased. This convention is based on the assumption that an asset’s value and usefulness decline evenly over time.

For example, if an asset has a useful life of 5 years, the Half Year Convention would assume that the asset is used for 2.5 years in the first year, 1 year in the second year, and so on. This means that the depreciation expense for the first year would be half of what it would be under the straight-line method.

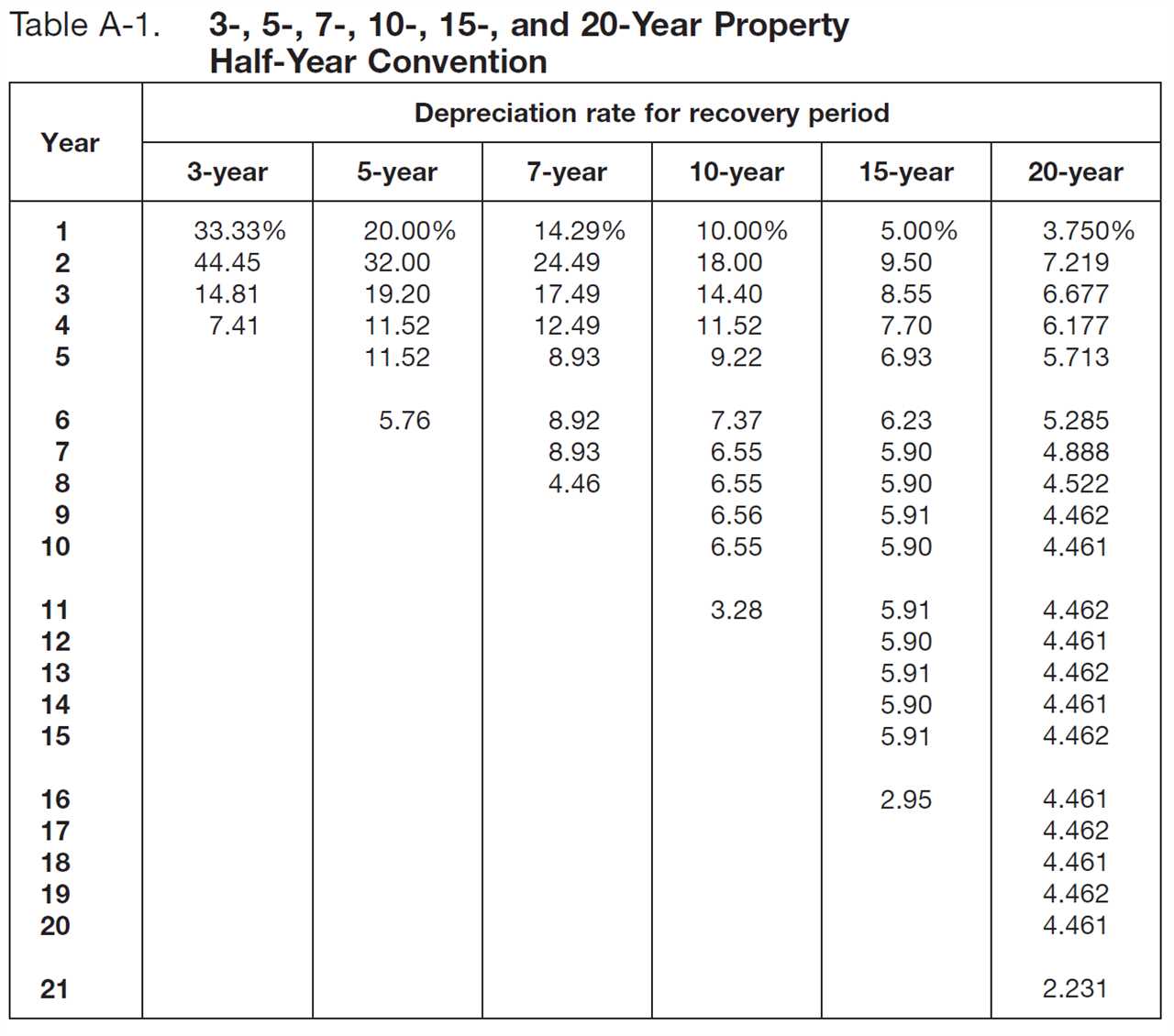

The Half Year Convention is commonly used for tax purposes, as it allows businesses to claim higher depreciation expenses in the early years of an asset’s life, reducing their taxable income. It is also used to simplify the calculation of depreciation and align it with the actual usage of the asset.

However, it is important to note that the Half Year Convention may not accurately reflect the actual usage of an asset. Some assets may be used more heavily in the first year, while others may have a more even usage pattern. Therefore, it is important for businesses to consider their specific circumstances and the nature of their assets when deciding whether to apply the Half Year Convention.

Depreciation Calculation under Half Year Convention

Under the half year convention, the depreciation expense for an asset is calculated based on the assumption that the asset is acquired or disposed of halfway through the year. This convention is commonly used in accounting to simplify the calculation of depreciation and allocate the expense evenly over the life of the asset.

To calculate depreciation under the half year convention, the following steps are typically followed:

| Step | Description |

|---|---|

| 1 | Determine the cost of the asset |

| 2 | Estimate the salvage value of the asset at the end of its useful life |

| 3 | Calculate the depreciable cost by subtracting the salvage value from the cost |

| 4 | Divide the depreciable cost by the useful life of the asset in years |

| 5 | Multiply the result from step 4 by 0.5 to account for the half year convention |

For example, let’s say a company purchases a machine for $10,000 with an estimated salvage value of $2,000 and a useful life of 5 years. Using the half year convention, the depreciation expense for the first year would be calculated as follows:

Depreciation expense = (Depreciable cost / Useful life) * 0.5 = ($8,000 / 5) * 0.5 = $800

By using the half year convention, the company recognizes a depreciation expense of $800 for the first year instead of $1,600 (which would be the case without the convention). This allows for a more accurate allocation of the asset’s cost over its useful life.

Benefits of Half Year Convention

The Half Year Convention is a commonly used method for calculating depreciation in accounting. It offers several benefits to businesses that choose to apply this convention:

1. Simplified Calculation

One of the main advantages of the Half Year Convention is its simplicity. Instead of calculating depreciation based on the exact number of months an asset is in use, this convention assumes that the asset is used for half of its useful life in the first year of acquisition. This simplifies the calculation process and saves time for accountants.

2. Tax Savings

Another benefit of the Half Year Convention is that it can result in tax savings for businesses. By assuming that an asset is used for half of its useful life in the first year, the depreciation expense for that year is higher compared to other methods. This higher depreciation expense reduces the taxable income, resulting in lower tax liabilities.

3. Matching Principle

4. Cash Flow Management

Using the Half Year Convention for depreciation can also help with cash flow management. By recognizing higher depreciation expenses in the first year, businesses can allocate more funds towards replacing or upgrading assets in the future. This allows for better planning and budgeting of capital expenditures.

Limitations of Half Year Convention

The Half Year Convention is a widely used method for calculating depreciation in accounting. However, like any other accounting method, it has its limitations. It is important to be aware of these limitations in order to make informed decisions regarding the use of the Half Year Convention.

1. Inaccurate Depreciation Calculation

One of the main limitations of the Half Year Convention is that it may result in inaccurate depreciation calculations. This is because the convention assumes that the asset is used evenly throughout the year, which may not always be the case. If the asset is used more heavily in the first or second half of the year, the depreciation expense calculated using the Half Year Convention may not accurately reflect the actual wear and tear on the asset.

2. Potential Overstatement of Profits

Another limitation of the Half Year Convention is that it can potentially overstate profits in the early years of an asset’s life. This is because the convention allows for a higher depreciation expense in the first year, which reduces the taxable income and results in lower taxes. However, this higher depreciation expense may not accurately reflect the actual decrease in the asset’s value, leading to an overstatement of profits.

3. Limited Applicability

The Half Year Convention is not applicable to all types of assets. It is generally used for assets that are expected to have a longer useful life, such as buildings and machinery. For assets with shorter useful lives, such as computers and software, other depreciation methods may be more appropriate. Therefore, the Half Year Convention may not be suitable for all businesses and industries.

4. Lack of Flexibility

5. Impact on Financial Statements

The use of the Half Year Convention can have an impact on the financial statements of a company. The higher depreciation expense in the first year may result in lower net income and lower retained earnings. This can affect the company’s financial ratios and may give a misleading picture of its financial performance.

Application of Half Year Convention in Accounting

The half year convention is a commonly used method in accounting for calculating depreciation expenses. It is based on the assumption that an asset is used evenly over its useful life, regardless of when it was acquired during the year. This convention allows for a simplified and consistent approach to depreciation calculations.

Under the half year convention, the depreciation expense for an asset is calculated as if it were in use for only half of the year, regardless of when it was actually acquired. This means that the depreciation expense is divided by the useful life of the asset and multiplied by the remaining number of months in the year.

For example, if an asset has a useful life of 5 years and was acquired in the middle of the year, the depreciation expense for that year would be calculated as follows:

This method ensures that the depreciation expense is spread evenly over the useful life of the asset, regardless of when it was acquired. It also provides a more accurate representation of the asset’s value over time.

The application of the half year convention in accounting has several benefits. Firstly, it simplifies the depreciation calculation process, as it eliminates the need to track the exact acquisition date of each asset. This saves time and reduces the chances of errors in depreciation calculations.

Secondly, the half year convention provides consistency in depreciation calculations across different assets and companies. It allows for easier comparison of financial statements and facilitates financial analysis.

However, it is important to note that the half year convention has its limitations. It assumes that an asset’s usefulness declines evenly over time, which may not always be the case. Some assets may depreciate more rapidly in the early years of their useful life, while others may have a more consistent depreciation pattern.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.