What is Discretionary Income?

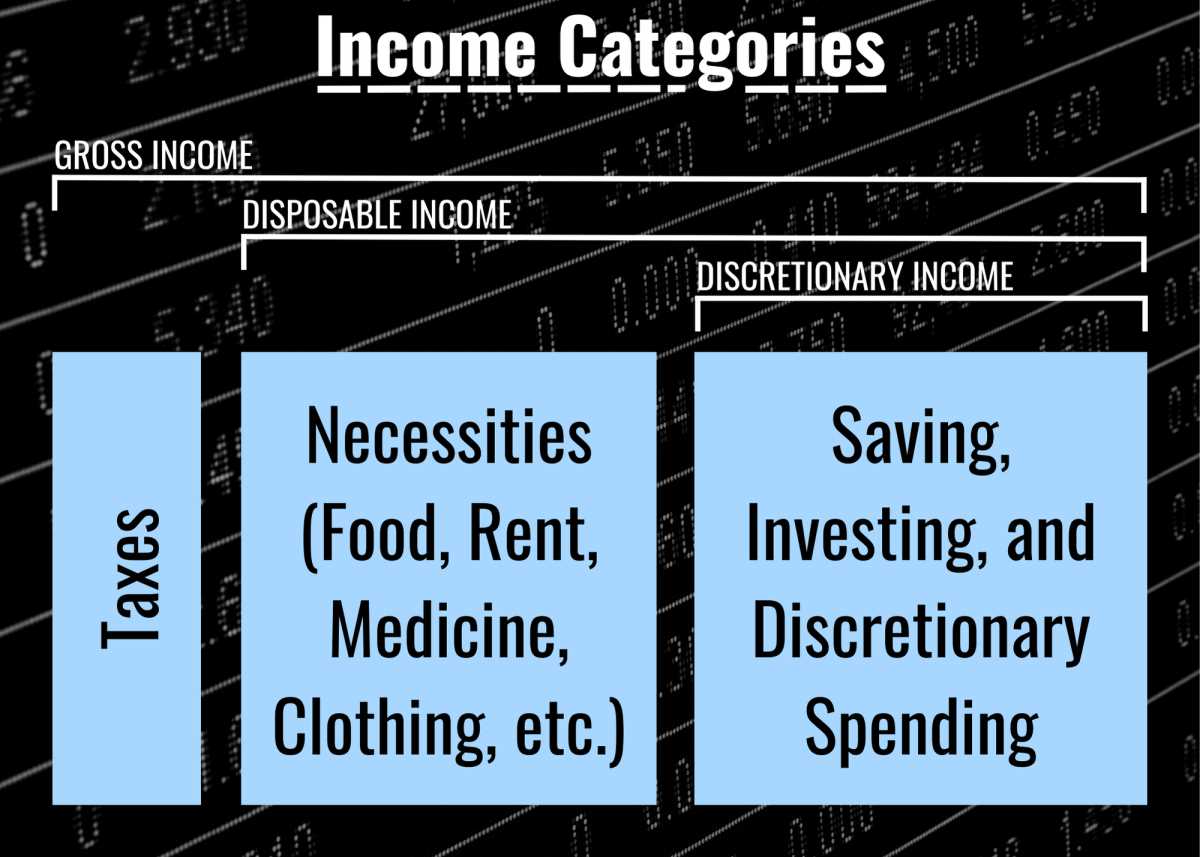

Discretionary income refers to the amount of money that an individual or household has left over after paying for necessary expenses, such as rent, utilities, and groceries. It is the money that can be used at the discretion of the individual or household for non-essential purchases and activities.

Discretionary income is often seen as a measure of financial freedom and flexibility. It allows individuals to make choices about how they want to spend their money, whether it be on entertainment, travel, hobbies, or saving for the future.

Calculating Discretionary Income

To calculate discretionary income, one must first determine their total income and subtract their necessary expenses. Total income includes wages, salaries, bonuses, and any other sources of income, such as investments or rental properties.

Necessary expenses include rent or mortgage payments, utilities, transportation costs, groceries, and other essential bills. These are expenses that are required for basic living and cannot be easily eliminated or reduced.

Once the necessary expenses are subtracted from the total income, the remaining amount is considered discretionary income. This is the money that can be used for discretionary spending or saving.

Importance of Managing Discretionary Income

Managing discretionary income is crucial for maintaining financial stability and achieving long-term financial goals. Without proper management, discretionary income can easily be wasted on unnecessary purchases or frivolous expenses.

One effective way to manage discretionary income is by creating a budget. A budget helps individuals allocate their discretionary income towards specific categories, such as entertainment, dining out, or saving for a vacation. By setting limits and priorities, individuals can ensure that their discretionary income is being used in a way that aligns with their values and goals.

Another important aspect of managing discretionary income is saving for the future. By setting aside a portion of discretionary income for savings or investments, individuals can build an emergency fund, plan for retirement, or work towards other financial milestones.

It is also important to regularly review and adjust discretionary spending. By tracking expenses and identifying areas where spending can be reduced or eliminated, individuals can free up more discretionary income for other purposes.

Managing Your Discretionary Income

| 1. Set Priorities | |

| 2. Create a Budget | |

| 3. Save and Invest | Consider using a portion of your discretionary income to save and invest for the future. Whether it’s putting money into a savings account, contributing to a retirement fund, or investing in stocks or real estate, saving and investing can help you build wealth over time. |

| 4. Pay Off Debt | If you have any outstanding debt, such as credit card debt or student loans, consider using your discretionary income to pay it off faster. By making extra payments towards your debt, you can save on interest and become debt-free sooner. |

| 5. Treat Yourself |

By following these tips, you can effectively manage your discretionary income and make the most of your extra money. Remember to regularly review and adjust your plan as needed to ensure you are meeting your financial goals.

Maximizing Your Discretionary Income

1. Reduce unnecessary expenses:

Take a close look at your spending habits and identify areas where you can cut back. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for your everyday expenses. By reducing unnecessary expenses, you can free up more money to allocate towards your discretionary income.

2. Increase your income:

Consider ways to increase your income, such as taking on a side gig or freelancing. This can provide you with an additional source of income that can be used to boost your discretionary income. Look for opportunities to monetize your skills or hobbies, and explore different ways to generate extra income.

3. Automate your savings:

Set up automatic transfers from your paycheck to a separate savings account specifically for your discretionary income. By automating your savings, you can ensure that a portion of your income is consistently allocated towards your discretionary funds. This can help you avoid the temptation to spend all of your extra money and instead build up your savings over time.

4. Prioritize your financial goals:

Identify your financial goals and prioritize them based on their importance. This could include saving for a down payment on a house, paying off debt, or investing for retirement. By prioritizing your goals, you can allocate your discretionary income towards the most important objectives first, ensuring that you are making progress towards your long-term financial aspirations.

5. Seek out discounts and deals:

When making discretionary purchases, always look for discounts and deals that can help you save money. This could include using coupons, shopping during sales, or comparing prices before making a purchase. By being proactive in finding ways to save, you can stretch your discretionary income further and make it go a long way.

Remember, maximizing your discretionary income requires discipline and conscious decision-making. By implementing these strategies, you can make the most of your extra money and achieve financial freedom faster.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.