Overview of Delivered Duty Unpaid (DDU)

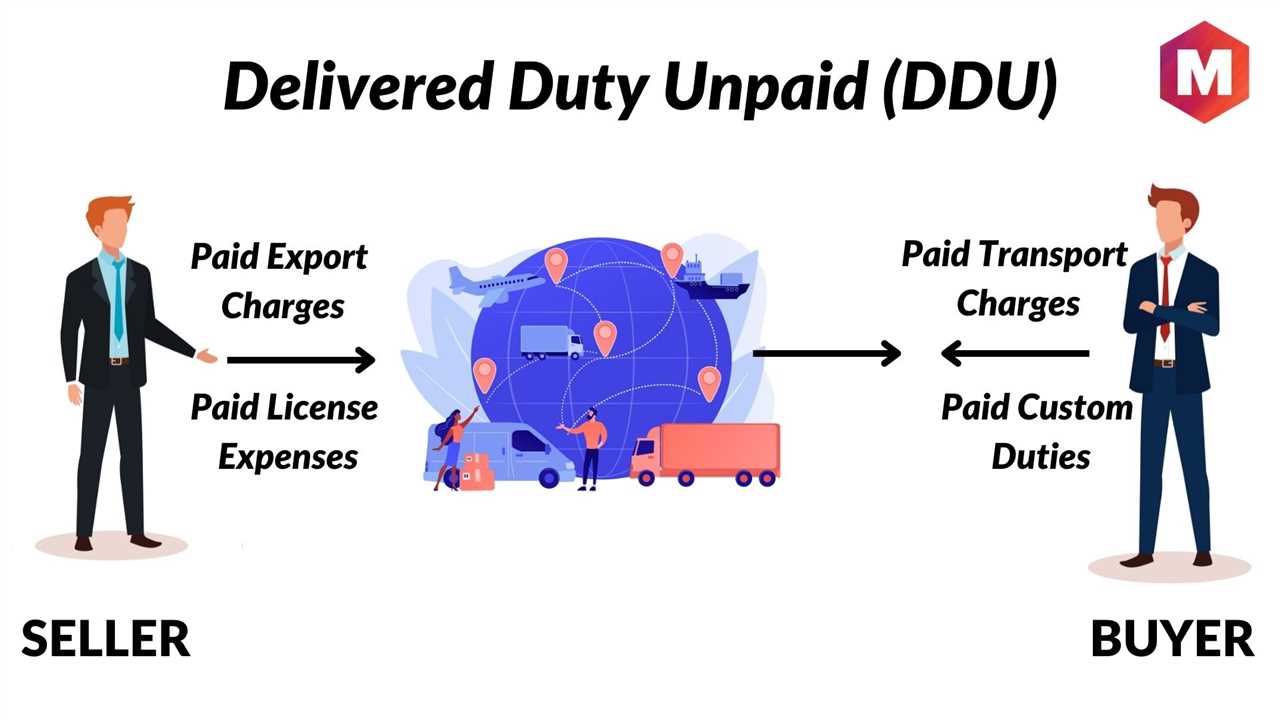

Delivered Duty Unpaid (DDU) is an international trade term that defines the responsibilities and obligations of the buyer and seller in a transaction. It is commonly used in international shipping and trade agreements to determine who is responsible for paying import duties, taxes, and other fees associated with the delivery of goods.

Under DDU terms, the seller is responsible for delivering the goods to the buyer’s specified location, but the buyer is responsible for clearing the goods through customs and paying any applicable duties or taxes. This means that the buyer bears the risk and cost of importing the goods, including any potential delays or additional fees that may arise during the customs clearance process.

DDU is often preferred by sellers who want to maintain control over the shipment until it reaches the buyer’s location, but do not want to be responsible for the import duties and taxes. It allows the seller to focus on the logistics of delivering the goods, while the buyer takes care of the customs clearance process.

Advantages of DDU

One of the main advantages of DDU is that it can help simplify the shipping process for both the buyer and seller. The seller only needs to arrange for the delivery of the goods to the buyer’s specified location, without having to worry about the customs clearance process. This can save time and resources for the seller, allowing them to focus on other aspects of their business.

For the buyer, DDU can provide more control over the customs clearance process. They can choose their own customs broker and have more flexibility in managing the import duties and taxes. This can help them optimize their supply chain and potentially reduce costs.

Considerations of DDU

While DDU can offer advantages, there are also considerations that both buyers and sellers should be aware of. One of the main considerations is the potential risk and cost associated with customs clearance. If the buyer is not familiar with the import regulations and procedures of the destination country, they may face delays, penalties, or additional fees.

Additionally, the buyer may be responsible for any damages or losses that occur during the customs clearance process. It is important for buyers to have proper insurance coverage to protect their goods in case of any unforeseen events.

Operational Mechanism of Delivered Duty Unpaid (DDU)

The operational mechanism of Delivered Duty Unpaid (DDU) involves several key steps to ensure the smooth delivery of goods and the payment of duties and taxes. These steps include:

- Agreement between the buyer and seller: The buyer and seller must agree on the terms of the DDU transaction, including the delivery location, the responsibilities of each party, and the payment of duties and taxes.

- Transportation: The seller arranges for the transportation of the goods to the agreed-upon destination. This may involve using various modes of transportation, such as trucks, ships, or airplanes.

- Import customs clearance: Once the goods arrive at the destination country, the buyer is responsible for arranging the import customs clearance. This includes submitting the necessary documentation to the customs authorities and paying any applicable duties and taxes.

- Delivery: After the import customs clearance is completed, the goods are delivered to the buyer’s specified location. This may involve using a local transport company or the buyer’s own transportation.

- Payment of duties and taxes: The buyer is responsible for paying any duties and taxes associated with the importation of the goods. This payment is typically made to the customs authorities or through a designated payment method.

- Documentation: Throughout the DDU process, both the buyer and seller must maintain accurate documentation of the transaction. This includes records of the commercial invoice, packing list, customs clearance documents, and any other relevant paperwork.

Benefits and Considerations of Delivered Duty Unpaid (DDU)

Delivered Duty Unpaid (DDU) is a trade term that places the responsibility of import duties and taxes on the buyer rather than the seller. This incoterm can offer several benefits for both parties involved in the transaction, but it also comes with certain considerations that need to be taken into account.

Benefits of Delivered Duty Unpaid (DDU)

1. Cost savings: One of the main advantages of DDU is that it allows the buyer to save on import duties and taxes. By taking on the responsibility of these costs, the buyer can negotiate better terms with customs authorities and potentially reduce the overall expenses associated with importing goods.

Considerations of Delivered Duty Unpaid (DDU)

1. Potential risks and liabilities: While DDU offers cost savings and flexibility, it also comes with certain risks and liabilities. The buyer is responsible for ensuring that the goods comply with all applicable regulations and that they are properly classified for customs purposes. Any errors or non-compliance issues can result in delays, penalties, or additional costs.

3. Potential delays and uncertainties: With DDU, the buyer is responsible for the transportation and customs clearance of the goods. This can lead to potential delays and uncertainties, especially if there are any issues with customs authorities or if the buyer is unfamiliar with the import process. It is important for the buyer to plan and prepare accordingly to minimize any potential disruptions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.