Types of Adjustable-Rate Mortgages

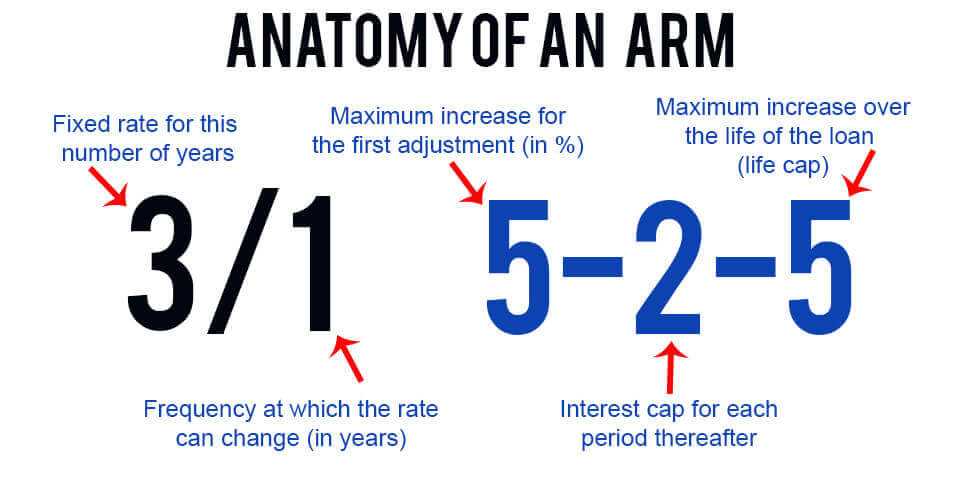

1. Hybrid ARMs: These mortgages have a fixed interest rate for an initial period, typically 3, 5, 7, or 10 years, and then adjust annually based on market conditions. Hybrid ARMs offer stability during the fixed period and potential savings if interest rates decrease after the adjustment period.

2. Interest-Only ARMs: With this type of ARM, borrowers have the option to pay only the interest for a specified period, usually 5, 7, or 10 years. After the interest-only period, the loan converts to a fully amortizing loan, and the monthly payments increase to include both principal and interest. Interest-only ARMs can be beneficial for borrowers who expect their income to increase in the future.

3. Payment Option ARMs: These ARMs offer borrowers multiple payment options each month, including a minimum payment, an interest-only payment, and a fully amortizing payment. Payment option ARMs provide flexibility but can also carry the risk of negative amortization, where the loan balance increases over time.

4. Convertible ARMs: Convertible ARMs allow borrowers to convert their adjustable-rate mortgage into a fixed-rate mortgage at a predetermined time. This option provides borrowers with the opportunity to lock in a fixed interest rate if they anticipate rising interest rates in the future.

5. Portfolio ARMs: Portfolio ARMs are adjustable-rate mortgages that are held by the lender instead of being sold on the secondary market. These mortgages may have unique terms and features tailored to the lender’s specific criteria. Portfolio ARMs can be an option for borrowers who don’t meet the traditional mortgage requirements.

Benefits of Adjustable-Rate Mortgages

Adjustable-Rate Mortgages (ARMs) offer several benefits that make them an attractive option for homebuyers. Here are some of the key advantages:

| 1. Initial Lower Interest Rate: | One of the main benefits of ARMs is that they typically start with a lower interest rate compared to fixed-rate mortgages. This can result in lower monthly mortgage payments, allowing borrowers to save money in the early years of homeownership. |

| 2. Potential for Lower Payments: | ARMs offer the potential for lower payments in the future if interest rates decrease. This can be beneficial for borrowers who plan to sell their home or refinance before the adjustable period begins. |

| 3. Flexibility: | ARMs provide borrowers with flexibility in terms of loan terms and repayment options. Some ARMs offer interest-only payment options or allow borrowers to choose between different adjustment periods. |

| 4. Shorter Adjustment Periods: | Unlike fixed-rate mortgages, ARMs have adjustment periods where the interest rate can change. However, these adjustment periods are typically shorter, ranging from one to five years. This means borrowers can take advantage of potentially lower interest rates more frequently. |

| 5. Potential for Savings: | If interest rates remain stable or decrease over time, borrowers with ARMs have the potential to save money compared to those with fixed-rate mortgages. This is especially true if the borrower plans to sell the property or refinance before the adjustable period begins. |

Why Choose an Adjustable-Rate Mortgage?

Choosing an adjustable-rate mortgage (ARM) can be a smart financial decision for many borrowers. Here are some reasons why you might want to consider an ARM:

1. Lower Initial Interest Rate:

One of the main advantages of an ARM is that it typically offers a lower initial interest rate compared to a fixed-rate mortgage. This can result in lower monthly mortgage payments, which can be especially beneficial for borrowers who plan to sell their home or refinance before the initial fixed-rate period ends.

2. Potential for Lower Future Rates:

3. Flexibility:

ARMs offer more flexibility compared to fixed-rate mortgages. For example, some ARMs offer an initial fixed-rate period, such as 5, 7, or 10 years, before the interest rate starts adjusting. This can provide borrowers with a predictable payment amount for a certain period of time. Additionally, ARMs may have rate adjustment caps and lifetime caps, which limit how much the interest rate can increase over the life of the loan.

4. Shorter Loan Terms:

ARMs often have shorter loan terms compared to fixed-rate mortgages. This can be advantageous for borrowers who want to pay off their mortgage faster or who plan to sell their home in the near future. Shorter loan terms can also save borrowers money on interest payments over the life of the loan.

5. Potential for Savings:

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.