What are Account Balances?

Account balances are typically displayed as a numerical value, indicating the current amount of funds available in the account. This balance takes into account various factors, such as deposits, withdrawals, interest earned, and fees charged. It provides a snapshot of your financial position and helps you track your spending, savings, and overall financial health.

Why are Account Balances Important?

Account balances play a vital role in managing your finances for several reasons:

1. Monitoring your spending: By regularly checking your account balances, you can keep track of your expenses and ensure that you are not overspending. It allows you to stay within your budget and make adjustments if necessary.

2. Avoiding overdrafts: Knowing your account balance helps you avoid overdrawing your account, which can result in costly fees. By keeping an eye on your balances, you can ensure that you have sufficient funds to cover your expenses and avoid any potential financial setbacks.

How to Check Your Account Balances

There are several ways to check your account balances:

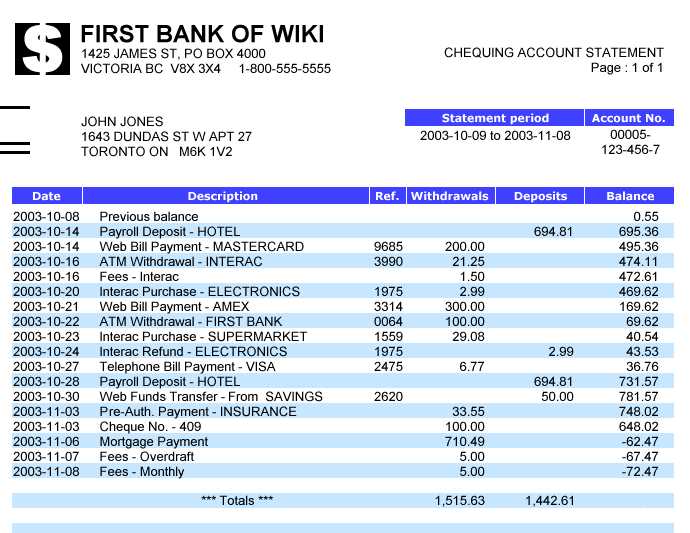

1. Online banking: Most banks offer online banking services that allow you to view your account balances, transaction history, and other account details. Simply log in to your online banking portal or mobile app to access this information.

2. ATM: You can also check your account balances at an ATM by inserting your debit card and selecting the balance inquiry option. The ATM will display your current balance on the screen.

3. Bank statements: Your bank will typically send you monthly or quarterly statements that provide an overview of your account balances, transactions, and other important information. Review these statements to keep track of your account balances.

4. Mobile banking: Many banks offer mobile banking apps that allow you to check your account balances on your smartphone or tablet. Download the app from your bank’s website or app store, and log in to access your account information.

By regularly monitoring your account balances and staying informed about your financial situation, you can make better financial decisions and achieve your financial goals.

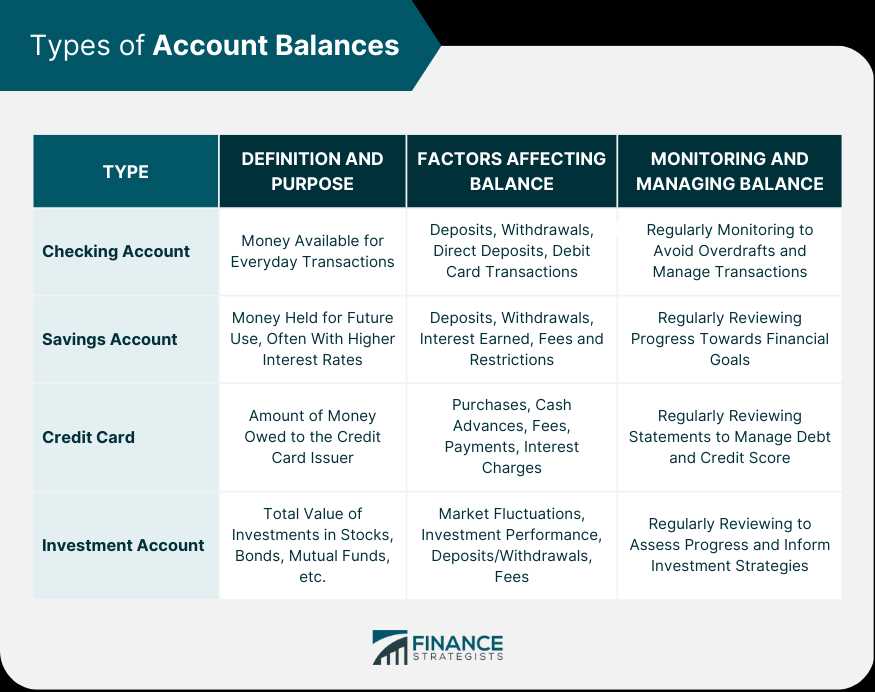

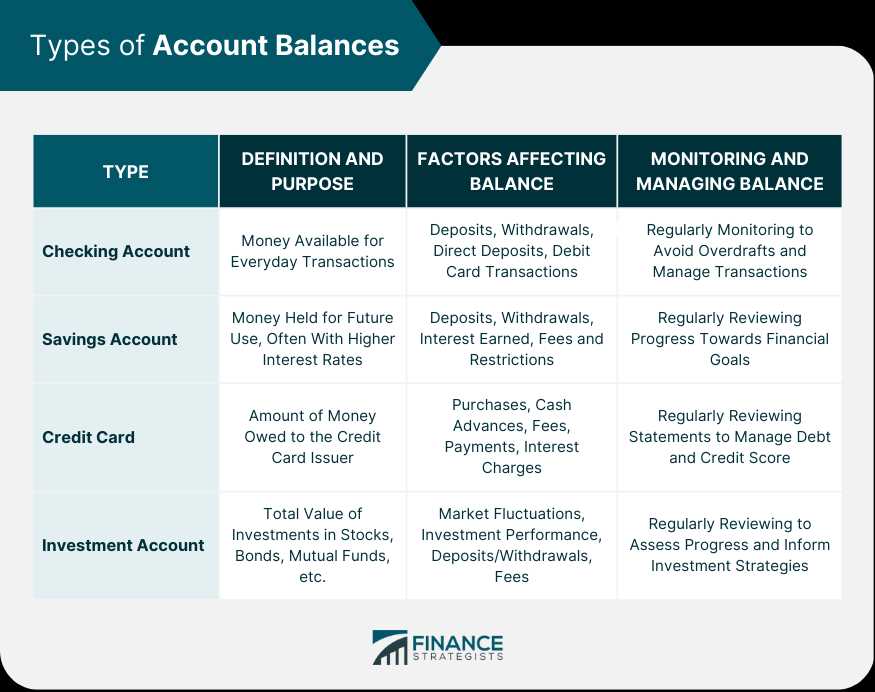

Types of Account Balances

1. Available Balance

The available balance is the amount of money that you can access and use for transactions. It takes into account any pending transactions, holds, or restrictions on your account. This balance is important to consider when making purchases or withdrawals, as it reflects the actual funds that are available to you.

2. Current Balance

Example: Let’s say you have $500 in your account and you make a purchase for $50. The available balance will decrease to $450, while the current balance will still show $500 until the transaction clears.

3. Ledger Balance

The ledger balance is the balance that the bank uses to calculate interest and fees. It takes into account all transactions, including deposits, withdrawals, and any pending transactions. This balance is typically used for account reconciliation and to determine if any fees or interest should be applied to your account.

4. Minimum Balance

The minimum balance is the lowest amount of money that must be maintained in your account to avoid fees or penalties. Banks often require customers to maintain a minimum balance to keep their accounts open. If your account falls below the minimum balance, you may be charged a fee or have other restrictions placed on your account.

5. Available Credit

While not technically an account balance, available credit is an important concept to understand for credit card accounts. It refers to the amount of credit that you have available to use on your credit card. It is the difference between your credit limit and your current balance.

How to Manage Account Balances

Managing your account balances is an essential part of maintaining financial stability and ensuring that you have enough funds to cover your expenses. Here are some tips on how to effectively manage your account balances:

1. Track your expenses:

One of the first steps in managing your account balances is to keep track of your expenses. This can be done by reviewing your bank statements, using budgeting apps, or creating a spreadsheet to record your expenses. By knowing where your money is going, you can make better decisions about how to allocate your funds and avoid overspending.

2. Set a budget:

Creating a budget is crucial for managing your account balances. Start by determining your monthly income and fixed expenses, such as rent or mortgage payments, utility bills, and loan payments. Then, allocate a certain amount for variable expenses, such as groceries, entertainment, and transportation. Stick to your budget and make adjustments as needed to ensure that your expenses do not exceed your income.

3. Automate your savings:

Another effective way to manage your account balances is to automate your savings. Set up automatic transfers from your checking account to a savings account or investment account. This way, a portion of your income will be saved or invested before you have a chance to spend it. Automating your savings can help you build an emergency fund, save for future goals, and grow your wealth over time.

4. Monitor your account regularly:

Make it a habit to regularly check your account balances. This will help you stay aware of your financial situation and identify any discrepancies or unauthorized transactions. By monitoring your account regularly, you can also ensure that you have enough funds to cover upcoming expenses and avoid overdraft fees or bounced checks.

5. Review and adjust your financial goals:

Periodically review your financial goals and make adjustments as needed. This includes reassessing your savings targets, investment strategies, and debt repayment plans. By regularly reviewing and adjusting your financial goals, you can stay on track and make progress towards achieving financial stability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.