Underfunded Pension Plan: Definition

Underfunded pension plans typically arise when a company fails to contribute enough money to its pension fund to meet its future obligations. This can occur due to various reasons, such as poor investment performance, economic downturns, or inadequate funding policies. When a pension plan becomes underfunded, it poses a risk to the retirement security of employees who rely on the plan for their future income.

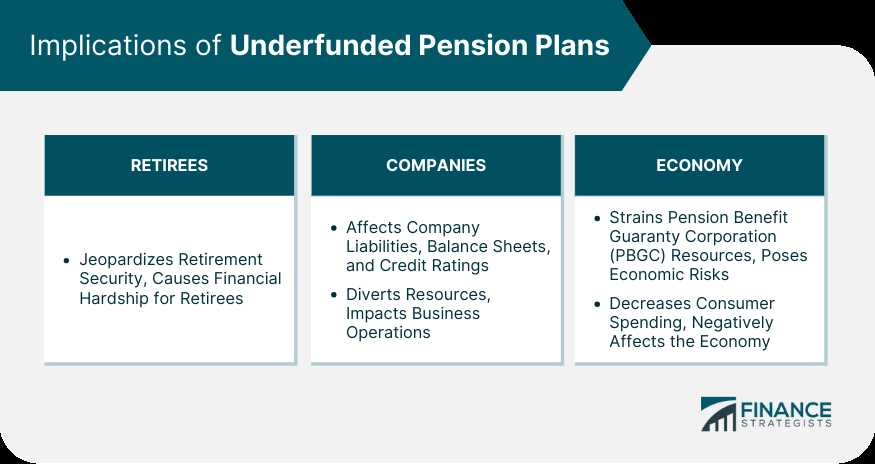

Underfunded pension plans can have serious consequences for retirees. In some cases, retirees may receive reduced pension benefits or face the possibility of their benefits being cut altogether. This can lead to financial hardship and a lower standard of living during retirement.

Eligibility for Underfunded Pension Plans

Eligibility for underfunded pension plans depends on the specific plan and its rules. Generally, employees who have participated in a pension plan for a certain number of years or have reached a certain age may be eligible for benefits. However, the level of benefits received may be affected by the plan’s funding status.

It is important for employees to understand the funding status of their pension plan and the potential risks associated with underfunding. This can help them make informed decisions about their retirement savings and consider alternative options, such as additional savings or investment strategies, to ensure a secure retirement.

Conclusion

How Does an Underfunded Pension Plan Occur?

Another factor that can lead to underfunding is inadequate contributions. If the employer does not contribute enough funds to the plan or fails to make the required contributions, the plan may not have enough assets to cover its liabilities. Additionally, demographic changes, such as an aging workforce or longer life expectancies, can increase the plan’s obligations and contribute to underfunding.

Consequences of Underfunded Pension Plans

Underfunded pension plans can have significant consequences for both retirees and employers. For retirees, underfunding can result in reduced retirement benefits. If the plan does not have enough assets to meet its obligations, retirees may receive lower monthly payments or face benefit cuts. This can have a significant impact on their financial security during retirement.

Employers also face consequences when a pension plan is underfunded. They may be required to make additional contributions to the plan to address the shortfall, which can strain their financial resources. Underfunding can also damage the employer’s reputation and lead to legal and regulatory issues.

It is important for both employees and employers to monitor the funding status of a pension plan and take appropriate actions to address any underfunding. This may include increasing contributions, adjusting investment strategies, or implementing other measures to improve the plan’s financial health.

Eligibility for Underfunded Pension Plans

Eligibility for underfunded pension plans is determined by the specific rules and regulations set by the pension plan itself. These rules may vary depending on the type of pension plan and the organization offering it. However, there are some common eligibility criteria that are typically considered when determining who qualifies for an underfunded pension plan.

1. Employment Status

One of the primary factors in determining eligibility for an underfunded pension plan is employment status. Typically, these plans are offered to employees of a specific organization or industry. To be eligible, an individual must be employed by the organization or industry that sponsors the pension plan.

2. Length of Service

Another important criterion for eligibility is the length of service with the organization. Most underfunded pension plans require a minimum number of years of service before an employee becomes eligible to participate. This is often referred to as a vesting period. The specific length of the vesting period can vary, but it is typically around 5 years.

3. Age

Age is another factor that may be considered when determining eligibility for an underfunded pension plan. Some plans may have a minimum age requirement, such as 21 or 25, before an employee can participate in the plan. This requirement is often in place to ensure that employees have had enough time to establish their careers and contribute to the plan.

4. Contribution Requirements

Many underfunded pension plans require employees to make contributions to the plan in order to be eligible for benefits. These contributions are often deducted from the employee’s paycheck and may be a fixed percentage of their salary. The specific contribution requirements can vary depending on the plan and may change over time.

5. Other Factors

In addition to the criteria mentioned above, there may be other factors that are considered when determining eligibility for an underfunded pension plan. These factors can include factors such as job title, union membership, or participation in other retirement savings plans.

It is important for individuals to carefully review the eligibility requirements of an underfunded pension plan to determine if they meet the criteria. If eligible, participating in such a plan can provide valuable retirement benefits and help individuals secure their financial future.

Who Qualifies for Underfunded Pension Plans?

Underfunded pension plans are designed to provide retirement benefits to employees who meet certain eligibility requirements. The specific qualifications for these plans can vary depending on the company or organization offering the plan. However, there are some common criteria that are often used to determine eligibility.

1. Length of Service

One of the main factors that determine eligibility for an underfunded pension plan is the length of service with the company. Typically, employees must have worked for a certain number of years to qualify for the plan. This requirement ensures that the employee has contributed a significant amount of time and effort to the company and is deserving of retirement benefits.

2. Age

Another important factor in determining eligibility for an underfunded pension plan is the employee’s age. Many plans have a minimum age requirement, such as 55 or 60, before an employee can start receiving benefits. This requirement is in place to ensure that employees have reached a certain stage in their lives where retirement is a realistic and viable option.

3. Employment Status

The employment status of an individual can also play a role in determining eligibility for an underfunded pension plan. Typically, these plans are offered to full-time employees who have a permanent or long-term employment status. Part-time or temporary employees may not be eligible for the plan. This requirement ensures that the employee has made a significant commitment to the company and has a stable source of income.

4. Vesting Period

Some underfunded pension plans have a vesting period, which is the amount of time an employee must work for the company before they become eligible to receive the full benefits of the plan. This period can range from a few years to a decade or more. During the vesting period, the employee may only be entitled to a portion of the benefits. This requirement is in place to encourage employees to stay with the company for a longer period of time.

5. Other Factors

In addition to the above criteria, there may be other factors that determine eligibility for an underfunded pension plan. These can include the employee’s job title, salary level, or participation in other retirement savings plans. It is important for employees to carefully review the plan documents and consult with their employer to understand the specific eligibility requirements.

Overall, underfunded pension plans are designed to provide retirement benefits to employees who have dedicated a significant amount of time and effort to a company. By meeting the eligibility requirements, employees can secure a stable source of income during their retirement years.

Common Questions about Underfunded Pension Plans

Underfunded pension plans can be complex, and individuals often have questions about how they work and what their implications are. Here are some common questions about underfunded pension plans:

| Question | Answer |

|---|---|

| 1. What is an underfunded pension plan? | An underfunded pension plan is a retirement plan where the assets in the plan are not sufficient to cover the promised benefits to retirees. This can happen due to poor investment performance, inadequate contributions, or other financial challenges faced by the plan sponsor. |

| 2. How does underfunding affect retirees? | Underfunding can have significant implications for retirees. It may result in reduced benefits or even the possibility of the plan being unable to pay out the promised benefits. Retirees may need to rely on other sources of income or government assistance to make up for the shortfall. |

| 3. Can underfunded pension plans be fixed? | Underfunded pension plans can be addressed through various means. The plan sponsor may increase contributions, adjust investment strategies, or negotiate benefit reductions with retirees or unions. In some cases, the plan may need to be terminated, and participants may receive reduced benefits through the Pension Benefit Guaranty Corporation. |

| 4. How can individuals protect themselves from underfunded pension plans? | Individuals can take steps to protect themselves from underfunded pension plans. They can research the financial health of the plan sponsor before joining a pension plan and diversify their retirement savings across different types of accounts. It is also important to stay informed about the financial status of the plan and any potential changes that may affect benefits. |

| 5. Are underfunded pension plans common? | Underfunded pension plans are not uncommon, especially in industries or sectors facing financial challenges. Economic downturns, poor investment performance, and inadequate funding can all contribute to underfunding. It is important for individuals to be aware of the financial health of their pension plan and take appropriate steps to protect their retirement savings. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.