What is Triple Witching?

Triple Witching refers to the simultaneous expiration of three different types of financial instruments: stock options, stock index futures, and stock index options. It occurs on the third Friday of March, June, September, and December.

| Key Points about Triple Witching: |

| 1. Triple Witching refers to the simultaneous expiration of stock options, stock index futures, and stock index options. |

| 2. It occurs on the third Friday of March, June, September, and December. |

| 3. Triple Witching can lead to increased trading activity and volatility in the market. |

| 4. Traders and investors need to close out their positions or roll them over during Triple Witching. |

Definition and Explanation

Stock Options

Stock options are derivative contracts that give the holder the right, but not the obligation, to buy or sell a specific stock at a predetermined price within a certain timeframe. These options can be used for speculation, hedging, or income generation.

Stock Index Options

Stock Index Futures

Stock index futures are contracts to buy or sell a specific stock index at a predetermined price on a future date. These futures contracts are often used by institutional investors and traders to speculate on the direction of the stock market or to hedge existing positions.

During triple witching, all three of these types of contracts expire at the same time, leading to increased trading activity and potentially higher levels of market volatility. Traders and investors may be adjusting their positions or closing out their contracts, which can result in significant price movements in individual stocks and the overall stock market.

| Key Points: |

|---|

| – Triple Witching refers to the simultaneous expiration of stock options, stock index options, and stock index futures contracts. |

| – It occurs on the third Friday of March, June, September, and December. |

| – Triple Witching can lead to increased trading activity and market volatility. |

| – Traders should be aware of triple witching and develop strategies to take advantage of the opportunities it presents. |

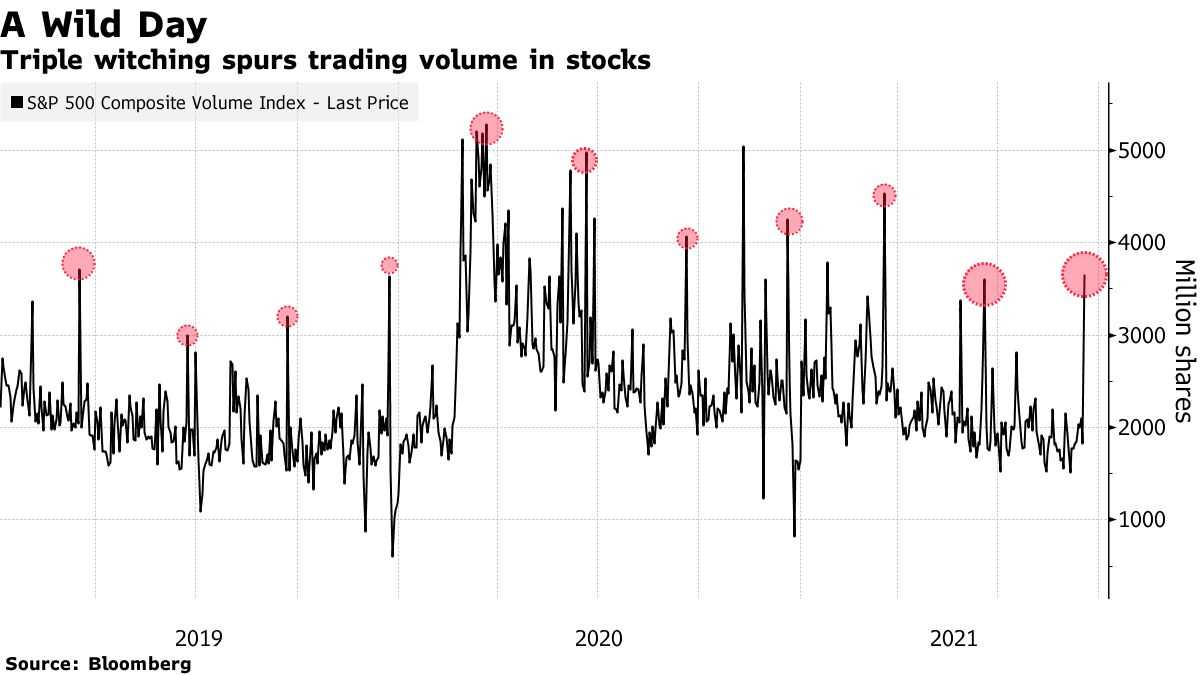

Triple Witching Impact on Trading

During Triple Witching, there is typically increased volatility in the market as traders and investors rush to close out their positions before the contracts expire. This can lead to sharp price movements and increased trading volume.

One of the main impacts of Triple Witching on trading is the potential for increased market volatility. As traders rush to close out their positions, there can be a higher level of uncertainty and unpredictability in the market. This can create opportunities for traders who are able to navigate and take advantage of these price swings.

Additionally, Triple Witching can lead to increased trading volume. As traders and investors adjust their positions, there is typically a surge in trading activity. This increased volume can provide liquidity to the market and potentially lead to more efficient price discovery.

It is important for traders to be aware of the impact of Triple Witching on trading and to have a strategy in place. This may involve closely monitoring market conditions, setting appropriate stop-loss orders, and being prepared for increased volatility.

Effects on Market Volatility

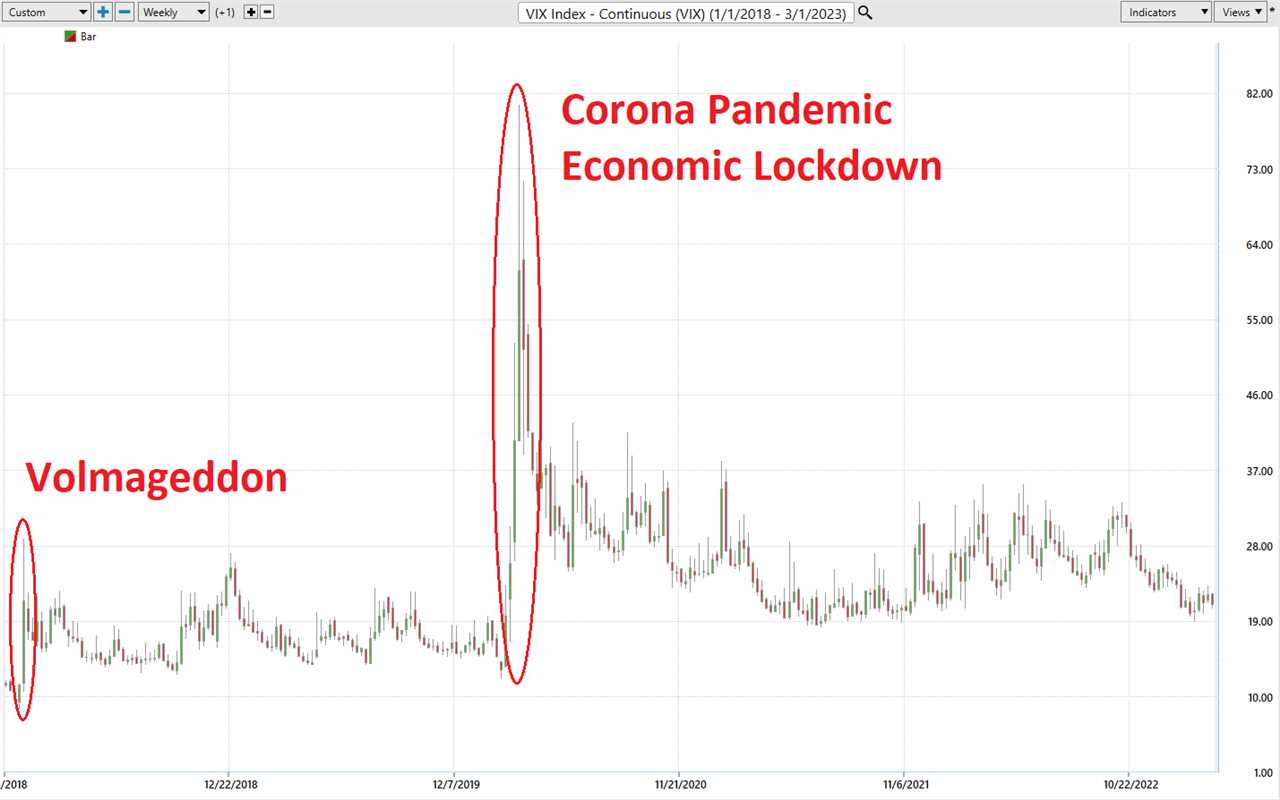

Triple witching can have a significant impact on market volatility. During this period, the simultaneous expiration of stock options, stock index futures, and stock index options can lead to increased uncertainty and rapid price movements.

One of the main reasons for the increased volatility is the need for market participants to adjust their positions before the contracts expire. Traders and investors may choose to close out their positions or roll them over to the next expiration cycle. This can lead to a flurry of buying or selling activity, causing prices to fluctuate.

Additionally, the expiration of these derivatives contracts can result in increased hedging activity. Market participants may need to adjust their hedges or establish new ones to protect their portfolios from potential losses. This can further contribute to volatility as large trades are executed to offset risk.

Furthermore, the expiration of these contracts can also impact the prices of the underlying securities. For example, if a significant number of options contracts are expiring in a particular stock, it can lead to increased buying or selling pressure on that stock, affecting its price.

Overall, triple witching can create a more turbulent trading environment, with larger price swings and increased trading volume. Traders need to be aware of these effects and adjust their strategies accordingly to navigate the market during this period.

Increased Trading Volume

One of the key effects of triple witching on the financial markets is the significant increase in trading volume. During this time, traders and investors are actively buying and selling contracts for options, futures, and stock index futures. This surge in trading activity can lead to higher liquidity and tighter bid-ask spreads, making it easier for market participants to execute trades.

With increased trading volume, there is also a higher likelihood of price volatility. As more market participants enter the market, the supply and demand dynamics can rapidly shift, causing prices to fluctuate more rapidly. Traders who are skilled at navigating volatile markets may find opportunities to profit from these price swings.

Impact on Market Liquidity

Triple witching can have a significant impact on market liquidity. With the increased trading volume, there is a higher level of liquidity available in the market. This means that traders can buy or sell contracts without significantly impacting the price. The presence of liquidity allows traders to enter and exit positions more easily, reducing the risk of slippage.

However, it is important to note that while triple witching can increase liquidity, it can also lead to periods of reduced liquidity. During times of high volatility, market participants may become hesitant to trade, leading to thinner order books and wider bid-ask spreads. Traders should be aware of these potential liquidity challenges and adjust their trading strategies accordingly.

- Triple witching leads to increased trading volume in the financial markets.

- Higher trading volume can result in greater liquidity and tighter bid-ask spreads.

- Increased volume can also lead to higher price volatility.

- Market liquidity can be impacted during triple witching, with periods of both increased and reduced liquidity.

Triple Witching Strategy

1. Plan Ahead

Before triple witching day arrives, take the time to research and analyze the market. Identify potential opportunities and set clear goals for your trades. Having a well-defined plan will help you stay focused and make informed decisions.

2. Monitor Market Sentiment

During triple witching, market sentiment can change rapidly. Stay updated on the latest news and developments that may impact the market. Pay attention to economic indicators, company earnings reports, and any other relevant information that could influence trading activity.

3. Use Risk Management Techniques

4. Be Prepared for Volatility

Triple witching often leads to increased market volatility, which can create both opportunities and risks. Be mentally prepared for sudden price swings and be cautious when entering trades. Use technical analysis tools to identify support and resistance levels and consider using trailing stops to protect your profits.

5. Stay Disciplined

By following these strategies, you can increase your chances of success when trading during triple witching. Remember to stay informed, manage your risk, and remain disciplined in your approach. Good luck!

Tips for Trading during Triple Witching

1. Do Your Research

Before the Triple Witching day, make sure you are well-informed about the stocks you plan to trade. Research the companies, their financials, and any recent news or events that may impact their stock prices.

2. Set Clear Goals

Define your trading goals and stick to them. Determine your desired profit targets and stop-loss levels before entering any trades. This will help you stay disciplined and avoid making impulsive decisions based on market fluctuations.

3. Monitor Market Sentiment

Keep a close eye on market sentiment and investor behavior during Triple Witching. Pay attention to any major news announcements or economic indicators that could affect overall market sentiment. This will help you gauge the direction of the market and make more informed trading decisions.

4. Use Limit Orders

During periods of high volatility, it’s advisable to use limit orders instead of market orders. This allows you to set a specific price at which you are willing to buy or sell a stock, ensuring that you don’t get caught in sudden price swings.

5. Manage Risk

6. Be Mindful of Liquidity

Triple Witching can result in increased trading volume, but it can also lead to decreased liquidity in certain stocks. Be mindful of the bid-ask spread and trade stocks with sufficient liquidity to ensure smooth execution of your trades.

7. Stay Calm and Patient

By following these tips, you can increase your chances of success when trading during Triple Witching. Remember to always stay informed, stay disciplined, and manage your risk effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.