Traunch Splitting Payments: A Risk Management Strategy for Private Equity & VC Investors

Private equity and venture capital investments can be highly lucrative, but they also come with a significant amount of risk. One strategy that investors can use to manage this risk is traunch splitting payments.

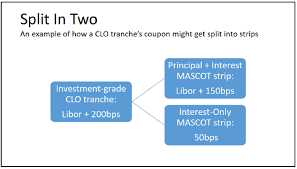

Traunch splitting involves dividing an investment into multiple smaller payments, or traunches, which are released to the investment manager based on certain milestones or performance targets. This strategy allows investors to spread their risk over time and ensure that the investment manager is meeting their expectations.

There are several benefits to traunch splitting for investor risk management. Firstly, it allows investors to have more control over their investment. By releasing payments in smaller increments, investors can closely monitor the performance of the investment manager and make adjustments if necessary.

Secondly, traunch splitting helps to align the interests of the investor and the investment manager. By tying payments to specific milestones or targets, the investment manager is incentivized to work towards the success of the investment. This can help to mitigate conflicts of interest and ensure that both parties are working towards the same goal.

Implementing traunch splitting in private equity and venture capital investments requires careful consideration. Firstly, investors need to determine the appropriate milestones or targets to use for releasing payments. These should be specific, measurable, and achievable within a reasonable timeframe.

Additionally, investors should establish clear communication channels with the investment manager to ensure that both parties are on the same page regarding expectations and performance. Regular reporting and updates can help to keep investors informed and provide transparency into the progress of the investment.

Traunch splitting is a risk management strategy commonly used in private equity and venture capital investments. It involves dividing the investment amount into multiple tranches or portions, which are released over a period of time or upon the achievement of specific milestones.

The purpose of traunch splitting is to mitigate the risk associated with making a large upfront investment. By releasing funds in tranches, investors can better manage their exposure to risk and make more informed decisions based on the performance of the investment.

Each traunch represents a specific stage or phase of the investment. For example, in a startup investment, the first traunch may be released upon the completion of product development, while subsequent tranches may be tied to achieving certain revenue targets or milestones.

By linking the release of funds to specific milestones, traunch splitting aligns the interests of the investor and the investee. It incentivizes the investee to meet the agreed-upon targets and provides the investor with greater control over their investment.

Benefits of Traunch Splitting for Investor Risk Management

Traunch splitting is a risk management strategy that can provide significant benefits for private equity and venture capital investors. By dividing investments into multiple tranches, or portions, investors can mitigate their risk and increase their chances of achieving positive returns.

Diversification

Furthermore, traunch splitting allows investors to diversify their investments across different industries or sectors. This diversification can help to protect against downturns in specific sectors and increase the overall stability of the investment portfolio.

Risk Management

Traunch splitting also provides effective risk management for investors. By investing in multiple tranches, investors can assess the performance of each tranche and make informed decisions about whether to continue investing or exit the investment. This allows investors to manage their risk by adjusting their investment allocation based on the performance of each tranche.

In addition, traunch splitting allows investors to have more control over their investment timeline. Investors can choose to release funds in tranches based on specific milestones or performance targets. This flexibility helps investors to manage their risk by ensuring that funds are only released when certain conditions are met.

Optimized Returns

Traunch splitting can also lead to optimized returns for investors. By investing in multiple tranches, investors have the opportunity to capture the upside potential of successful tranches while limiting their exposure to underperforming tranches. This allows investors to maximize their returns by focusing on the tranches that are performing well.

Furthermore, traunch splitting can provide investors with the ability to exit an investment early if a particular tranche is not performing as expected. This exit strategy helps to minimize losses and allows investors to reallocate their funds to more promising opportunities.

Implementing Traunch Splitting in Private Equity & VC Investments

Implementing traunch splitting in private equity and venture capital investments can be a strategic move for investor risk management. This approach involves dividing the investment into multiple tranches or portions, each with its own set of terms and conditions.

Benefits of Traunch Splitting

Traunch splitting offers several benefits for investor risk management:

- Risk mitigation: By dividing the investment into tranches, investors can spread their risk across different stages of the project or company’s development. This helps to minimize the impact of potential losses and provides a more balanced risk profile.

- Increased control: Traunch splitting allows investors to have more control over their investment. They can set specific milestones or conditions for each tranche, ensuring that the company meets certain targets before receiving additional funding.

- Flexibility: This approach provides flexibility for investors to adjust their investment based on the company’s performance. If the company is not meeting expectations, investors can choose to allocate less capital to subsequent tranches or even halt further funding.

- Alignment of interests: Traunch splitting helps align the interests of investors and entrepreneurs. By tying funding to specific milestones, investors can incentivize entrepreneurs to achieve certain goals and create value for the company.

Implementing Traunch Splitting

When implementing traunch splitting in private equity and venture capital investments, there are several considerations to keep in mind:

- Clear investment plan: It is essential to have a clear investment plan that outlines the milestones and conditions for each tranche. This plan should be agreed upon by all parties involved and provide a roadmap for the investment.

- Thorough due diligence: Before implementing traunch splitting, investors should conduct thorough due diligence on the company or project. This includes assessing the management team, market potential, and financial projections to ensure the investment is viable.

- Regular monitoring and evaluation: Investors should closely monitor the company’s progress and evaluate its performance against the set milestones. Regular updates and reporting should be provided to all parties involved to ensure transparency and accountability.

- Flexibility in funding: Traunch splitting allows for flexibility in funding. Investors can adjust the amount allocated to each tranche based on the company’s performance and funding needs.

Overall, implementing traunch splitting in private equity and venture capital investments can be an effective risk management strategy. It provides investors with greater control, flexibility, and alignment of interests, while mitigating potential risks. However, careful planning, due diligence, and transparent communication are essential for successful implementation.

Considerations for Successful Traunch Splitting

Traunch splitting is a risk management strategy that can provide significant benefits for private equity and venture capital investors. However, it is important to carefully consider certain factors to ensure the successful implementation of this strategy.

1. Investor Alignment

Before implementing traunch splitting, it is crucial to ensure that all investors are aligned in terms of their risk tolerance and investment objectives. This can be achieved through clear communication and transparency regarding the potential risks and rewards associated with the investment.

2. Due Diligence

Prior to engaging in traunch splitting, thorough due diligence should be conducted on the investment opportunity. This includes evaluating the financial health and performance of the target company, as well as assessing the market conditions and competitive landscape. A comprehensive analysis will help investors make informed decisions and mitigate potential risks.

3. Legal and Regulatory Compliance

Investors must ensure that the traunch splitting strategy complies with all relevant legal and regulatory requirements. This may involve consulting with legal professionals to ensure that the investment structure and agreements are in accordance with applicable laws and regulations.

4. Clear Traunch Structure

It is essential to establish a clear traunch structure that outlines the timing and conditions for each payment installment. This will help manage investor expectations and provide transparency throughout the investment process.

5. Risk Mitigation Strategies

Investors should also develop risk mitigation strategies to address potential challenges or setbacks that may arise during the investment period. This may include contingency plans, alternative financing options, or diversification of investments to minimize potential losses.

6. Ongoing Monitoring and Evaluation

Once the traunch splitting strategy is implemented, it is important to continuously monitor and evaluate the investment performance. This will allow investors to make timely adjustments or decisions based on the progress and outcomes of the investment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.