What is Times Interest Earned Ratio?

Definition and Calculation

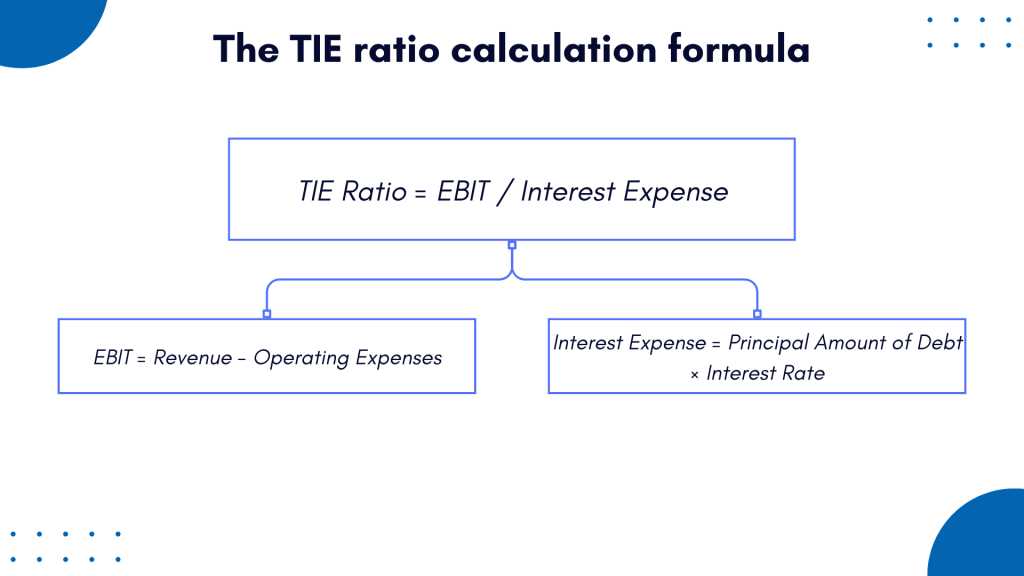

The Times Interest Earned Ratio is calculated by dividing the company’s earnings before interest and taxes (EBIT) by its interest expense. The formula is as follows:

Times Interest Earned Ratio = EBIT / Interest Expense

EBIT represents the company’s operating income before deducting interest and taxes, while interest expense refers to the interest payments made on the company’s debt.

Importance of Times Interest Earned Ratio

The Times Interest Earned Ratio is an important indicator of a company’s financial health and stability. It provides insight into the company’s ability to meet its interest obligations and avoid defaulting on its debt. A higher ratio indicates a stronger ability to cover interest expenses, which is favorable for both creditors and investors.

For creditors, a higher ratio implies a lower risk of default, making the company more creditworthy. This may result in lower borrowing costs for the company. On the other hand, investors use this ratio to assess the company’s profitability and financial stability. A higher ratio suggests that the company is generating sufficient earnings to cover its interest expenses, which is a positive sign for investors.

Interpretation and Analysis

When analyzing the Times Interest Earned Ratio, it is important to consider the industry standards and compare the ratio with other companies in the same industry. Different industries have different levels of risk and profitability, which can affect the ideal range for this ratio.

A ratio below 1 indicates that the company is not generating enough earnings to cover its interest expenses, which may be a sign of financial distress. A ratio between 1 and 2 is considered low and suggests that the company has limited ability to cover its interest payments. A ratio above 2 is generally considered healthy, indicating that the company has a strong ability to meet its interest obligations.

Definition and Calculation

The formula for calculating the Times Interest Earned Ratio is:

Times Interest Earned Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

EBIT is the company’s operating income before deducting interest and taxes. Interest expense refers to the interest payments made by the company on its debt obligations.

The Times Interest Earned Ratio indicates how many times a company’s earnings can cover its interest expenses. A higher ratio suggests that the company is more capable of meeting its interest obligations, while a lower ratio indicates a higher risk of defaulting on its debt.

For example, if a company has an EBIT of $500,000 and an interest expense of $100,000, the Times Interest Earned Ratio would be 5 ($500,000 / $100,000). This means that the company’s earnings are five times higher than its interest expenses.

Importance of Times Interest Earned Ratio

The Times Interest Earned Ratio is an important financial metric that helps investors, creditors, and analysts assess a company’s ability to meet its interest obligations. It provides valuable insights into a company’s financial health and its capacity to generate enough earnings to cover its interest expenses.

A high Times Interest Earned Ratio indicates that a company has a strong ability to meet its interest payments. This is a positive sign for investors and creditors, as it suggests that the company is financially stable and can easily handle its debt obligations. It also indicates that the company has sufficient earnings to cover its interest expenses, which reduces the risk of defaulting on its loans.

On the other hand, a low Times Interest Earned Ratio is a cause for concern. It suggests that a company may be struggling to generate enough earnings to cover its interest payments. This could be a sign of financial distress and may indicate that the company is at risk of defaulting on its debt. Creditors may be hesitant to lend to a company with a low Times Interest Earned Ratio, as it increases the risk of not being repaid.

Furthermore, the Times Interest Earned Ratio is often used by investors and analysts to compare companies within the same industry. By comparing the ratios of different companies, investors can identify which companies are more financially sound and have a better ability to meet their interest obligations. This information can be used to make informed investment decisions and assess the creditworthiness of a company.

Interpretation and Analysis

The times interest earned ratio is a crucial financial metric that helps investors and creditors assess a company’s ability to meet its interest payment obligations. By analyzing this ratio, stakeholders can gain insights into a company’s financial health and its ability to generate enough income to cover its interest expenses.

Interpretation

A times interest earned ratio of 1 indicates that a company’s earnings are just enough to cover its interest expenses. This suggests that the company has a high level of risk, as any decrease in earnings could make it difficult to meet its interest obligations. Generally, a higher ratio is preferred, as it indicates a greater ability to meet interest payments.

If the times interest earned ratio is less than 1, it means that the company’s earnings are not sufficient to cover its interest expenses. This is a red flag for investors and creditors, as it indicates a high risk of default on interest payments.

On the other hand, a times interest earned ratio greater than 1 indicates that a company’s earnings are more than enough to cover its interest expenses. This suggests a lower risk of default and a healthier financial position.

Analysis

When analyzing the times interest earned ratio, it is important to consider the industry average and compare the company’s ratio to its competitors. This helps to provide context and determine if the company’s ratio is above or below the industry norm.

Additionally, it is important to track the trend of the times interest earned ratio over time. A declining ratio may indicate deteriorating financial health, while an increasing ratio may suggest improving financial performance.

Furthermore, it is essential to consider other financial ratios and factors when interpreting the times interest earned ratio. For example, a company with a high debt-to-equity ratio may have a higher times interest earned ratio but still be at risk due to its high level of debt.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.