Tier 1 Common Capital Ratio: Meaning and Overview

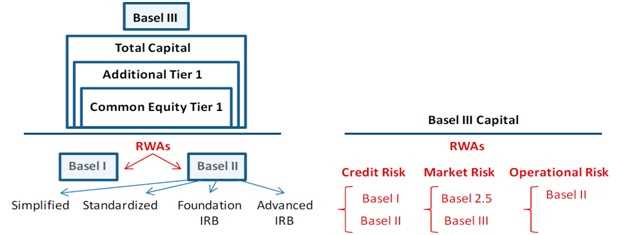

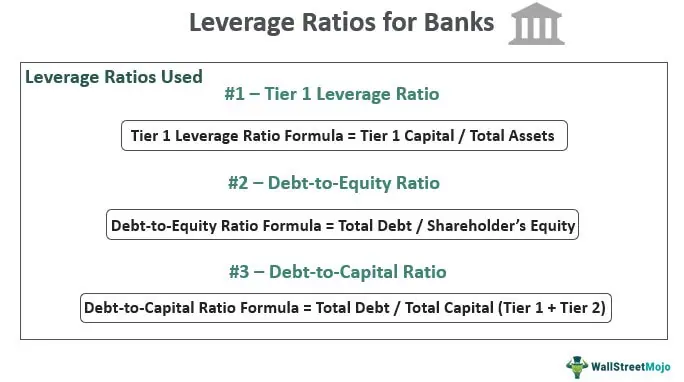

The Tier 1 Common Capital Ratio is a financial ratio that measures a bank’s core equity capital as a percentage of its risk-weighted assets. It is used to assess a bank’s financial strength and ability to absorb losses during times of economic stress.

Definition and Calculation

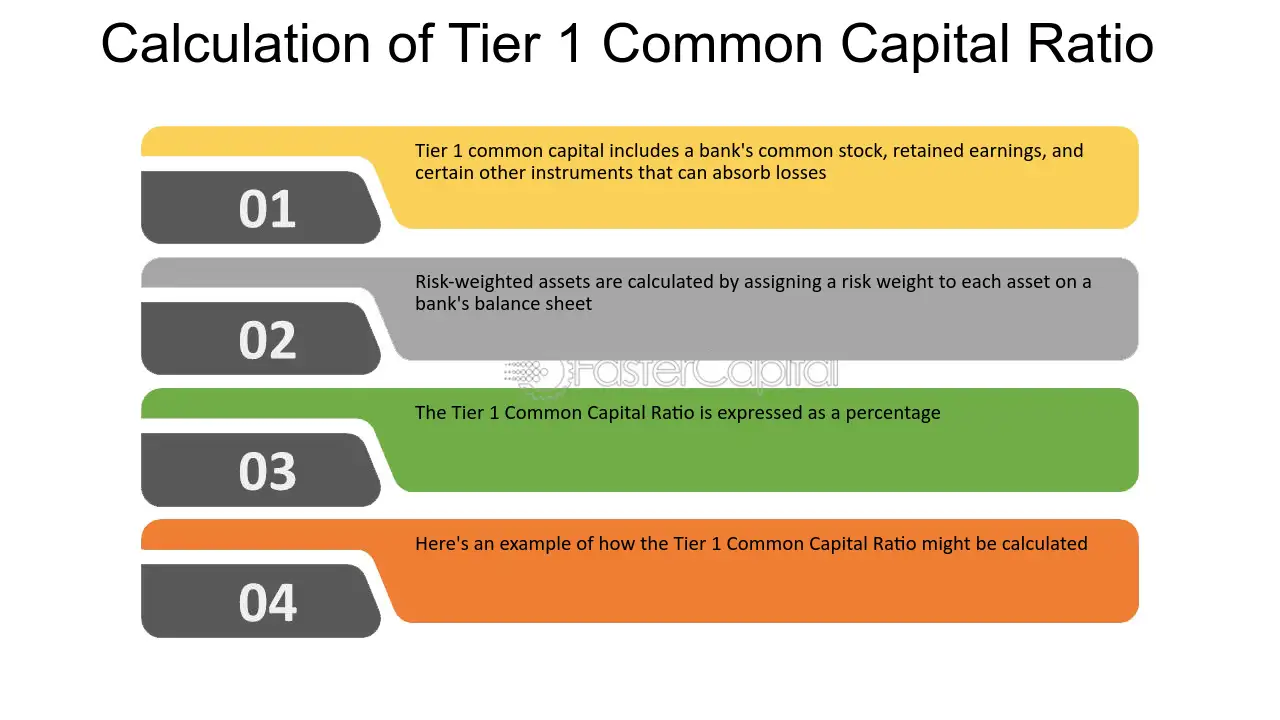

The Tier 1 Common Capital Ratio is calculated by dividing a bank’s Tier 1 common capital by its risk-weighted assets. Tier 1 common capital includes common equity tier 1 capital, which consists of common stock, retained earnings, and other comprehensive income.

Risk-weighted assets are calculated by assigning a risk weight to each asset on a bank’s balance sheet. The risk weight reflects the level of risk associated with the asset. For example, loans to individuals with good credit ratings may have a lower risk weight compared to loans to individuals with poor credit ratings.

The formula for calculating the Tier 1 Common Capital Ratio is as follows:

Tier 1 Common Capital Ratio = (Tier 1 common capital / Risk-weighted assets) x 100

Importance and Interpretation

The Tier 1 Common Capital Ratio is an important measure of a bank’s financial health and stability. A higher ratio indicates that a bank has a larger capital buffer to absorb potential losses, making it more resilient during economic downturns. It also indicates that a bank is less reliant on debt and has a stronger equity base.

Regulatory authorities, such as central banks, use the Tier 1 Common Capital Ratio to assess a bank’s capital adequacy and determine if it meets regulatory requirements. Banks with a lower ratio may be required to raise additional capital to strengthen their financial position.

Investors and analysts also use the Tier 1 Common Capital Ratio to evaluate a bank’s risk profile and compare it to industry peers. A higher ratio may indicate a lower risk of default and a more stable financial institution.

Example

Let’s say Bank X has Tier 1 common capital of $10 billion and risk-weighted assets of $100 billion. Using the formula mentioned earlier, the Tier 1 Common Capital Ratio for Bank X would be:

Tier 1 Common Capital Ratio = ($10 billion / $100 billion) x 100 = 10%

This means that Bank X’s Tier 1 Common Capital Ratio is 10%, indicating that it has a strong capital base to absorb potential losses.

Definition and Explanation of Tier 1 Common Capital Ratio

The Tier 1 Common Capital Ratio is a financial ratio that measures a bank’s core equity capital as a percentage of its risk-weighted assets. It is a key indicator of a bank’s financial strength and ability to absorb losses.

Tier 1 common capital refers to a bank’s highest quality capital, which consists of common equity tier 1 capital and retained earnings. Common equity tier 1 capital includes common stock and retained earnings, while retained earnings are the accumulated profits that have not been distributed to shareholders.

The ratio is calculated by dividing a bank’s tier 1 common capital by its risk-weighted assets. Risk-weighted assets are determined by assigning different risk weights to different types of assets, with riskier assets having higher weights. This reflects the fact that riskier assets are more likely to result in losses for the bank.

A higher Tier 1 Common Capital Ratio indicates that a bank has a larger buffer of capital to absorb potential losses. This is important because it reduces the likelihood of a bank becoming insolvent and needing a bailout. It also indicates that a bank is better positioned to meet regulatory requirements and withstand economic downturns.

The Tier 1 Common Capital Ratio is a key measure of a bank’s financial stability and is closely monitored by regulators. It is also used by investors and analysts to assess a bank’s risk profile and compare it to other banks in the industry.

For example, if a bank has a Tier 1 Common Capital Ratio of 10%, it means that its tier 1 common capital represents 10% of its risk-weighted assets. This indicates that the bank has a strong capital base and is well-capitalized.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.