What is Theta?

Theta is a critical concept in options trading because it helps traders understand the impact of time on the value of their options. It measures how much an option’s price will decrease for each day that passes, assuming all other factors remain constant.

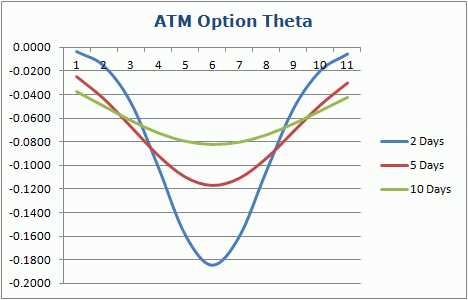

Theta is influenced by various factors, including the time remaining until the option’s expiration date, the volatility of the underlying asset, and the strike price of the option. Generally, options with longer expiration dates have higher theta values, meaning they lose value at a faster rate compared to options with shorter expiration dates.

Importance of Theta in Options Trading

Theta can also help traders assess the potential profitability of different options strategies. For example, options strategies that involve selling options with high theta values can be profitable if the underlying asset remains relatively stable or moves in the desired direction.

Overall, theta provides options traders with valuable insights into the time decay of their options and helps them make more informed trading decisions.

Why is Theta Important in Options Trading?

Theta is important because it affects the profitability of options positions. As time passes, the value of an option decreases due to the diminishing time value. This means that if the underlying asset’s price remains unchanged, the option will become less valuable over time.

For option buyers, theta represents a risk. If the underlying asset’s price does not move significantly, the option’s value will decline over time. Therefore, option buyers need to be aware of theta and consider it when making their trading decisions.

On the other hand, for option sellers, theta can be an advantage. As time passes, the value of the options they sold decreases, allowing them to profit from the time decay. Option sellers can take advantage of theta by selling options with a short expiration date and collecting premium income.

Managing theta is crucial for options traders. They need to be aware of the time decay effect and consider it when choosing their trading strategies. Traders can use theta to their advantage by selecting options with a longer expiration date or by implementing strategies that benefit from time decay, such as credit spreads or iron condors.

Examples of Theta in Options Trading

Example 1: Call Option

Let’s say you purchased a call option on a stock with a strike price of $100 and an expiration date of one month from now. The current price of the stock is $105. At the time of purchase, the theta of the option is -0.03.

As time passes, the value of the option will decrease by $0.03 per day. If the stock price remains unchanged, the option will lose $0.03 in value every day until expiration. This is due to the time decay component of theta.

Example 2: Put Option

Now let’s consider a put option on the same stock with a strike price of $100 and an expiration date of one month from now. The current price of the stock is $95. At the time of purchase, the theta of the option is -0.02.

Similar to the call option example, the value of the put option will decrease by $0.02 per day as time passes. If the stock price remains unchanged, the option will lose $0.02 in value every day until expiration.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.