What is the Wealth Effect?

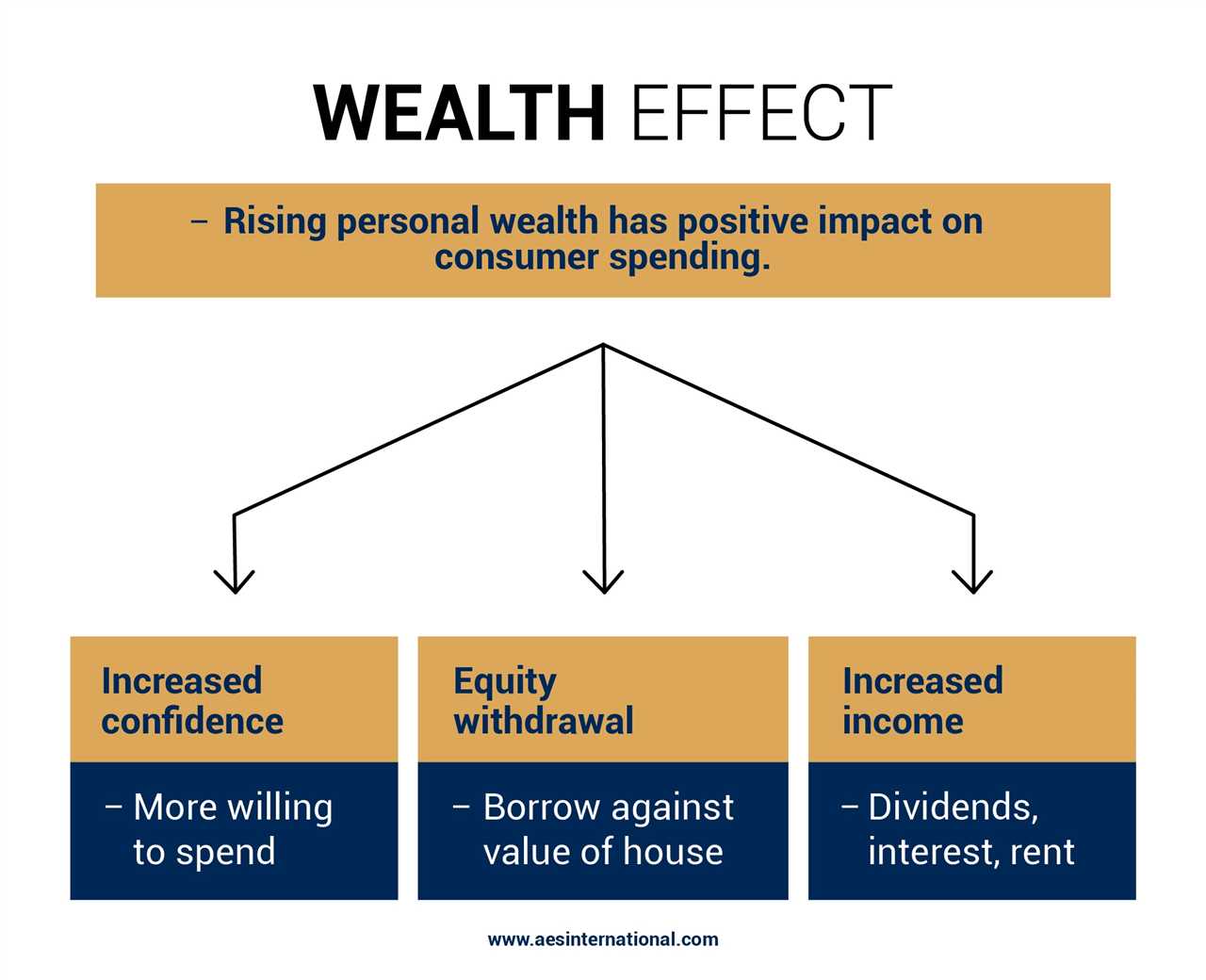

The wealth effect is an economic theory that suggests that individuals tend to spend more when they perceive themselves to be wealthier. It is based on the idea that people’s spending habits are influenced by changes in their wealth or financial situation.

According to the wealth effect theory, when individuals experience an increase in their wealth, such as through an increase in the value of their assets or investments, they tend to feel more financially secure and confident. This increase in perceived wealth then leads to an increase in their willingness to spend money on goods and services.

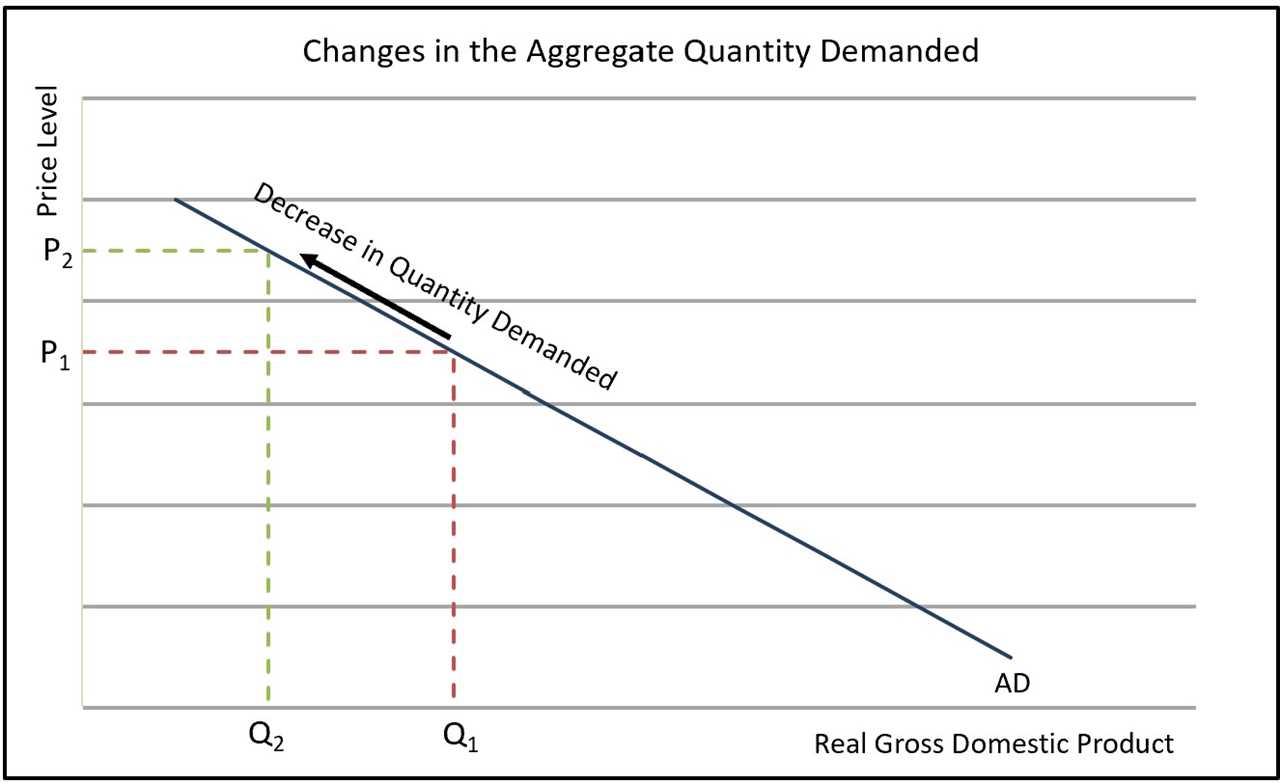

Conversely, when individuals experience a decrease in their wealth, such as through a decline in the value of their assets or investments, they tend to feel less financially secure and confident. This decrease in perceived wealth then leads to a decrease in their willingness to spend money on goods and services.

Factors Influencing the Wealth Effect

Several factors can influence the wealth effect:

- Changes in the value of assets: When the value of assets, such as real estate or stocks, increases, individuals may feel wealthier and be more inclined to spend.

- Changes in income: An increase in income can also contribute to the wealth effect, as individuals may feel more financially secure and have more disposable income to spend.

- Consumer confidence: The overall confidence and optimism of consumers can also impact the wealth effect. When consumers feel confident about the economy and their financial situation, they are more likely to spend.

- Interest rates: Lower interest rates can stimulate borrowing and spending, as individuals may find it more affordable to take on debt and make purchases.

Examples of the Wealth Effect

The wealth effect can be observed in various real-life scenarios. For example:

| Example | Explanation |

|---|---|

| Rising stock market | When the stock market is performing well and stock prices are rising, individuals who own stocks may feel wealthier and be more willing to spend. |

| Real estate boom | During a real estate boom, homeowners may see the value of their properties increase, leading them to feel wealthier and potentially spend more. |

| Income increase | When individuals receive a raise or bonus at work, they may feel more financially secure and be more inclined to increase their spending. |

Examples of the Wealth Effect

The wealth effect is a concept in economics that describes how individuals’ spending patterns are influenced by changes in their perceived wealth. When people feel wealthier, they tend to spend more, which stimulates economic growth. Here are some examples of the wealth effect in action:

1. Real Estate Boom

2. Stock Market Gains

When the stock market experiences significant gains, investors see their portfolios increase in value. This increase in wealth can lead to a boost in consumer confidence and an increase in spending. Investors may feel more comfortable making large purchases or investing in other assets, which can stimulate economic growth.

However, it is important to note that the wealth effect can also work in reverse. If the stock market crashes or there is a decline in real estate values, individuals may feel less wealthy and reduce their spending. This decrease in consumer spending can have a negative impact on the economy.

3. Income Growth

When individuals experience an increase in their income, they often feel wealthier and may increase their spending. This can be seen in situations where individuals receive a raise or a bonus at work. The increase in income gives them more disposable income, which they can use to purchase goods and services. This increased spending can contribute to economic growth.

However, it is important to consider that the wealth effect is not universal and can vary among individuals. Some individuals may be more prone to spending when they feel wealthier, while others may be more inclined to save or invest their additional income.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.