The Interbank Market: A Key Component of the Global Financial System

The interbank market plays a crucial role in the functioning of the global financial system. It serves as a platform for banks to trade currencies, borrow and lend money, and manage their liquidity needs. This market is where banks interact with each other, facilitating the flow of funds between institutions.

What is the Interbank Market?

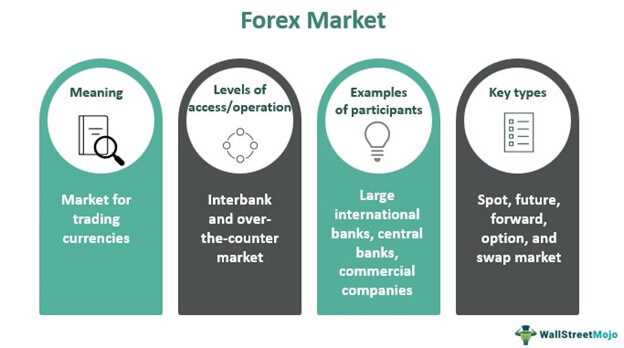

The interbank market is a decentralized network of banks and financial institutions that trade currencies and other financial instruments among themselves. It operates on a global scale, with transactions taking place electronically or through telephone communication. This market is not accessible to individual retail traders; it is exclusively reserved for banks and other large financial institutions.

In the interbank market, banks act as both buyers and sellers of currencies. They trade with each other to meet their own needs, as well as to provide liquidity to other market participants. This market is characterized by high trading volumes, tight bid-ask spreads, and low transaction costs.

Functioning of the Interbank Market

Spot transactions involve the immediate exchange of one currency for another at the prevailing exchange rate. Forward contracts, on the other hand, are agreements to buy or sell currencies at a specified future date and exchange rate. Swaps involve the simultaneous buying and selling of currencies with an agreement to reverse the transaction at a later date.

Banks participate in the interbank market to manage their foreign exchange exposure, hedge risks, and meet the funding requirements of their clients. They also use this market to speculate on currency movements and generate profits.

The interbank market is regulated to ensure transparency, fairness, and stability. Central banks and regulatory authorities play a crucial role in overseeing the operations of this market and maintaining its integrity.

The interbank market plays a crucial role in the global financial system by facilitating the exchange of funds between banks. It is a decentralized market where banks trade with each other directly or through electronic platforms. The interbank market is essential for maintaining liquidity in the banking system and ensuring the smooth functioning of financial markets.

Role of the Interbank Market

The primary role of the interbank market is to provide banks with a platform to borrow and lend funds to meet their short-term liquidity needs. Banks often have surplus funds that they lend to other banks in need, earning interest on these transactions. On the other hand, banks that require additional funds can borrow from other banks in the interbank market, paying interest on the borrowed amount.

The interbank market also serves as a mechanism for banks to manage their reserve requirements. Central banks set reserve requirements that banks must maintain to ensure stability in the financial system. If a bank falls short of its reserve requirements, it can borrow from other banks in the interbank market to meet the shortfall.

Functioning of the Interbank Market

The interbank market operates through various channels, including telephone trading, electronic trading platforms, and voice brokers. Banks can directly contact each other to negotiate and execute transactions, or they can use electronic platforms that match buyers and sellers. Voice brokers act as intermediaries, facilitating trades between banks.

The interest rates in the interbank market are determined by supply and demand dynamics. Banks with excess funds are willing to lend at lower interest rates, while banks in need of funds are willing to pay higher interest rates. The rates are influenced by factors such as market conditions, central bank policies, and the creditworthiness of the participating banks.

Risks and Challenges

While the interbank market plays a crucial role in the financial system, it is not without risks and challenges. One of the main risks is counterparty risk, which refers to the possibility that a bank may default on its obligations. Banks carefully assess the creditworthiness of their counterparties before entering into transactions.

Another challenge is the potential for market disruptions during times of financial stress. If banks become hesitant to lend to each other due to concerns about counterparty risk or market instability, it can lead to a liquidity crunch and impact the overall functioning of the financial system. Central banks often step in during such times to provide liquidity and restore confidence in the interbank market.

Conclusion

The interbank market is a vital component of the global financial system, facilitating the exchange of funds between banks. It plays a crucial role in maintaining liquidity, managing reserve requirements, and ensuring the smooth functioning of financial markets. While it is not without risks and challenges, the interbank market continues to be an essential mechanism for banks to meet their short-term funding needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.