The Importance of Behavioral Economics

Behavioral economics is a field of study that combines psychology and economics to understand how individuals make economic decisions. It recognizes that human behavior is not always rational and that emotions, biases, and cognitive limitations can influence decision-making.

1. Overcoming Biases

2. Nudging Behavior

By applying the principles of behavioral economics, policymakers can design policies that promote healthier lifestyles, increase savings rates, and reduce harmful behaviors such as smoking or excessive drinking.

Conclusion

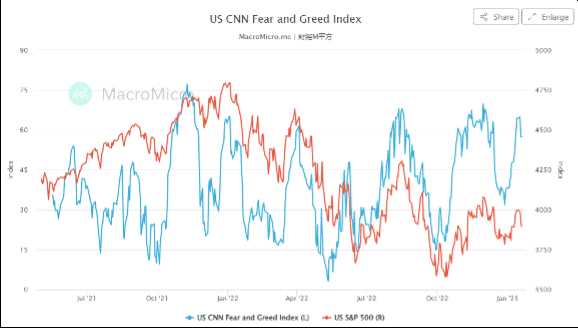

How the Fear & Greed Index Works

Key Indicators

The Fear & Greed Index takes into account various indicators to determine the overall sentiment of the market. These indicators include:

- Market Volatility: Volatility is a measure of the price fluctuations in the market. High volatility indicates fear and uncertainty, while low volatility suggests confidence and complacency.

- Put and Call Options: The ratio of put options to call options can provide insights into the sentiment of options traders. A high ratio indicates fear and a bearish outlook, while a low ratio suggests greed and a bullish outlook.

- Market Breadth: This indicator looks at the number of stocks advancing versus declining. A high number of advancing stocks indicates greed, while a high number of declining stocks suggests fear.

- Safe Haven Demand: Safe haven assets, such as gold and government bonds, tend to rise during times of fear and uncertainty. This indicator measures the demand for these assets as a gauge of market sentiment.

Calculation and Interpretation

The Fear & Greed Index combines the readings of these key indicators into a single number on a scale of 0 to 100. A reading of 0 indicates extreme fear, while a reading of 100 suggests extreme greed. The index is calculated using a proprietary algorithm that weights each indicator based on its importance and relevance.

Traders and investors can interpret the Fear & Greed Index in several ways. A high reading of the index may indicate that the market is overbought and due for a correction, while a low reading may suggest that the market is oversold and poised for a rebound. Additionally, extreme readings can signal potential turning points in the market, as sentiment reaches an extreme level.

It is important to note that the Fear & Greed Index is just one tool among many that investors and traders can use to analyze market sentiment. It should be used in conjunction with other technical and fundamental analysis tools to make well-informed investment decisions.

Using the Fear & Greed Index to Make Informed Decisions

One of the key benefits of the Fear & Greed Index is its ability to gauge investor sentiment. It measures the level of fear and greed in the market, which can be a strong indicator of market direction. When investors are fearful, it often indicates that the market is oversold and may be due for a rebound. Conversely, when investors are greedy, it suggests that the market may be overbought and due for a correction.

By monitoring the Fear & Greed Index, investors can identify potential buying or selling opportunities. For example, if the index is showing high levels of fear, it may be a good time to consider buying stocks or other assets at discounted prices. On the other hand, if the index is showing high levels of greed, it may be a signal to sell or take profits.

Another way to utilize the Fear & Greed Index is to use it as a contrarian indicator. Contrarian investors believe that when the majority of investors are acting in a certain way, it is often a good time to take the opposite position. For example, if the Fear & Greed Index is showing extreme levels of greed, a contrarian investor may consider selling or shorting the market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.