Synergies in Finance: Concepts and Real-Life Examples

There are various types of synergies in finance, including cost synergies, revenue synergies, and financial synergies. Cost synergies refer to the reduction of costs that can be achieved through the combination of two or more entities. This can include economies of scale, shared resources, and streamlined operations.

On the other hand, revenue synergies involve the increase in revenue that can be generated through the combination of entities. This can be achieved through cross-selling opportunities, expanded customer base, and enhanced market presence.

Financial synergies, on the other hand, focus on the financial benefits that can be gained through the combination of entities. This can include improved access to capital, enhanced credit ratings, and increased bargaining power with suppliers.

Real-Life Examples of Synergies

There are numerous real-life examples of synergies in finance that have resulted in significant benefits for companies. One such example is the merger between Disney and Pixar. By combining Disney’s distribution and marketing capabilities with Pixar’s creative expertise, the merger resulted in the creation of highly successful animated films such as Toy Story, Finding Nemo, and The Incredibles.

Another example is the acquisition of WhatsApp by Facebook. By integrating WhatsApp’s messaging platform with Facebook’s vast user base, the acquisition allowed Facebook to expand its reach and enhance its advertising capabilities.

These examples highlight the importance of synergies in finance and how they can lead to increased profitability, market share, and competitive advantage.

There are different types of synergies in finance, including cost synergies and revenue synergies. Cost synergies occur when two companies merge or collaborate and are able to reduce their operating costs by eliminating duplicate functions or streamlining processes. This can lead to increased efficiency and improved profitability.

On the other hand, revenue synergies occur when two companies are able to generate additional revenue by leveraging their combined resources, customer base, or market presence. For example, a company that acquires another company may be able to cross-sell their products or services to the acquired company’s customers, resulting in increased sales and revenue.

The Importance of Synergies in Finance

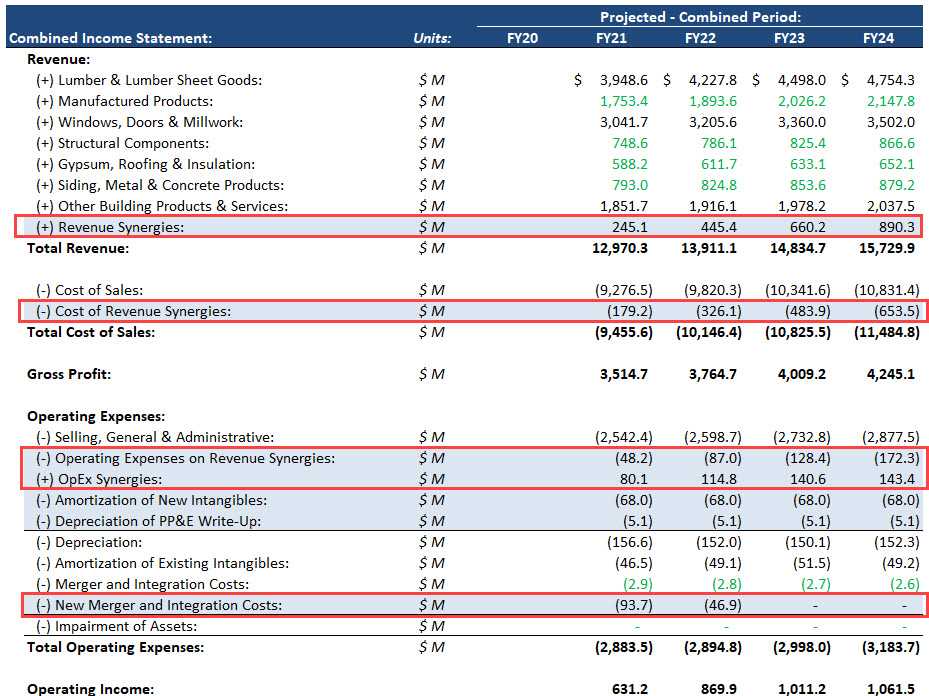

Moreover, synergies can also play a crucial role in mergers and acquisitions. When two companies merge, they often aim to achieve synergies that can result in cost savings, increased market share, and improved operational efficiency. These synergies can lead to enhanced competitiveness and increased shareholder value.

Examples of Synergies in Finance

There are numerous real-life examples of companies successfully leveraging synergies in finance. One such example is the merger between two telecommunications companies, which resulted in significant cost synergies through the consolidation of their networks and infrastructure.

Another example is the collaboration between a technology company and a financial institution to develop a new digital payment platform. By combining their expertise and resources, the two companies were able to create a product that offered enhanced convenience and security for customers, leading to increased revenue and market share.

Real-Life Examples of Synergies

There are numerous real-life examples of synergies in finance that demonstrate the power of combining forces. One such example is the merger between Disney and Pixar. By joining forces, Disney gained access to Pixar’s cutting-edge animation technology and creative talent, while Pixar benefited from Disney’s extensive distribution network and marketing expertise. This synergy resulted in blockbuster movies like Toy Story, Finding Nemo, and The Incredibles, which generated billions of dollars in revenue for both companies.

Another example of synergies in finance is the acquisition of WhatsApp by Facebook. By acquiring WhatsApp, Facebook not only gained access to its massive user base but also its innovative messaging platform. This synergy allowed Facebook to expand its reach and provide its users with a more comprehensive social media experience. As a result, WhatsApp has become one of the most popular messaging apps in the world, while Facebook’s user engagement and advertising revenue have significantly increased.

These real-life examples highlight the importance of synergies in finance. They demonstrate how combining complementary resources, capabilities, and expertise can create significant value and drive business growth. Whether it’s through mergers, acquisitions, or strategic partnerships, synergies have the potential to transform businesses and unlock new opportunities for success.

Tools for Maximizing Synergies

- Financial Analysis Software: Utilizing financial analysis software can help finance professionals analyze data, identify trends, and make informed decisions. These tools often come with advanced features such as forecasting capabilities, scenario analysis, and financial modeling.

- Collaboration Platforms: Collaboration platforms enable teams to work together seamlessly, regardless of their physical location. These tools allow for real-time communication, file sharing, and project management, ensuring that everyone is on the same page and working towards shared goals.

- Automation Tools: Automating repetitive tasks can free up time for finance professionals to focus on more strategic initiatives. Automation tools can be used for tasks such as data entry, report generation, and invoice processing, reducing the risk of errors and increasing efficiency.

- Data Visualization Tools: Data visualization tools help finance professionals present complex financial information in a clear and visually appealing way. These tools can transform raw data into interactive charts, graphs, and dashboards, making it easier to identify patterns and trends.

- Risk Management Software: Managing risk is a critical aspect of finance, and having the right software can help streamline the process. Risk management software can assist with tasks such as risk assessment, mitigation planning, and compliance monitoring, ensuring that potential risks are identified and addressed proactively.

By leveraging these tools, finance professionals can enhance their ability to identify and capitalize on synergies within their organizations. Whether it’s through advanced financial analysis, seamless collaboration, or automated processes, these tools can help drive better financial outcomes and maximize the potential for synergies.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.