What Are Shutdown Points?

A shutdown point is a concept in economics that refers to the level of production at which a firm decides to temporarily or permanently cease operations. It is the point at which the firm’s revenue is equal to its variable costs, meaning that it is no longer profitable to continue producing.

Shutdown points are important because they help firms make decisions about whether to continue operating or shut down in the short run. When a firm reaches its shutdown point, it is typically experiencing financial difficulties and may be unable to cover its fixed costs.

Factors Influencing Shutdown Points

Several factors can influence a firm’s shutdown point:

- Market conditions: If the market for a firm’s product is experiencing a downturn, demand may be low, leading to lower revenue and a higher likelihood of reaching the shutdown point.

- Availability of substitutes: If there are readily available substitutes for a firm’s product, it may be more difficult for the firm to generate sufficient revenue to cover its costs.

- Government regulations: Regulations can impact a firm’s costs and profitability, potentially pushing it closer to its shutdown point.

Implications of Shutdown Points

When a firm reaches its shutdown point, it faces several implications:

- The firm may have to lay off employees and reduce its workforce.

- Suppliers and creditors may be left unpaid or face delayed payments.

- Investors and shareholders may experience losses.

- The firm’s market share may be taken over by competitors.

In some cases, a firm may choose to temporarily shut down operations until market conditions improve. However, if the shutdown point is reached due to long-term financial difficulties, the firm may decide to permanently cease operations.

How Do Shutdown Points Work?

In economics, a shutdown point refers to the level of production at which a firm decides to temporarily or permanently cease operations. This decision is typically made when the firm is unable to cover its variable costs and generate a profit.

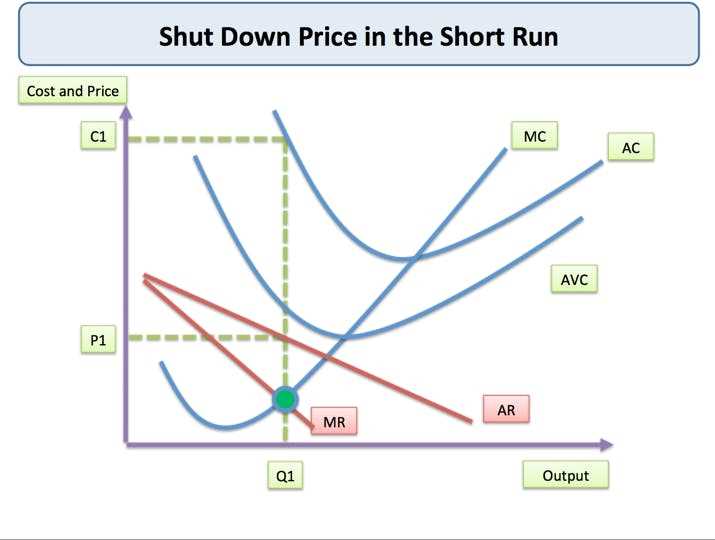

Shutdown points are determined by comparing a firm’s average variable costs (AVC) with its average revenue (AR). The AVC represents the variable costs per unit of output, while the AR represents the revenue per unit of output. If the AVC exceeds the AR, the firm is operating at a loss and may consider shutting down.

When a firm reaches its shutdown point, it is no longer able to cover its variable costs, meaning that it is losing money on each unit produced. By shutting down, the firm can avoid further losses and minimize its financial burden.

However, it is important to note that shutdown points can vary depending on the specific circumstances of the firm. Factors such as fixed costs, market conditions, and the availability of alternative uses for resources can all influence a firm’s decision to shut down.

| Pros of Shutdown Points | Cons of Shutdown Points |

|---|---|

| – Allows firms to minimize losses | – Can lead to job losses and economic downturn |

| – Helps firms assess their financial viability | – May result in the loss of market share |

| – Enables firms to allocate resources more efficiently | – Can have negative effects on suppliers and other stakeholders |

Examining Examples of Shutdown Points in Corporate Debt

Shutdown points in corporate debt refer to the level of debt at which a company becomes unable to continue its operations. When a company reaches its shutdown point, it is unable to generate enough revenue to cover its debt obligations and sustain its business activities. This can lead to bankruptcy or other financial difficulties for the company.

Let’s examine some examples of shutdown points in corporate debt to better understand how they work:

| Company | Debt Level | Shutdown Point | Consequences |

|---|---|---|---|

| Company A | $10 million | $15 million | If Company A’s debt level reaches $15 million, it may not be able to generate enough revenue to cover its debt payments. This could result in bankruptcy or the need for restructuring its debt. |

| Company B | $20 million | $25 million | Company B’s shutdown point is at $25 million of debt. If its debt level exceeds this amount, the company may face financial distress and be unable to meet its debt obligations, potentially leading to insolvency. |

| Company C | $5 million | $8 million | At a debt level of $8 million, Company C reaches its shutdown point. Beyond this point, the company may struggle to generate enough cash flow to service its debt, putting it at risk of defaulting on its obligations. |

These examples illustrate how shutdown points can vary for different companies depending on their financial health, revenue generation capabilities, and debt levels. It is crucial for companies to closely monitor their debt levels and ensure they stay below their shutdown points to maintain financial stability and avoid potential bankruptcy or insolvency.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.