Routing Transit Number: All You Need to Know

The RTN plays a crucial role in various financial transactions, such as direct deposits, wire transfers, electronic payments, and automatic bill payments. It ensures that the funds are directed to the correct bank or credit union and the appropriate account within that institution.

Each financial institution has its unique RTN, which is assigned by the American Bankers Association (ABA). The first four digits of the RTN represent the Federal Reserve Routing Symbol, followed by the ABA institution identifier, and the last digit is a verification digit.

When initiating a transaction, it is essential to provide the correct RTN to avoid any delays or errors. You can find your RTN in various ways:

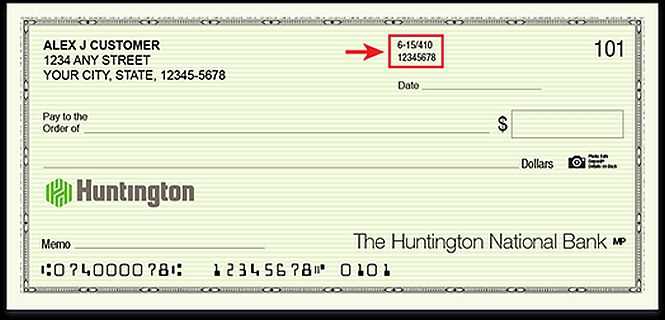

1. Check: The RTN is typically printed on the bottom left corner of your checks. It is the first set of numbers, followed by your account number and the check number.

2. Online Banking: If you have online banking, you can usually find your RTN by logging into your account and navigating to the account details or settings section. Look for a section specifically labeled “Routing Number” or “ABA Routing Number.”

3. Bank Statement: Your RTN may also be listed on your bank statement. Check for a section that provides your account information or transaction details.

4. Contact Your Bank: If you are unable to find your RTN through the above methods, you can contact your bank directly. They will be able to provide you with the correct RTN associated with your account.

It is important to note that the RTN is different from your account number. While the RTN identifies the bank or credit union, the account number identifies your specific account within that institution.

What is a Routing Transit Number?

The RTN is unique to each bank or credit union and helps ensure that funds are transferred accurately and securely between accounts. It is similar to a postal code or ZIP code, but specifically for financial institutions.

The first two digits of the RTN represent the Federal Reserve Bank district where the bank is located. The next two digits represent the Federal Reserve Bank office where the bank is located. The remaining five digits are unique to the individual bank or credit union.

For example, if a bank’s RTN is 123456789, the first two digits (12) indicate that it is located in the first Federal Reserve Bank district. The next two digits (34) indicate the specific Federal Reserve Bank office. The remaining five digits (56789) identify the individual bank or credit union.

Knowing a bank’s RTN is essential for various financial transactions. It is required when setting up direct deposit for your paycheck, initiating a wire transfer, or making electronic bill payments. It ensures that the funds are directed to the correct financial institution and account.

It is important to note that the RTN is different from an account number. The RTN identifies the bank, while the account number identifies the specific account within that bank.

If you are unsure of your bank’s RTN, you can find it on your checks. The RTN is typically printed at the bottom left corner of the check, along with the account number and check number. It is also available on your bank’s website, in your online banking portal, or by contacting your bank directly.

Where to Find Your Routing Transit Number?

2. Bank Statement: If you don’t have access to your checkbook, you can also find your RTN on your bank statement. Look for a section that includes your account information, and you should see your RTN listed there.

3. Online Banking: Many banks provide online banking services that allow you to access your account information from anywhere. Log in to your online banking account and navigate to the section that displays your account details. Your RTN should be listed there.

4. Bank’s Website: If you don’t have access to your checkbook or bank statement, you can also visit your bank’s website. Look for a section that provides information about your account or contact the bank’s customer service for assistance. They should be able to provide you with your RTN.

5. Mobile Banking App: If your bank has a mobile banking app, you can also find your RTN there. Open the app and navigate to the section that displays your account information. Your RTN should be listed along with your other account details.

By knowing where to find your Routing Transit Number, you can easily access this important piece of information whenever you need it.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.