Definition of Retention Ratio

The retention ratio is calculated by dividing the retained earnings by the net income. The formula for calculating the retention ratio is as follows:

Retention Ratio = Retained Earnings / Net Income

The retention ratio is expressed as a percentage, ranging from 0% to 100%. A higher retention ratio indicates that a larger portion of the company’s earnings is being reinvested, while a lower retention ratio suggests that more profits are being distributed as dividends.

Formula for Calculating Retention Ratio

The retention ratio is a financial ratio that measures the percentage of earnings a company retains for reinvestment in the business rather than distributing them to shareholders as dividends. It is an important metric for investors and analysts to assess a company’s ability to generate internal growth.

The formula for calculating the retention ratio is:

Where:

- Net Income is the total income earned by the company after deducting all expenses and taxes.

- Dividends are the payments made to shareholders as a distribution of profits.

The numerator of the formula represents the amount of earnings that the company retains, while the denominator represents the total earnings generated. By dividing the retained earnings by the total earnings, we get the retention ratio expressed as a percentage.

A high retention ratio indicates that the company is reinvesting a significant portion of its earnings back into the business for future growth opportunities. This can be a positive sign for investors, as it suggests that the company has confidence in its ability to generate higher returns in the future.

On the other hand, a low retention ratio may indicate that the company is distributing a large portion of its earnings as dividends, which could be attractive to income-seeking investors. However, it may also suggest that the company has limited growth prospects or is unable to generate sufficient internal returns.

Limitations of Retention Ratio

The retention ratio is a useful financial ratio for analyzing a company’s ability to reinvest its earnings back into the business. However, it is important to understand its limitations in order to make informed decisions based on this ratio.

1. Ignores external factors

2. Does not consider alternative uses of earnings

The retention ratio assumes that all retained earnings are reinvested back into the business. However, this may not always be the case. Companies may have alternative uses for their earnings, such as paying off debt, acquiring other companies, or returning cash to shareholders through dividends or share buybacks. The retention ratio does not provide information on these alternative uses of earnings, which may be important for investors and analysts.

3. Does not indicate the efficiency of reinvestment

The retention ratio does not indicate how effectively a company is reinvesting its earnings. A high retention ratio does not necessarily mean that the company is making profitable investments. It is possible for a company to have a high retention ratio but still have low returns on its reinvested earnings. Therefore, it is important to consider other financial ratios, such as return on equity or return on assets, to evaluate the efficiency of a company’s reinvestment.

4. Varies across industries

5. Historical data may not reflect future performance

The retention ratio is based on historical data and may not accurately reflect a company’s future performance. Changes in a company’s business strategy, market conditions, or competitive landscape can impact its ability to retain earnings in the future. Therefore, it is important to consider other factors and future projections when using the retention ratio to assess a company’s financial health.

| Limitation | Description |

|---|---|

| Ignores external factors | The retention ratio does not consider external factors that may affect a company’s ability to retain earnings. |

| Does not consider alternative uses of earnings | The retention ratio assumes that all retained earnings are reinvested back into the business, ignoring other potential uses. |

| Does not indicate the efficiency of reinvestment | A high retention ratio does not necessarily mean that a company is making profitable investments with its retained earnings. |

| Varies across industries | The retention ratio can vary significantly across industries, making industry comparisons important. |

| Historical data may not reflect future performance | The retention ratio is based on historical data and may not accurately predict a company’s future performance. |

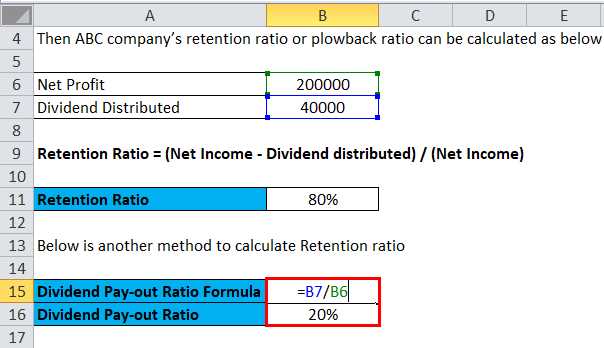

Example of Retention Ratio Calculation

Let’s understand the concept of the retention ratio with the help of an example. Suppose a company has a net income of $1 million and pays out $500,000 as dividends to its shareholders. To calculate the retention ratio, we need to divide the retained earnings by the net income.

Retained earnings = $500,000

Now, we can calculate the retention ratio using the formula:

Retention Ratio = Retained Earnings / Net Income

Retention Ratio = $500,000 / $1,000,000

Retention Ratio = 0.5 or 50%

This means that the company retains 50% of its net income for reinvestment in the business or other purposes, while the remaining 50% is distributed as dividends to shareholders.

The retention ratio is an important financial ratio as it indicates the company’s ability to generate profits and reinvest them for future growth. A higher retention ratio suggests that the company is retaining more earnings, which can be used to fund expansion projects, research and development, or debt repayment. On the other hand, a lower retention ratio may indicate that the company is distributing a significant portion of its earnings as dividends, which could be attractive to income-seeking investors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.