Real Rate of Return: Definition and Importance

The real rate of return is a financial concept that measures the actual return on an investment after accounting for inflation. It is an important metric for investors as it provides a more accurate assessment of the profitability of an investment.

Definition

The real rate of return is calculated by subtracting the inflation rate from the nominal rate of return. The nominal rate of return is the actual rate of return earned on an investment, while the inflation rate measures the increase in the general level of prices over a given period of time.

The real rate of return is expressed as a percentage and represents the purchasing power gained or lost on an investment. A positive real rate of return indicates that the investment has outperformed inflation, while a negative real rate of return indicates that the investment has not kept pace with inflation.

Importance

The real rate of return is important for several reasons:

- Accurate assessment of investment performance: By accounting for inflation, the real rate of return provides a more accurate measure of how well an investment has performed. It allows investors to compare the real returns of different investments and make informed decisions.

- Preservation of purchasing power: Inflation erodes the purchasing power of money over time. By considering the real rate of return, investors can ensure that their investments are keeping up with or exceeding the rate of inflation, thereby preserving their purchasing power.

- Long-term financial planning: The real rate of return is crucial for long-term financial planning. It helps investors estimate the future value of their investments and determine whether they are on track to meet their financial goals.

The real rate of return is a financial concept that measures the actual return on an investment after adjusting for inflation. It is an important metric for investors as it provides a more accurate picture of the profitability of an investment.

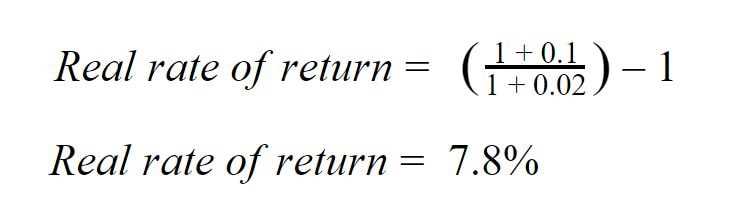

When calculating the real rate of return, the inflation rate is subtracted from the nominal rate of return. The nominal rate of return is the rate of return before adjusting for inflation, while the inflation rate measures the increase in prices over a specific period of time.

By subtracting the inflation rate from the nominal rate of return, investors can determine the real rate of return, which represents the purchasing power gained or lost on an investment. A positive real rate of return indicates that the investment has outpaced inflation and has preserved or increased its purchasing power. On the other hand, a negative real rate of return means that the investment has not kept up with inflation and has lost purchasing power.

The real rate of return is particularly important for long-term investors who want to ensure that their investments are growing in real terms, rather than simply keeping pace with inflation. It helps investors make informed decisions about where to allocate their funds and assess the true profitability of their investments.

For example, let’s say an investor has a bond that pays a nominal rate of return of 5% and the inflation rate is 2%. By subtracting the inflation rate from the nominal rate of return, the investor can calculate that the real rate of return on the bond is 3%. This means that the investor’s purchasing power has increased by 3% after accounting for inflation.

How the Real Rate of Return is Used in Portfolio Management

By using the real rate of return, portfolio managers can make more informed decisions about which investments to include in their portfolios. They can compare the real rates of return of different investments and choose those that offer the highest potential for growth after adjusting for inflation.

For example, let’s say an investor is considering two investment options: Option A offers a nominal rate of return of 8% and Option B offers a nominal rate of return of 6%. At first glance, Option A may seem like the better choice. However, when the real rate of return is calculated by adjusting for inflation, Option B may actually provide a higher real rate of return.

Portfolio managers also use the real rate of return to assess the performance of their portfolios over time. By comparing the real rates of return of different periods, they can evaluate the effectiveness of their investment strategies and make adjustments if necessary.

In addition, the real rate of return is used to set investment goals and expectations. By considering the real rate of return, investors can set realistic targets for their portfolios and avoid overestimating their potential returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.