Ponzi Schemes: Unveiling the Definition

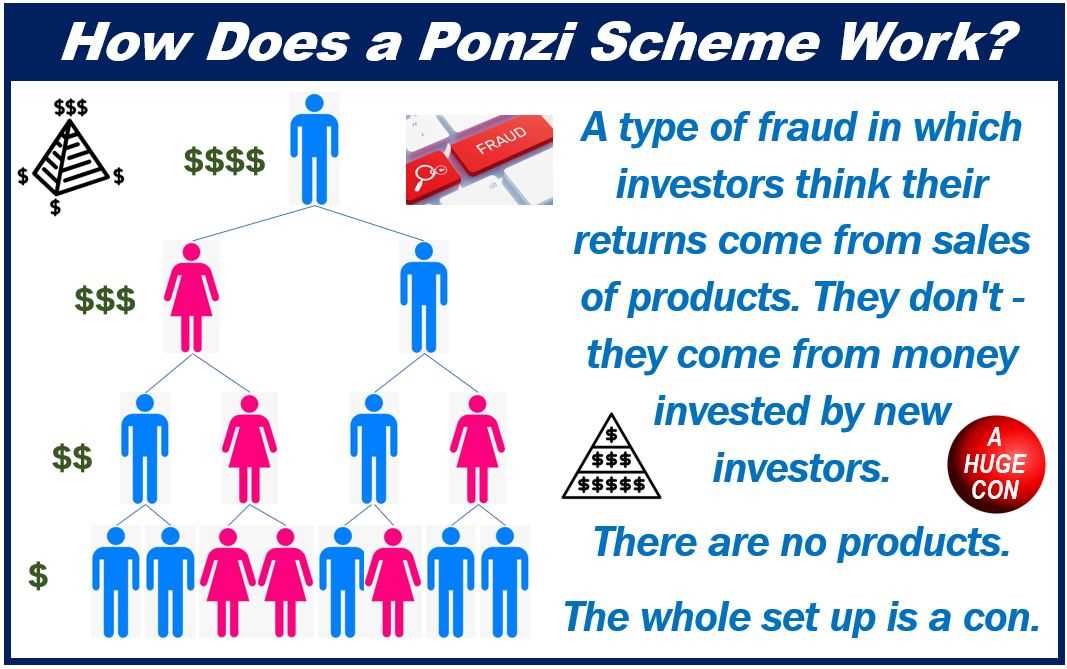

A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the individual or organization running the operation. This type of scheme is named after Charles Ponzi, an Italian-born swindler who became notorious for running such a scheme in the early 20th century.

How Ponzi Schemes Work

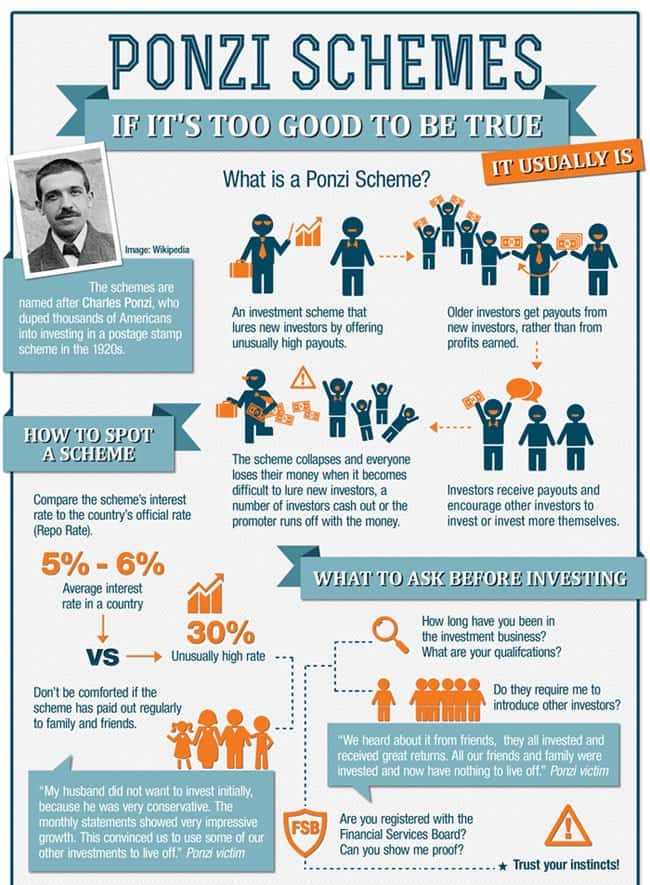

Ponzi schemes typically promise high returns with little to no risk. They attract investors by offering consistent and above-average returns on their investments. The initial investors are paid using the money contributed by new investors, creating the illusion of a successful and profitable investment opportunity.

Characteristics of Ponzi Schemes

There are several key characteristics that are common to most Ponzi schemes:

- Promise of high returns: Ponzi schemes often promise returns that are significantly higher than what is available through traditional investments.

- Consistent returns: The fraudster will typically pay out consistent returns to early investors to create the illusion of a successful investment.

- Lack of transparency: Ponzi schemes often lack transparency and provide little to no information about the underlying investments or strategies.

- Recruitment of new investors: The success of a Ponzi scheme relies on continuously recruiting new investors to provide funds for existing investors.

- Unregistered investments: Ponzi schemes are often unregistered with regulatory authorities, making it difficult for investors to verify the legitimacy of the investment.

Examples of Ponzi Schemes

There have been numerous Ponzi schemes throughout history that have defrauded investors out of billions of dollars. Some notable examples include:

| Name | Year | Amount Defrauded |

|---|---|---|

| Charles Ponzi | 1920 | $20 million |

| Bernard Madoff | 2008 | $65 billion |

| Allen Stanford | 2009 | $7 billion |

These examples serve as a reminder of the devastating impact that Ponzi schemes can have on individuals, families, and even the global economy.

How Ponzi Schemes Work

Ponzi schemes typically operate by enticing investors with the promise of high returns on their investments in a short period of time. The initial investors are paid returns using the money contributed by new investors, rather than from actual profits generated by the investment. This creates the illusion of a successful investment and attracts more investors.

The scheme collapses when the number of new investors decreases or when existing investors try to withdraw their investments. At this point, the fraudster running the scheme is unable to meet the demands of all the investors, resulting in financial losses for the majority of participants.

Red Flags of a Ponzi Scheme

There are several red flags that can indicate the presence of a Ponzi scheme:

- Consistent high returns: Ponzi schemes promise unrealistically high returns on investments, often significantly higher than market rates.

- Lack of transparency: Ponzi schemes often provide vague or incomplete information about the investment strategy or how the returns are generated.

- Pressure to recruit new investors: Ponzi schemes rely on a constant influx of new investors to sustain the payouts to existing investors.

- Difficulty withdrawing funds: Ponzi schemes may make it difficult for investors to withdraw their funds, often citing various reasons such as administrative delays or market conditions.

Protecting Yourself from Ponzi Schemes

It is important to exercise caution and due diligence when considering any investment opportunity. Here are some steps you can take to protect yourself from falling victim to a Ponzi scheme:

- Research the investment: Conduct thorough research on the investment opportunity, including the company or individual offering it, their track record, and any regulatory approvals or warnings.

- Seek professional advice: Consult with a financial advisor or investment professional to get an independent opinion on the investment.

- Avoid investments that seem too good to be true: Be skeptical of investments that promise unusually high returns with little risk.

- Verify registration: Check if the investment and the individuals or companies offering it are registered with the appropriate regulatory authorities.

- Be cautious of pressure tactics: Beware of individuals or companies that use high-pressure tactics to convince you to invest quickly without giving you enough time to conduct due diligence.

By being aware of the basics of Ponzi schemes and taking proactive steps to protect yourself, you can minimize the risk of falling victim to financial fraud.

Ponzi Schemes: Examples and Origins

A Ponzi scheme is a fraudulent investment operation that promises high returns to investors, but instead uses the funds from new investors to pay off earlier investors. This type of scheme is named after Charles Ponzi, an Italian-born swindler who became notorious for running one of the most infamous Ponzi schemes in history.

One of the earliest examples of a Ponzi scheme dates back to the 1920s when Charles Ponzi promised investors a 50% return on their investment in just 45 days. He claimed to be taking advantage of international postal reply coupons, which he believed could be bought cheaply in one country and sold for a higher price in another. However, Ponzi was actually using the money from new investors to pay off earlier investors, with very little of the funds going towards the actual investment.

Another well-known example of a Ponzi scheme is the case of Bernie Madoff, who orchestrated the largest Ponzi scheme in history. Madoff promised consistent, high returns to his investors, and for many years, he was able to deliver on those promises. However, it was later revealed that Madoff was using new investors’ money to pay off existing investors, and the whole operation eventually collapsed, causing billions of dollars in losses.

There have been numerous other Ponzi schemes throughout history, each with its own unique story and set of circumstances. Some notable examples include the Zeek Rewards Ponzi scheme, the Stanford Financial Group Ponzi scheme, and the MMM Ponzi scheme in Russia. These schemes all follow the same basic principle of using new investors’ money to pay off earlier investors, while the mastermind behind the scheme pockets a significant portion of the funds for themselves.

While Ponzi schemes may seem like a quick and easy way to make money, they are illegal and highly unethical. They inevitably collapse when there are no longer enough new investors to sustain the payouts to earlier investors. Those who are caught running Ponzi schemes often face severe legal consequences, including lengthy prison sentences.

It is important for investors to be aware of the signs of a Ponzi scheme and to exercise caution when considering any investment opportunity. If something seems too good to be true, it probably is. Conducting thorough research, seeking advice from trusted financial professionals, and diversifying investments are all key strategies for protecting oneself from falling victim to a Ponzi scheme.

Notorious Ponzi Schemes Throughout History

Ponzi schemes have been a recurring theme throughout history, with several notable cases that have left a lasting impact on the financial world. These schemes, named after Charles Ponzi, who orchestrated one of the most infamous scams in the early 20th century, involve promising high returns to investors by using funds from new investors. Here are some of the most notorious Ponzi schemes throughout history:

1. Charles Ponzi (1920)

Charles Ponzi, an Italian immigrant, is often credited with creating the first Ponzi scheme. He promised investors a 50% return on their investment in just 45 days or a 100% return within 90 days. Ponzi claimed that he was making profits through international postal reply coupons, but in reality, he was using the funds from new investors to pay off earlier investors. The scheme eventually collapsed, and Ponzi was arrested and sentenced to prison.

2. Bernie Madoff (2008)

Bernie Madoff, a former chairman of the NASDAQ stock exchange, orchestrated one of the largest and most infamous Ponzi schemes in history. Madoff promised consistent and high returns to his investors, using a complex strategy that involved falsifying financial statements. The scheme lasted for decades, with Madoff attracting high-profile clients and even charities. When the financial crisis hit in 2008, investors began to withdraw their funds, and the scheme unraveled. Madoff was sentenced to 150 years in prison.

3. Allen Stanford (2009)

Allen Stanford, a former financier and cricket mogul, operated a Ponzi scheme that defrauded investors out of billions of dollars. Stanford promised high returns on certificates of deposit issued by his offshore bank in Antigua. He used the funds from new investors to pay off earlier investors and lived a lavish lifestyle with the stolen money. The scheme collapsed in 2009 when the Securities and Exchange Commission (SEC) charged Stanford with fraud. He was sentenced to 110 years in prison.

4. Robert Allen Stanford (2012)

Robert Allen Stanford, not to be confused with Allen Stanford, operated a separate Ponzi scheme that targeted Native American tribes. Stanford promised tribal leaders that he would invest their money in safe and secure investments, but instead, he used the funds for personal expenses and to pay off earlier investors. The scheme collapsed in 2012, and Stanford was sentenced to 14 years in prison.

5. Tom Petters (2008)

Tom Petters, a Minnesota businessman, operated a Ponzi scheme that defrauded investors out of billions of dollars. Petters promised high returns on investments in consumer electronic goods, but in reality, he was using the funds from new investors to pay off earlier investors and to fund his extravagant lifestyle. The scheme collapsed in 2008 when one of Petters’ associates turned him in to the authorities. Petters was sentenced to 50 years in prison.

These notorious Ponzi schemes serve as a reminder of the dangers of investing in schemes that promise unrealistic returns. Investors should always exercise caution and conduct thorough due diligence before committing their hard-earned money.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.