Paid-Up Capital Definition

Paid-up capital refers to the total amount of money that a company has received from its shareholders in exchange for shares of stock. It represents the initial investment made by the shareholders to start the company and is an important indicator of the financial health and stability of the company.

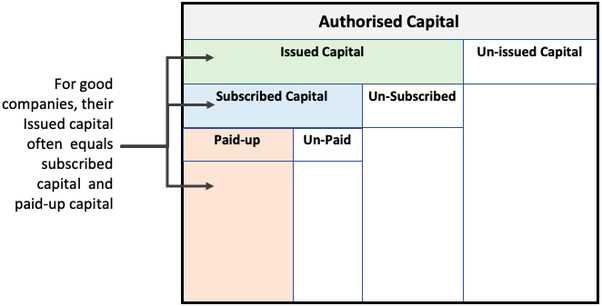

When a company is formed, it issues shares of stock to its shareholders in exchange for their investment. The shareholders can either pay for the shares in full or in installments. The paid-up capital is the portion of the total capital that has been fully paid by the shareholders.

The paid-up capital can be calculated by multiplying the number of shares issued by the nominal value of each share. For example, if a company issues 1,000 shares with a nominal value of $10 per share, and all the shares have been fully paid by the shareholders, then the paid-up capital would be $10,000.

The paid-up capital represents the permanent equity of the company and cannot be withdrawn by the shareholders. It remains invested in the company and is used to finance its operations, investments, and growth. It serves as a cushion to absorb any losses and provides a measure of financial stability to the company.

Importance in Corporate Finance

The paid-up capital is an important metric in corporate finance as it provides insights into the financial strength and stability of a company. It indicates the level of commitment and confidence that shareholders have in the company. A higher paid-up capital suggests that the company has a solid financial base and is less reliant on external sources of funding.

Furthermore, the paid-up capital is used to calculate various financial ratios such as return on equity (ROE) and earnings per share (EPS), which are important indicators of a company’s profitability and performance. It also plays a role in determining the company’s creditworthiness and ability to attract investors and lenders.

Paid-up capital is a term used in corporate finance to refer to the amount of money that shareholders have contributed to a company in exchange for shares of stock. It represents the initial investment made by shareholders and is an important metric for assessing the financial health and stability of a company.

Paid-up capital can be contributed in various forms, including cash, assets, or services. Cash is the most common form of contribution, as it provides immediate liquidity to the company. However, assets such as property, equipment, or intellectual property can also be contributed as paid-up capital.

The amount of paid-up capital a company has can have significant implications for its financial position. A higher paid-up capital indicates that shareholders have made a substantial investment in the company, which can be seen as a vote of confidence in its prospects. It also provides a cushion of capital that can be used to cover any unexpected expenses or losses.

Furthermore, paid-up capital is an important factor in determining a company’s financial ratios and valuation. It is often used as a basis for calculating metrics such as return on equity (ROE) and price-to-earnings (P/E) ratio. These metrics are widely used by investors and analysts to assess the profitability and value of a company.

In addition, paid-up capital can also affect a company’s ability to raise additional capital in the future. A company with a higher paid-up capital may be viewed as more financially stable and therefore more attractive to potential investors or lenders.

Importance in Corporate Finance

One of the main reasons why paid-up capital is important is that it represents the amount of money that shareholders have invested in a company. This capital is used by the company to finance its operations, invest in new projects, and expand its business. A higher paid-up capital indicates that the company has a strong financial base and is capable of withstanding financial challenges.

Paid-up capital also plays a crucial role in determining a company’s creditworthiness. Lenders and creditors often consider the amount of paid-up capital when assessing the company’s ability to repay its debts. A higher paid-up capital can increase the company’s borrowing capacity and improve its chances of obtaining favorable loan terms.

Furthermore, paid-up capital affects a company’s valuation. Investors and analysts use this metric to evaluate the worth of a company’s shares. A higher paid-up capital can indicate that the company is well-established and has a solid track record, making it more attractive to potential investors.

In addition, paid-up capital is important for regulatory compliance. Many jurisdictions require companies to have a minimum amount of paid-up capital to ensure their financial stability and protect the interests of shareholders. Failing to meet these requirements can result in penalties or even the dissolution of the company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.