Exploring the Mechanics of Overlapping Debt

Overlapping debt refers to a situation where multiple levels of government, such as federal, state, and local governments, all have outstanding debt obligations. This can occur when different levels of government issue their own debt securities to finance their operations or infrastructure projects.

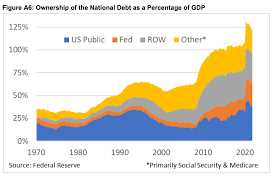

The mechanics of overlapping debt also involve the role of bondholders. When a government issues debt securities, such as bonds, investors purchase these securities and become bondholders. These bondholders have a legal claim on the government’s revenues and assets, and they expect to receive regular interest payments and the return of their principal investment upon maturity.

In the case of overlapping debt, bondholders may hold securities issued by different levels of government. This means that they are exposed to the credit risk of multiple government entities. If one level of government defaults on its debt, bondholders may face the risk of not receiving their expected payments. This can have a ripple effect on the overall financial stability and credibility of the government sector.

Furthermore, the mechanics of overlapping debt can also impact the borrowing costs for governments. When multiple levels of government have outstanding debt, investors may demand higher interest rates to compensate for the increased credit risk. This can make it more expensive for governments to borrow funds, which can have implications for their ability to finance public projects and services.

The Economic Impact of Overlapping Debt

Overlapping debt refers to a situation where a government has multiple layers of debt obligations, often resulting from different levels of government issuing debt. This can occur when both the national government and local governments issue debt, or when different levels of local governments issue debt.

The economic impact of overlapping debt can be significant and can have both positive and negative effects on the economy. One of the main concerns with overlapping debt is the potential for fiscal stress. When different levels of government have debt obligations, it can create a complex web of financial responsibilities that can strain government budgets.

One potential negative impact of overlapping debt is the risk of default. If a government is unable to meet its debt obligations, it can lead to a default, which can have severe consequences for the economy. Defaults can lead to a loss of investor confidence, higher borrowing costs, and a decrease in economic growth.

Additionally, overlapping debt can create inefficiencies in the allocation of resources. When different levels of government have debt obligations, it can lead to duplication of efforts and inefficient use of funds. This can hinder economic development and reduce the overall productivity of the economy.

On the other hand, overlapping debt can also have positive effects on the economy. It can provide a mechanism for transferring resources from higher levels of government to lower levels, which can promote economic development and reduce regional disparities. This can help stimulate economic growth and improve living standards in less developed regions.

Furthermore, overlapping debt can also enhance fiscal discipline. When different levels of government have debt obligations, it can create a system of checks and balances, as each level of government is accountable for its own debt. This can help prevent excessive borrowing and promote responsible fiscal management.

Government Debt and Overlapping Debt: A Closer Look

Government debt is a common phenomenon in modern economies, and it plays a crucial role in financing government spending and addressing fiscal deficits. However, an often overlooked aspect of government debt is the concept of overlapping debt.

What is overlapping debt?

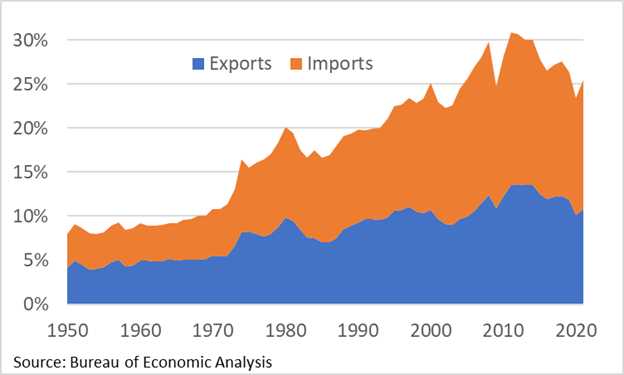

For example, in a federal system like the United States, the federal government issues its own debt securities, such as Treasury bonds, to finance its spending. At the same time, state governments and local governments also issue their own debt securities to finance their respective projects and initiatives.

How does overlapping debt work?

Overlapping debt works by allowing each level of government to independently borrow funds from the financial markets. This means that investors can choose to invest in the debt securities of the federal government, state governments, or local governments, depending on their risk preferences and investment objectives.

Each level of government is responsible for servicing its own debt, which includes making regular interest payments and repaying the principal amount at maturity. The revenue sources for debt servicing typically come from taxes, fees, and other sources of income generated by the respective level of government.

What is the economic impact of overlapping debt?

Overlapping debt can have several economic impacts. Firstly, it can lead to increased competition among different levels of government for investor funds. This competition can drive up borrowing costs, as investors demand higher interest rates to compensate for the perceived risks associated with multiple levels of debt.

Secondly, overlapping debt can complicate the overall debt management and fiscal planning of a country. Each level of government has its own debt repayment schedule and interest rate, making it challenging to coordinate and manage the overall debt burden effectively.

Lastly, overlapping debt can also have implications for intergovernmental relations. Disputes may arise between different levels of government over the allocation of resources, as each level of government may prioritize its own debt servicing obligations over other spending priorities.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.