What is Over and Short?

Definition and Explanation

Over and Short can occur in various situations, such as cash handling, inventory management, or sales transactions. It represents the discrepancy between the amount that should be present and the actual amount counted or recorded.

For example, if a cash register is expected to have $500 based on sales records but only contains $480, there is an overage of $20. Conversely, if the cash register contains $520, there is a shortage of $20.

Over and Short can also apply to inventory discrepancies. If a company’s records show that it should have 100 units of a product in stock, but a physical count reveals only 95 units, there is an overage of 5 units. On the other hand, if the physical count shows 105 units, there is a shortage of 5 units.

Importance in Accounting

Over and Short is important in accounting because it helps identify and reconcile discrepancies between expected and actual amounts. It allows businesses to track and investigate potential errors, theft, or other issues that may affect their financial records.

By regularly monitoring and analyzing over and short amounts, businesses can identify patterns or trends that may indicate systemic issues in their cash handling or inventory management processes. This information can then be used to implement corrective measures and improve overall financial controls.

Causes of Over and Short

There are several possible causes of over and short discrepancies. These include errors in recording transactions, theft or fraud, incorrect cash handling procedures, inaccurate inventory counts, or system glitches.

For example, a cashier may accidentally record a sale for the wrong amount, resulting in an over or short amount. Alternatively, an employee may intentionally steal cash or inventory, leading to discrepancies in the records.

How to Handle Over and Short

When over and short discrepancies occur, it is important for businesses to investigate and resolve them promptly. This typically involves reviewing transaction records, conducting physical counts, and comparing them to the expected amounts.

If the cause of the discrepancy is identified, appropriate actions should be taken. For example, if an error in recording transactions is found, the records should be corrected, and staff may need additional training to prevent future mistakes.

In cases of theft or fraud, businesses should involve appropriate authorities and take legal action if necessary. Implementing stronger internal controls and security measures can help prevent such incidents in the future.

Overall, effectively handling over and short discrepancies is crucial for maintaining accurate financial records, ensuring the integrity of business operations, and preventing financial losses.

Definition and Explanation

When conducting financial transactions, it is crucial to ensure that the amount of cash or inventory matches the amount recorded in the books. However, due to various factors, such as errors in recording, theft, or miscalculations, there can be a difference between the actual amount and the recorded amount. This difference is referred to as Over and Short.

The Over and Short amount can be either positive or negative. A positive Over and Short occurs when the actual amount is greater than the recorded amount, while a negative Over and Short occurs when the actual amount is less than the recorded amount.

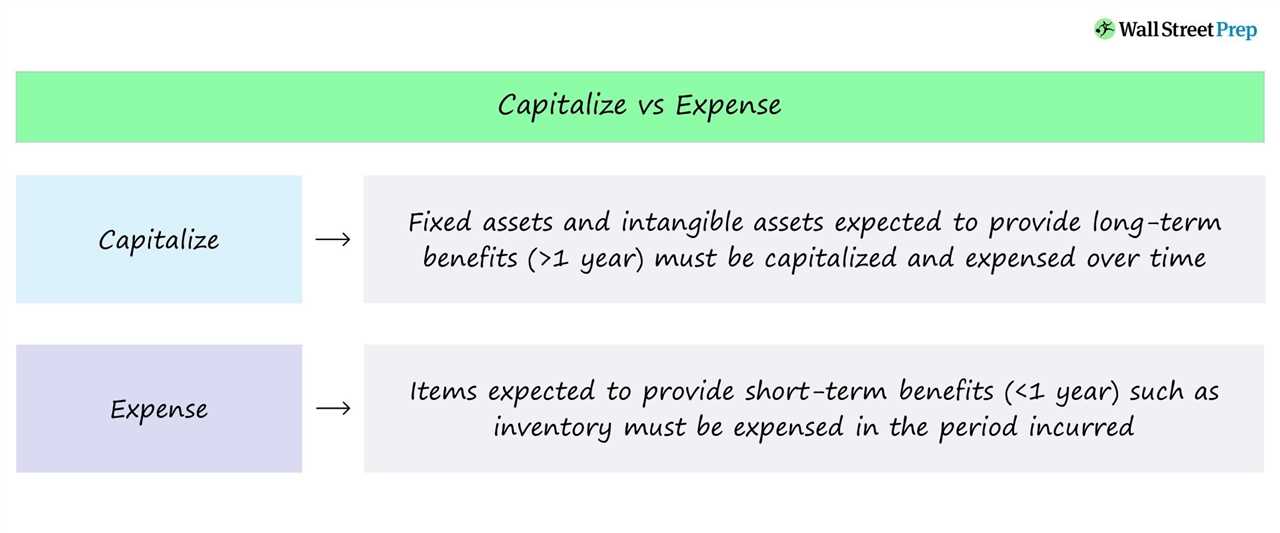

Over and Short is typically recorded as an expense or income in the financial statements, depending on whether it is positive or negative. It is important to identify and resolve Over and Short discrepancies promptly to ensure the accuracy of financial records and to prevent any potential financial loss.

To identify the cause of Over and Short, accountants may conduct thorough investigations, including reviewing transaction records, conducting physical inventory counts, and reconciling cash transactions. Once the cause is determined, appropriate actions can be taken to rectify the discrepancy and prevent future occurrences.

| Positive Over and Short | Negative Over and Short |

|---|---|

| Actual amount > Recorded amount | Actual amount < Recorded amount |

| Recorded as income | Recorded as expense |

Importance in Accounting

The concept of “Over and Short” is of great importance in the field of accounting. It plays a crucial role in ensuring the accuracy and integrity of financial records. By identifying and addressing discrepancies in cash transactions, over and short helps maintain the reliability of financial statements.

One of the main reasons why over and short is important in accounting is because it helps detect errors and fraud. Discrepancies in cash transactions can be an indication of mistakes in recording or theft. By regularly reconciling cash transactions and investigating any overages or shortages, accountants can identify and rectify errors, as well as detect any fraudulent activities.

Furthermore, over and short provides valuable insights into the efficiency of cash handling processes. By analyzing the causes of overages or shortages, organizations can identify areas for improvement in their cash management procedures. This can help streamline operations, reduce losses, and enhance overall financial performance.

Additionally, over and short is important for maintaining internal controls. It serves as a control mechanism to ensure that cash transactions are accurately recorded and accounted for. By regularly reconciling cash transactions, organizations can identify any discrepancies and take appropriate measures to address them, thereby strengthening their internal control systems.

Moreover, over and short plays a significant role in financial reporting. Accurate and reliable financial statements are essential for making informed business decisions. By properly accounting for overages or shortages, organizations can provide a true and fair view of their financial position and performance.

Causes of Over and Short

Over and short is a term used in accounting to describe the difference between the expected amount of cash and the actual amount of cash counted or recorded. There are several causes of over and short, which can vary depending on the specific circumstances of the business or transaction.

One common cause of over and short is human error. Cashiers or employees responsible for handling cash may make mistakes when counting or recording the amount of cash received. These errors can result in a discrepancy between the expected and actual cash amounts.

Another cause of over and short is theft or fraud. Dishonest employees may steal cash from the business, leading to a shortage in the cash count. On the other hand, employees may also intentionally overstate the amount of cash received in order to pocket the excess amount. Both theft and fraud can contribute to over and short in accounting.

System errors or glitches can also cause over and short. Malfunctions in cash registers or accounting software can result in incorrect cash counts or discrepancies between the expected and actual amounts. These errors may be unintentional and can be resolved by fixing the system or software issue.

Additionally, external factors such as counterfeit money or invalid checks can contribute to over and short. If a business accepts counterfeit money or invalid checks without realizing it, the cash count may be higher than the actual value of the currency. This can result in an overstatement of cash and contribute to over and short.

It is important for businesses to identify and address the causes of over and short in order to maintain accurate financial records. Implementing proper cash handling procedures, conducting regular audits, and training employees on cash handling best practices can help minimize the occurrence of over and short in accounting.

How to Handle Over and Short

When dealing with over and short discrepancies in accounting, it is important to follow a systematic approach to ensure accuracy and accountability. Here are some steps to handle over and short:

- Identify the Discrepancy: The first step is to identify the over and short amount. This can be done by comparing the recorded cash transactions with the actual cash count.

- Investigate the Cause: Once the discrepancy is identified, it is important to investigate the cause. This can involve reviewing transaction records, interviewing employees, and examining any potential errors or fraudulent activities.

- Rectify the Error: If the cause of the over and short is determined to be an error, it is important to rectify the error. This can involve correcting the transaction records, adjusting the cash balance, or taking any necessary actions to prevent future errors.

- Document the Discrepancy: It is crucial to document the over and short discrepancy and the steps taken to investigate and rectify the error. This documentation will serve as a record for future reference and can be used for auditing purposes.

- Implement Internal Controls: To prevent future over and short discrepancies, it is important to implement internal controls. This can involve implementing cash handling procedures, segregation of duties, and regular audits to ensure accuracy and accountability.

- Train Employees: Proper training of employees is essential to minimize over and short discrepancies. Employees should be educated on cash handling procedures, the importance of accuracy, and the consequences of errors or fraudulent activities.

- Monitor and Review: It is important to continuously monitor and review cash transactions to identify any potential over and short discrepancies. Regular reviews and audits can help detect errors or fraudulent activities early on and prevent financial losses.

By following these steps, businesses can effectively handle over and short discrepancies in accounting, ensuring accuracy, accountability, and financial integrity.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.