What are Other Post-Retirement Benefits?

Other Post-Retirement Benefits (OPRB) refer to the benefits that an employer provides to its retired employees, in addition to the regular pension plan. These benefits are designed to support retirees in maintaining their quality of life and ensuring their well-being after they have stopped working.

OPRB can include a variety of benefits, such as healthcare coverage, life insurance, dental and vision care, long-term care insurance, and other forms of assistance. These benefits are typically offered as part of a comprehensive retirement package and are intended to supplement the income provided by the pension plan.

One of the key features of OPRB is that they continue to be provided to retirees even after they have left the workforce. This is different from other employee benefits, such as health insurance, which typically end once an employee retires.

OPRB are important because they help retirees cover the costs of healthcare and other essential expenses that may arise during their retirement years. As individuals age, their healthcare needs often increase, and having access to affordable healthcare coverage can be crucial.

Furthermore, OPRB can provide retirees with a sense of security and peace of mind, knowing that they have additional support in place to help them navigate the challenges of retirement. This can help retirees feel more confident about their financial situation and allow them to enjoy their retirement years to the fullest.

It is worth noting that the availability and extent of OPRB can vary depending on the employer and the specific retirement plan. Some employers may offer more generous OPRB packages, while others may provide more limited benefits. It is important for employees to carefully review and understand the OPRB options available to them when planning for retirement.

Other Post-Retirement Benefits (OPRB) refer to a range of benefits that employers provide to their retired employees, in addition to pension plans. These benefits are designed to support retirees and ensure their well-being after they stop working.

What are Other Post-Retirement Benefits?

Other Post-Retirement Benefits include various types of benefits such as healthcare coverage, life insurance, dental and vision plans, and long-term care insurance. These benefits are offered to retired employees as a way to provide them with financial security and peace of mind during their retirement years.

Employers may choose to offer OPRB as part of their overall compensation package to attract and retain talented employees. These benefits can also serve as a way to show appreciation for the years of service an employee has dedicated to the company.

Importance of Other Post-Retirement Benefits

OPRB play a crucial role in ensuring the well-being of retired employees. As individuals transition from their working years to retirement, they may face increased healthcare costs and other financial challenges. OPRB help to alleviate some of these burdens by providing retirees with access to essential healthcare services and other benefits.

By offering OPRB, employers demonstrate their commitment to the long-term welfare of their employees. This can contribute to a positive work environment and foster employee loyalty and satisfaction. Retirees who feel supported by their former employers are more likely to have a positive perception of the company and may even become brand advocates.

Furthermore, OPRB can have a positive impact on the overall financial well-being of retirees. Access to healthcare coverage and other benefits can help retirees save on out-of-pocket expenses, allowing them to allocate their retirement savings towards other needs and goals.

Conclusion

Other Post-Retirement Benefits are an important component of a comprehensive retirement plan. These benefits provide retired employees with financial security, access to healthcare services, and other essential benefits. Employers who offer OPRB demonstrate their commitment to the well-being of their employees and can reap the benefits of a positive work environment and employee loyalty.

Benefits of Other Post-Retirement Benefits

Other Post-Retirement Benefits (OPRB) are an essential part of retirement planning, providing retirees with additional financial security and peace of mind. These benefits go beyond traditional retirement plans, such as pensions and 401(k) accounts, and can include healthcare coverage, life insurance, and other perks.

- Healthcare Coverage: One of the most significant advantages of OPRB is the provision of healthcare coverage. As retirees age, their healthcare needs often increase, and having access to affordable and comprehensive healthcare coverage can be crucial. OPRB can help cover medical expenses, including doctor visits, prescription medications, and hospital stays.

- Life Insurance: OPRB may also include life insurance coverage, which can provide financial protection for retirees and their families. Life insurance can help cover funeral expenses, outstanding debts, and provide a financial safety net for loved ones in the event of the retiree’s passing.

- Financial Stability: OPRB can provide retirees with a sense of financial stability during their retirement years. Knowing that they have additional benefits and resources available can alleviate financial stress and allow retirees to enjoy their retirement without constantly worrying about money.

- Peace of Mind: Perhaps one of the most valuable benefits of OPRB is the peace of mind it brings. Retirees can rest easy knowing that they have additional support and resources available to them, should they need it. This peace of mind can greatly enhance the overall retirement experience and allow retirees to focus on their health, hobbies, and spending time with loved ones.

Exploring the Advantages and Opportunities of Other Post-Retirement Benefits

Other post-retirement benefits (OPRBs) are an important aspect of retirement planning that go beyond just a pension or retirement savings. These benefits can provide retirees with additional financial security and peace of mind during their golden years. Let’s explore some of the advantages and opportunities that OPRBs can offer.

1. Healthcare Coverage:

2. Prescription Drug Benefits:

In addition to healthcare coverage, OPRBs may also include prescription drug benefits. As retirees often require medications to manage various health conditions, having access to affordable prescription drugs can greatly reduce their financial burden. OPRBs may cover a portion or all of the prescription drug costs, making it easier for retirees to afford their medications.

3. Life Insurance:

OPRBs may also provide retirees with life insurance coverage. This can be especially beneficial for retirees who have dependents or outstanding debts. Life insurance can help ensure that their loved ones are financially protected in the event of their passing. It can also be used to cover funeral expenses, relieving the burden on family members during an already difficult time.

4. Long-Term Care Benefits:

5. Travel and Leisure Opportunities:

OPRBs can also open up opportunities for retirees to enjoy their retirement years to the fullest. Some plans may offer travel benefits, such as discounted airfare or hotel accommodations. Others may provide access to recreational activities or clubs, allowing retirees to stay active and engaged in their communities. These opportunities can enhance the overall retirement experience and help retirees make the most of their newfound free time.

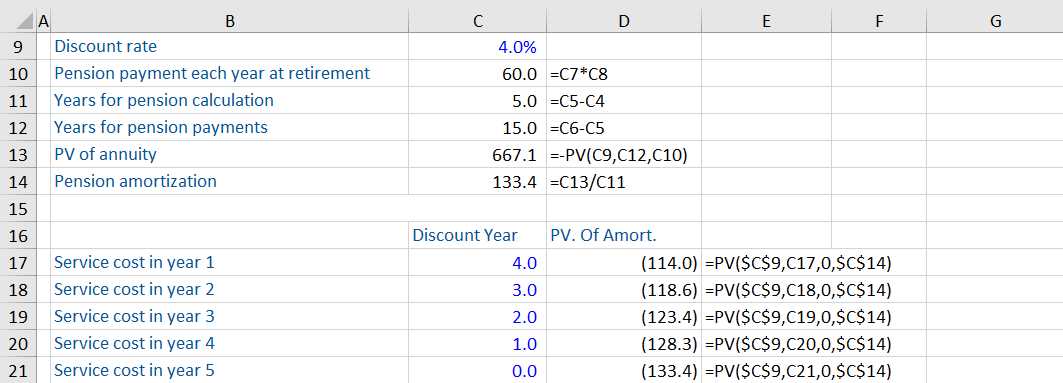

Cost of Other Post-Retirement Benefits

The cost of OPRBs can vary depending on several factors, including the type of benefits offered, the number of retirees, and the overall health and longevity of the retiree population. These costs are typically borne by the employer, although some companies may require retirees to contribute a portion of the cost.

Types of Other Post-Retirement Benefits

OPRBs can include a wide range of benefits, such as healthcare coverage, life insurance, disability insurance, and long-term care insurance. These benefits are designed to help retirees cover the costs of medical expenses, protect their loved ones financially, and provide support in the event of a disability or long-term care need.

Healthcare coverage is often the most significant cost associated with OPRBs. As retirees age, their healthcare needs tend to increase, leading to higher healthcare costs. Employers may offer retiree healthcare plans that provide coverage similar to what employees receive during their working years. Alternatively, retirees may be eligible for government-sponsored healthcare programs, such as Medicare, which can help offset some of the costs.

Factors Affecting the Cost of Other Post-Retirement Benefits

The type of benefits offered also plays a role in determining the cost. For example, offering comprehensive healthcare coverage will be more expensive than offering limited coverage. Similarly, providing life insurance or long-term care insurance will add to the overall cost of OPRBs.

Managing the Cost of Other Post-Retirement Benefits

Employers have several strategies for managing the cost of OPRBs. One common approach is to shift a portion of the cost to retirees by requiring them to contribute to the premiums or copayments. Another strategy is to modify the benefits offered, such as reducing the coverage or increasing the eligibility requirements.

Some companies also choose to outsource the administration of OPRBs to third-party providers. This can help streamline the process and potentially reduce costs by leveraging the provider’s expertise and economies of scale.

Overall, managing the cost of OPRBs requires careful planning and consideration. Employers must balance the financial needs of their retirees with the sustainability of the benefits program. Retirees, on the other hand, should carefully evaluate the benefits offered and consider their own financial situation to ensure they can afford the costs associated with OPRBs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.