Open Offer vs. Rights Issue: Definition and Differences

Definition of Open Offer

An open offer is a type of equity offering where a company offers its existing shareholders the opportunity to purchase additional shares at a discounted price. The company sets a specific ratio for the offer, such as one new share for every five shares owned. Existing shareholders have the right to accept or decline the offer.

Open offers are typically made when a company needs to raise capital quickly or wants to give existing shareholders the opportunity to increase their stake in the company. The discounted price is meant to incentivize shareholders to participate in the offer.

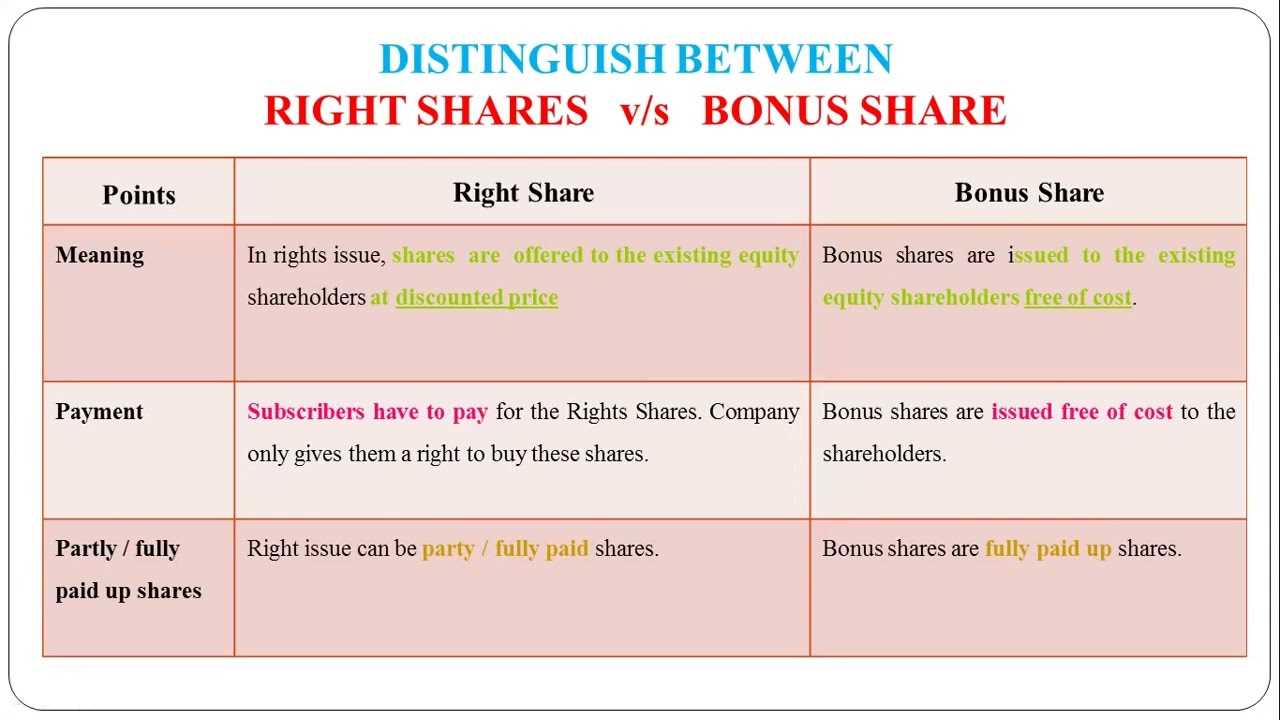

Definition of Rights Issue

A rights issue, on the other hand, is a type of equity offering where a company offers new shares to its existing shareholders in proportion to their existing holdings. Unlike an open offer, the price of the shares in a rights issue is usually not discounted. Existing shareholders have the right to purchase the new shares at the specified price or sell their rights to someone else.

Rights issues are commonly used by companies to raise capital for various purposes, such as funding expansion plans or reducing debt. By offering new shares to existing shareholders, the company ensures that the ownership structure remains relatively unchanged.

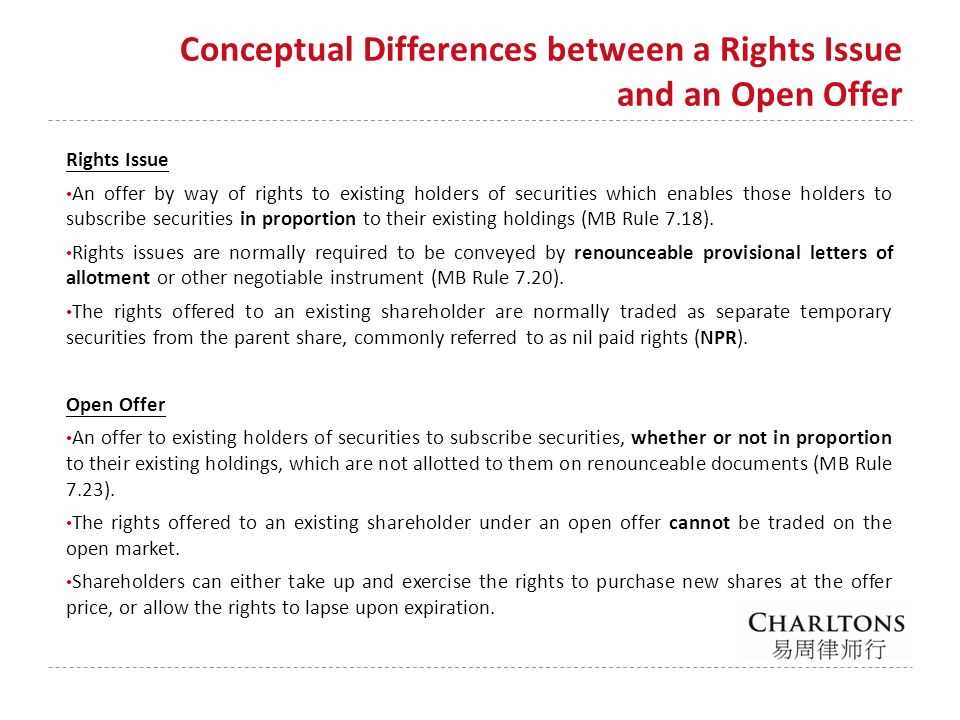

Differences between Open Offer and Rights Issue

The main differences between an open offer and a rights issue can be summarized as follows:

| Open Offer | Rights Issue |

|---|---|

| Discounted price | Usually not discounted |

| Existing shareholders can accept or decline the offer | Existing shareholders have the right to purchase new shares |

| Used for quick capital raising or allowing existing shareholders to increase their stake | Used for various purposes, such as funding expansion plans or reducing debt |

An open offer is a type of corporate action that allows existing shareholders of a company to purchase additional shares at a discounted price. It is a way for the company to raise additional capital without diluting the ownership of existing shareholders. The open offer is usually made on a pro-rata basis, meaning that shareholders are offered the opportunity to purchase additional shares in proportion to their existing holdings.

Open offers are typically announced by companies when they need to raise funds for various purposes, such as financing new projects, reducing debt, or funding acquisitions. The discounted price at which the shares are offered is usually lower than the current market price, which provides an incentive for existing shareholders to participate in the offer.

How Does an Open Offer Work?

When a company decides to make an open offer, it will issue a prospectus or offer document that contains all the details of the offer, including the number of shares being offered, the price at which they are being offered, and the deadline for shareholders to participate. Shareholders who wish to participate in the offer need to submit their application and payment within the specified timeframe.

Once the offer period has ended, the company will determine the total number of shares that have been applied for and the amount of money raised. If the total number of shares applied for is less than the number of shares available, all shareholders who applied will receive the full number of shares they requested. If the total number of shares applied for exceeds the number of shares available, the company will allocate the available shares on a pro-rata basis.

Advantages and Disadvantages of Open Offers

Open offers have several advantages for both the company and its existing shareholders. For the company, it is a way to raise capital quickly and efficiently without incurring high fees associated with other methods of fundraising, such as rights issues or private placements. It also allows the company to reward its existing shareholders by offering them the opportunity to purchase additional shares at a discounted price.

However, open offers also have some disadvantages. Shareholders who do not have sufficient funds to participate in the offer may be unable to take advantage of the discounted price. Additionally, if the company’s share price declines after the offer is announced, shareholders who participated in the offer may experience a loss on their investment.

Conclusion

Open offers are a common method used by companies to raise additional capital while providing benefits to existing shareholders. By offering shares at a discounted price, companies can incentivize shareholders to participate in the offer and increase their ownership stake. However, it is important for shareholders to carefully consider the potential risks and rewards before deciding to participate in an open offer.

| Open Offer | Rights Issue |

|---|---|

| Allows existing shareholders to purchase additional shares at a discounted price | Allows existing shareholders to purchase additional shares at a predetermined price |

| Raises additional capital without diluting ownership | Raises additional capital but may dilute ownership |

| Offered on a pro-rata basis | Offered on a pro-rata basis |

| Announced when the company needs to raise funds | Announced when the company needs to raise funds |

| Discounted price is lower than the market price | Price is predetermined and may be higher or lower than the market price |

Exploring Rights Issue

A rights issue is a method used by companies to raise additional capital from existing shareholders. It is a way for companies to offer their existing shareholders the opportunity to purchase additional shares at a discounted price, usually in proportion to their existing shareholdings.

When a company decides to issue new shares through a rights issue, it typically offers these shares to its existing shareholders on a pro-rata basis. This means that shareholders have the right to purchase a certain number of new shares for each share they already own. The price at which the new shares are offered is usually lower than the current market price, making it an attractive opportunity for shareholders to increase their stake in the company at a discounted rate.

The main purpose of a rights issue is to raise capital for the company. The funds raised through a rights issue can be used for various purposes, such as funding expansion plans, reducing debt, or financing acquisitions. By offering shares to existing shareholders, companies can tap into their loyal investor base and raise capital without having to seek external investors or take on additional debt.

One of the key advantages of a rights issue is that it allows existing shareholders to maintain their proportional ownership in the company. Since the new shares are offered in proportion to their existing shareholdings, shareholders have the opportunity to increase their stake in the company without diluting their ownership. This can be particularly beneficial for long-term shareholders who want to maintain their influence and control over the company.

However, rights issues also come with some risks and considerations. One of the main risks is the potential for dilution of existing shareholders’ ownership. If existing shareholders do not exercise their rights to purchase additional shares, their ownership stake in the company will be diluted as new shares are issued to other investors. Additionally, the success of a rights issue depends on the willingness of existing shareholders to invest more capital in the company. If shareholders do not have the financial means or confidence in the company’s prospects, they may choose not to participate in the rights issue.

Differences between Open Offer and Rights Issue

Open Offer and Rights Issue are two common methods used by companies to raise capital. While both methods involve issuing new shares, there are several key differences between the two.

1. Shareholder eligibility:

In an Open Offer, all existing shareholders have the opportunity to participate and purchase new shares. There is no restriction on who can participate, and all shareholders are treated equally.

In a Rights Issue, only existing shareholders are given the right to purchase new shares. This means that shareholders who do not already own shares in the company are excluded from participating.

2. Proportional allocation:

In an Open Offer, the allocation of new shares is typically done on a proportional basis. This means that each shareholder is given the opportunity to purchase new shares in proportion to their existing shareholding.

In a Rights Issue, the allocation of new shares is also done on a proportional basis. However, the allocation is based on the number of rights entitlements held by each shareholder. Shareholders are given a specific number of rights entitlements for each share they already own, and these entitlements can be used to purchase new shares.

3. Pricing:

In an Open Offer, the price at which new shares are offered is typically determined by the company. The price may be set at a discount to the market price in order to incentivize shareholders to participate.

In a Rights Issue, the price at which new shares are offered is usually set at a discount to the market price. This discount is often larger than the discount offered in an Open Offer, as it is intended to compensate existing shareholders for the dilution of their ownership.

4. Transferability:

In an Open Offer, shareholders have the option to transfer their rights to purchase new shares to another party. This allows shareholders who do not wish to participate in the offer to sell their rights to someone else.

In a Rights Issue, the rights to purchase new shares are typically non-transferable. This means that shareholders cannot sell or transfer their rights to another party.

5. Timeframe:

An Open Offer is usually open for a relatively short period of time, typically a few weeks. This allows shareholders to make a quick decision on whether to participate or not.

A Rights Issue, on the other hand, is open for a longer period of time, often several weeks or even months. This allows shareholders more time to consider their options and make an informed decision.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.