What is Open Interest?

Open Interest is a concept used in stock trading to measure the number of outstanding contracts or positions in a particular financial instrument, such as stocks, options, or futures contracts. It represents the total number of contracts that are currently open or not yet closed or delivered.

Open Interest is different from trading volume, which measures the number of shares or contracts that have been traded during a given period. While trading volume provides information about the activity and liquidity of a particular instrument, open interest provides insights into the overall interest and sentiment of market participants.

Open Interest is calculated by aggregating all the long positions (buyers) and short positions (sellers) in a particular instrument. For example, if there are 100 buyers and 100 sellers of a particular stock option, the open interest for that option would be 200 contracts.

Open Interest can be used by traders and analysts to gauge market sentiment and predict future price movements. A high open interest indicates a high level of interest and activity in a particular instrument, which may suggest that a significant price move is imminent. On the other hand, a low open interest may indicate a lack of interest or participation in the market.

It is important to note that open interest is not a standalone indicator and should be used in conjunction with other technical and fundamental analysis tools. Traders should also consider other factors such as trading volume, price trends, and news events when making trading decisions.

Open interest is a concept that is widely used in the world of stock trading. It refers to the total number of outstanding contracts for a particular financial instrument, such as stocks or options, that have not been closed or settled. In other words, it represents the number of contracts that are still active and have not yet been exercised, expired, or closed out.

Open interest is an important metric for traders and investors as it provides insights into the liquidity and popularity of a particular financial instrument. It helps traders gauge the level of interest and participation in a particular stock or option, which can be useful in determining market sentiment and potential price movements.

When open interest is high, it indicates that there is a large number of market participants actively trading the financial instrument. This suggests that there is a high level of liquidity, which can result in tighter bid-ask spreads and better execution prices for traders. On the other hand, low open interest may indicate a lack of interest or participation in the financial instrument, which can result in wider bid-ask spreads and potentially lower liquidity.

Calculating Open Interest

Open interest is calculated by taking the total number of long positions and subtracting the total number of short positions for a particular financial instrument. Long positions represent contracts that have been bought or opened, while short positions represent contracts that have been sold or opened. The difference between the two represents the open interest.

For example, if there are 100 long positions and 50 short positions for a particular stock, the open interest would be 50. This means that there are 50 contracts that are still active and have not been closed or settled.

Interpreting Open Interest

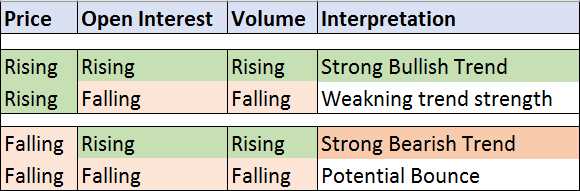

Interpreting open interest can be a bit more complex as it requires analyzing other factors such as price movements, volume, and market trends. High open interest combined with increasing prices and high trading volume may indicate a bullish sentiment, suggesting that more traders are entering long positions. Conversely, high open interest combined with decreasing prices and high trading volume may indicate a bearish sentiment, suggesting that more traders are entering short positions.

It is important to note that open interest alone cannot predict future price movements with certainty. It is just one of the many tools that traders use to analyze the market and make informed trading decisions. Traders should also consider other technical and fundamental factors before making any trading decisions.

Examples of Open Interest in Stock Trading

Example 1: Increasing Open Interest

Let’s say that the open interest for a specific stock has been steadily increasing over the past few days. This indicates that new positions are being created in the market, suggesting a growing interest in the stock. Traders may interpret this as a bullish signal, as it implies that more market participants are willing to buy the stock, potentially driving up its price.

For example, if the open interest for a stock is 1,000 contracts on Monday, 1,500 contracts on Tuesday, and 2,000 contracts on Wednesday, it suggests that more traders are entering the market and taking positions in the stock. This could be due to positive news or expectations of future price appreciation.

Example 2: Decreasing Open Interest

In contrast, a decrease in open interest can indicate a decline in market participation and a potential reversal in price. If the open interest for a stock is decreasing, it suggests that traders are closing out their positions or not initiating new ones. This could be a sign of waning interest or a shift in market sentiment.

For instance, if the open interest for a stock is 2,000 contracts on Monday, 1,500 contracts on Tuesday, and 1,000 contracts on Wednesday, it suggests that traders are losing interest in the stock. This could be due to negative news or expectations of future price depreciation.

Example 3: High Open Interest at a Key Price Level

Traders also pay close attention to open interest levels at key price levels, such as support or resistance levels. If there is a significant increase in open interest at a particular price level, it suggests that there is a strong consensus among market participants about the stock’s value at that level.

For example, if a stock has been trading in a range between $50 and $60, and there is a sudden surge in open interest when the stock price reaches $55, it indicates that many traders believe that $55 is an important level for the stock. This could lead to increased buying or selling pressure, potentially causing a breakout or reversal in the stock’s price.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.