Net Charge-Off: An Overview

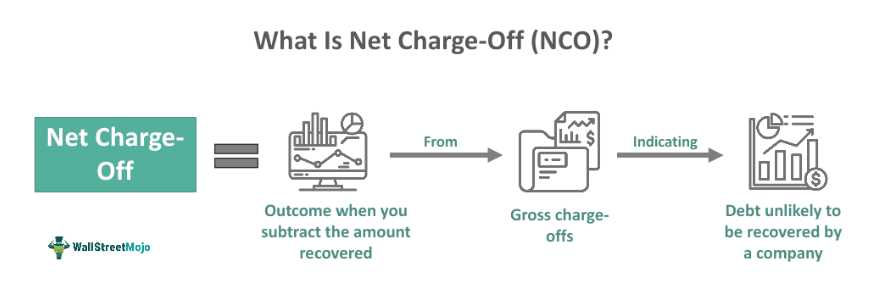

Net charge-off is a financial term that refers to the amount of debt that a company or financial institution writes off as uncollectible. It is a measure of the losses incurred by the institution due to defaulting borrowers.

When a borrower fails to repay their debt, the lender may decide to charge off the unpaid amount. This means that the lender removes the debt from its books and considers it as a loss. The net charge-off is calculated by subtracting any recoveries or repayments made by the borrower after the charge-off from the original amount of the debt.

Net charge-off is an important metric for lenders as it helps them assess the credit quality of their loan portfolio. It provides insights into the level of risk and potential losses associated with lending activities. A high net charge-off rate indicates that the lender is experiencing a significant number of defaults and may need to tighten its lending standards or take other actions to mitigate the risk.

Financial institutions typically track net charge-off rates on a regular basis to monitor the performance of their loan portfolio. They may compare these rates to industry benchmarks or historical data to identify any trends or areas of concern. This information can be used to make informed decisions about credit risk management and loan underwriting.

Net Charge-Off Mechanics: How It Works

Net charge-off is calculated by subtracting the recoveries from the gross charge-offs. Gross charge-offs refer to the total amount of debt that a company determines is unlikely to be repaid by the borrower. These charge-offs are typically recorded as expenses on the company’s financial statements.

Recoveries, on the other hand, represent the amount of previously charged-off debt that the company is able to collect from the borrower or through other means. These recoveries are recorded as income on the company’s financial statements.

The net charge-off amount provides valuable insights into the company’s ability to manage credit risk and collect outstanding debts. A high net charge-off ratio indicates that a significant portion of the company’s loans or credit portfolio is becoming uncollectible, which can be a sign of poor underwriting standards or economic downturn.

On the other hand, a low net charge-off ratio indicates that the company has effective risk management practices in place and is able to minimize losses from bad debts. This can be an indicator of a strong credit portfolio and sound financial health.

Net charge-off mechanics also involve the timing of when the charge-offs and recoveries are recognized. Generally, charge-offs are recognized when the company determines that the debt is uncollectible, while recoveries are recognized when the funds are actually received.

It is important to note that net charge-off is just one metric used to assess credit quality and financial health. Other factors, such as delinquency rates, loan loss reserves, and overall economic conditions, should also be considered when evaluating the creditworthiness of a company or financial institution.

Real-Life Example of Net Charge-Off

Net charge-off is a concept used in the financial industry to measure the amount of debt that a company or financial institution writes off as uncollectible. To better understand how net charge-off works, let’s take a look at a real-life example.

Scenario:

ABC Bank is a commercial bank that provides loans to individuals and businesses. They have a portfolio of loans with a total outstanding balance of $10 million. Over the course of a year, ABC Bank experiences a certain level of loan defaults and delinquencies.

At the end of the year, ABC Bank reviews its loan portfolio and determines that $500,000 worth of loans are unlikely to be repaid. These loans are considered to be uncollectible and are written off by the bank.

Calculating Net Charge-Off:

To calculate the net charge-off, ABC Bank subtracts the amount recovered from the written-off loans from the total amount written off. Let’s assume that ABC Bank is able to recover $200,000 from the written-off loans.

The net charge-off for ABC Bank would be calculated as follows:

- Total amount written off: $500,000

- Amount recovered: $200,000

Net charge-off is an important metric for financial institutions as it helps them assess the quality of their loan portfolio and manage their risk exposure. By monitoring net charge-off, banks can identify trends and take appropriate measures to mitigate potential losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.