What is Negative Amortization?

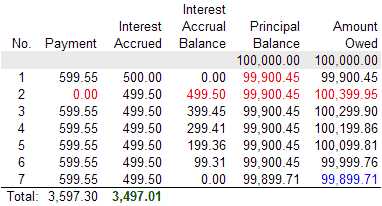

Negative amortization occurs when the principal balance of a loan increases over time instead of decreasing. This happens when the borrower makes minimum payments that do not cover the interest due on the loan. The unpaid interest is added to the principal balance, causing it to grow.

Typically, negative amortization is associated with adjustable-rate mortgages (ARMs) or certain types of student loans. These loans often have a low initial interest rate or payment amount, which can be attractive to borrowers. However, the low payments may not be enough to cover the full amount of interest that accrues, resulting in negative amortization.

How Does Negative Amortization Work?

Let’s say you have an adjustable-rate mortgage with a starting interest rate of 3%. Your monthly payment is $1,000, which is based on a 30-year repayment term. However, the interest rate on your mortgage adjusts annually, and after the first year, it increases to 5%.

With the new interest rate, the monthly interest due on your mortgage is now $1,250. However, your monthly payment remains at $1,000. The $250 difference between the interest due and your payment is added to the principal balance of the loan, causing it to increase.

Over time, the negative amortization can lead to a significant increase in the loan balance. This can be problematic for borrowers because they may owe more on the loan than the original amount borrowed.

Effects of Negative Amortization

Lastly, negative amortization can make it harder to build equity in the property. Equity is the difference between the market value of the property and the outstanding loan balance. With negative amortization, the loan balance increases, reducing the amount of equity the borrower has in the property.

| Pros | Cons |

|---|---|

| – Lower initial payments | – Increased overall cost of the loan |

| – Attractive for short-term financing | – Negative equity |

| – Can be beneficial in certain situations | – Reduced ability to build equity |

Examples of Negative Amortization

Negative amortization occurs when the monthly payment on a loan is not enough to cover the interest charges, resulting in the outstanding balance of the loan increasing over time. This can happen with certain types of loans, such as adjustable-rate mortgages (ARMs) or interest-only loans.

Here are a few examples to help illustrate how negative amortization works:

Example 1:

John takes out an adjustable-rate mortgage with a starting interest rate of 3%. The loan has a monthly payment of $1,000. However, after the first year, the interest rate adjusts to 5%. With the new interest rate, the monthly payment should increase to $1,200 to cover the higher interest charges. But John’s loan agreement has a provision that allows for negative amortization, meaning his monthly payment remains at $1,000. As a result, the unpaid interest of $200 is added to the outstanding balance of the loan. This means that John’s loan balance increases by $200 every month.

Example 2:

Sarah takes out an interest-only loan with a monthly payment of $1,500. The loan has an interest rate of 4%. In the first year, Sarah’s payment covers the interest charges in full, so there is no negative amortization. However, in the second year, the interest rate increases to 6%. Sarah’s monthly payment remains the same at $1,500, but now it is not enough to cover the higher interest charges. As a result, the unpaid interest of $300 is added to the outstanding balance of the loan. This means that Sarah’s loan balance increases by $300 every month.

Example 3:

Mike takes out a student loan with a repayment plan that starts with a low monthly payment of $200. The interest rate on the loan is 6%. However, the loan agreement allows for negative amortization, meaning the monthly payment does not cover the full interest charges. As a result, the unpaid interest is added to the outstanding balance of the loan. Over time, Mike’s loan balance increases significantly, and he ends up owing much more than the original loan amount.

These examples demonstrate the potential risks and drawbacks of negative amortization. While it may initially provide lower monthly payments, it can lead to a larger loan balance and increased interest costs over time. It is important for borrowers to fully understand the terms of their loans and the potential implications of negative amortization before making a decision.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.