Misery Index Definition and Components

The Misery Index is an economic indicator that measures the level of economic hardship experienced by individuals in a country. It is calculated by adding the unemployment rate and the inflation rate together. The higher the Misery Index, the more economic hardship the population is facing.

The unemployment rate represents the percentage of the labor force that is unemployed and actively seeking employment. It is a measure of the lack of job opportunities in the economy. High unemployment rates indicate a struggling job market and can lead to financial difficulties for individuals and families.

The inflation rate, on the other hand, measures the rate at which prices for goods and services are increasing. Inflation erodes the purchasing power of money, making it more difficult for individuals to afford basic necessities. High inflation rates can lead to rising costs of living and economic instability.

By combining these two components, the Misery Index provides a comprehensive measure of the economic well-being of a population. It takes into account both the lack of job opportunities and the impact of rising prices on individuals’ purchasing power.

| Component | Formula |

|---|---|

| Unemployment Rate | Number of unemployed individuals / Labor force * 100 |

| Inflation Rate |

Nevertheless, the Misery Index remains a useful tool for comparing the economic hardship experienced by different countries or tracking changes in economic conditions over time. It provides a simple and straightforward measure that can help policymakers and economists assess the well-being of a population and identify areas for improvement.

What is the Misery Index?

The Misery Index is an economic indicator that measures the overall level of economic hardship in a country. It is calculated by adding the unemployment rate to the inflation rate. The higher the Misery Index, the more difficult it is for people to find employment and afford goods and services.

The Misery Index provides a snapshot of the economic conditions in a country and can be used to compare different countries or track changes over time. It is a simple yet effective tool for policymakers, economists, and investors to gauge the economic well-being of a nation.

Components of the Misery Index:

The Misery Index is calculated using two key components:

- Unemployment Rate: This measures the percentage of the labor force that is unemployed and actively seeking employment. A high unemployment rate indicates a lack of job opportunities and can lead to financial hardship for individuals and families.

- Inflation Rate: This measures the rate at which the general level of prices for goods and services is rising. High inflation erodes the purchasing power of money and can make it difficult for people to afford basic necessities.

Interpreting the Misery Index:

A higher Misery Index indicates a higher level of economic hardship. It suggests that a country is experiencing both high unemployment and high inflation, which can have negative social and economic consequences. Conversely, a lower Misery Index indicates a lower level of economic hardship and generally reflects a healthier economy.

Misery Index History and Limitations

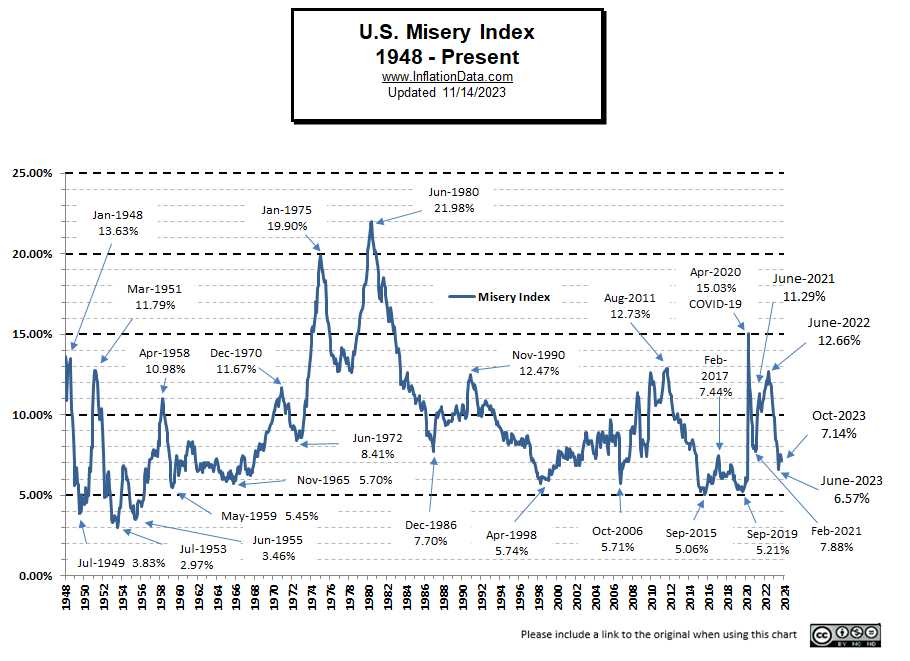

The Misery Index is a measure that combines the unemployment rate and the inflation rate to provide a snapshot of the economic well-being of a country. It was first introduced by economist Arthur Okun in the 1960s as a way to gauge the impact of economic policies on the average citizen. Since then, it has become a widely used tool for assessing the overall health of an economy.

Components of the Misery Index

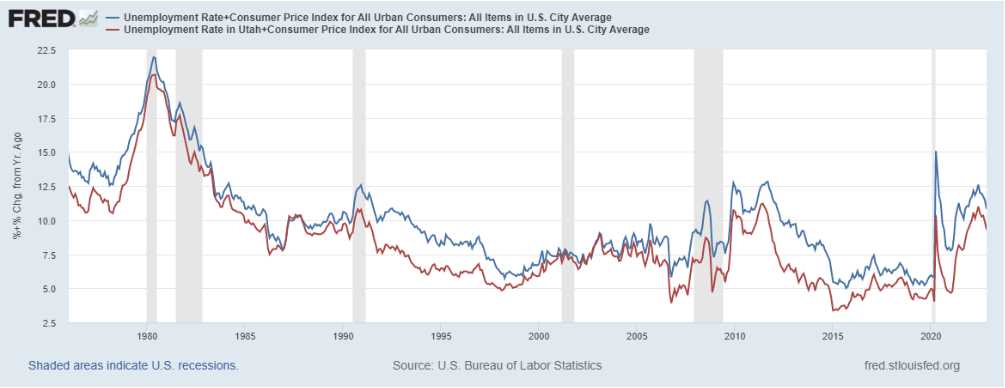

The Misery Index is calculated by adding the unemployment rate and the inflation rate together. The unemployment rate represents the percentage of the labor force that is unemployed and actively seeking employment. The inflation rate measures the rate at which prices for goods and services are rising. By combining these two factors, the Misery Index provides a comprehensive measure of economic hardship.

Limitations of the Misery Index

Furthermore, the Misery Index may not accurately reflect the experiences of different groups within a country. For example, certain demographics may be disproportionately affected by unemployment and inflation, leading to a skewed representation of the overall economic well-being. It is important to consider these limitations when interpreting the Misery Index.

History of the Misery Index

The Misery Index is an economic indicator that combines the unemployment rate and the inflation rate to provide a snapshot of the overall economic well-being of a country. It was first introduced by economist Arthur Okun in the 1960s as a way to gauge the impact of economic policies on the average citizen.

The Misery Index gained popularity in the United States during the 1970s, a period characterized by high inflation and unemployment rates. It became a useful tool for policymakers and economists to assess the effectiveness of government policies and to compare the economic performance of different countries.

Over the years, the Misery Index has evolved and been adapted by various countries to suit their specific economic conditions. Different countries may use different components to calculate their own version of the Misery Index, depending on their priorities and economic structure.

Despite its limitations, the Misery Index continues to be a widely used economic indicator. It provides a quick and easy way to compare the economic performance of different countries and can serve as a starting point for further analysis and discussion.

| Year | Country | Unemployment Rate (%) | Inflation Rate (%) | Misery Index |

|---|---|---|---|---|

| 2020 | United States | 8.1 | 2.3 | 10.4 |

| 2020 | Germany | 3.2 | 1.5 | 4.7 |

| 2020 | Japan | 2.9 | 0.2 | 3.1 |

As shown in the table above, the Misery Index can vary significantly between countries. In 2020, the United States had a Misery Index of 10.4, indicating a relatively higher level of economic hardship compared to Germany and Japan.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.