What is Mental Accounting?

Mental accounting is a concept in behavioral economics that refers to the tendency of individuals to categorize and treat money differently based on factors such as its source, purpose, or timing. It is a cognitive process through which people assign different values and importance to their financial resources, leading to biased decision-making.

When engaging in mental accounting, individuals create separate mental compartments or “accounts” for different financial transactions. For example, they may have a specific account for their monthly salary, another for savings, and yet another for discretionary spending. Each account is treated differently, and people often make decisions based on the balance or availability of funds in each account.

This categorization of money can lead to irrational financial behavior. People may prioritize spending from certain accounts over others, even if it is not financially optimal. For example, someone may be more willing to spend money from their “fun” account rather than their “savings” account, even if the expenditure is not necessary or beneficial in the long run.

Mental Accounting Bias

Mental accounting bias occurs when individuals make decisions based on the mental compartments they have created, rather than considering the overall financial situation. This bias can lead to suboptimal financial choices and hinder long-term financial goals.

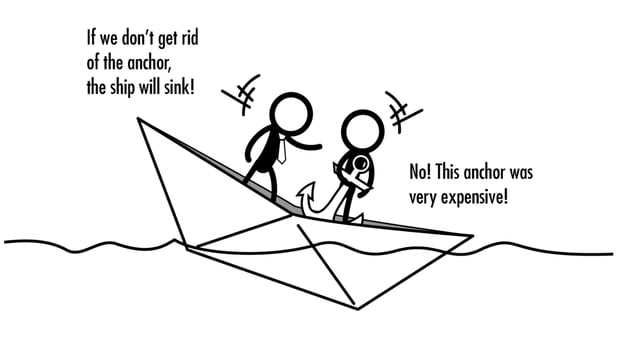

One common example of mental accounting bias is the “sunk cost fallacy.” This occurs when individuals continue to invest time, money, or resources into a project or activity because they have already invested a significant amount. They view the initial investment as a “sunk cost” and feel compelled to continue, even if it is not financially or emotionally beneficial.

Another example is the tendency to treat windfall gains differently from regular income. People may be more likely to spend or splurge when they receive unexpected money, such as a tax refund or a bonus, rather than saving or investing it wisely.

Overcoming Mental Accounting Bias

Awareness is the first step in overcoming mental accounting bias. By recognizing the tendency to categorize money and make decisions based on these categories, individuals can start to challenge their own biases and make more rational financial choices.

One strategy to overcome mental accounting bias is to focus on the overall financial picture rather than individual accounts. Instead of making decisions based solely on the balance in a specific account, individuals should consider their overall financial goals and priorities.

Another approach is to consolidate accounts and eliminate unnecessary mental compartments. By combining multiple accounts into a single account or budgeting system, individuals can reduce the temptation to make biased decisions based on account balances.

Additionally, seeking advice from financial professionals or using financial management tools can help individuals make more informed and objective financial decisions. These resources can provide a broader perspective and help individuals overcome the limitations of mental accounting bias.

Why is Mental Accounting Important?

One of the key reasons why mental accounting is important is because it can lead to suboptimal decision-making. People often categorize their money into different mental accounts, such as savings, investments, and everyday expenses. This categorization can sometimes lead to irrational behavior, as individuals may prioritize certain accounts over others, even if it is not financially beneficial.

For example, someone may have a mental account for vacation savings and a separate mental account for retirement savings. If they come across a great deal on a vacation package, they may be tempted to dip into their retirement savings to fund the vacation, even though it may not be the wisest financial decision in the long run.

Mental accounting can also lead to the creation of arbitrary boundaries and constraints on our financial decisions. For instance, individuals may have a mental account for a specific goal, such as buying a car, and they may be less willing to spend money on other important expenses, like healthcare or education, because they have mentally allocated those funds for the car purchase.

Overcoming Bias in Mental Accounting

Mental accounting bias can have a significant impact on our financial decision-making. However, by being aware of this bias and taking steps to overcome it, we can make more rational and informed choices.

1. Recognize the Bias

2. Consider the Bigger Picture

One way to overcome mental accounting bias is to step back and consider the bigger picture. Instead of compartmentalizing our finances into separate mental accounts, we should consider the overall impact of our financial decisions. This can help us make more rational choices and avoid unnecessary losses.

3. Create a Comprehensive Budget

4. Seek Outside Perspective

Seeking outside perspective can also be helpful in overcoming mental accounting bias. By discussing our financial decisions with a trusted friend, family member, or financial advisor, we can gain valuable insights and challenge our own biases. This outside perspective can help us make more rational and objective choices.

5. Educate Yourself

| Steps to Overcome Bias in Mental Accounting: |

|---|

| 1. Recognize the Bias |

| 2. Consider the Bigger Picture |

| 3. Create a Comprehensive Budget |

| 4. Seek Outside Perspective |

| 5. Educate Yourself |

By following these steps and actively working to overcome mental accounting bias, we can make more rational and informed financial decisions. This can lead to better financial outcomes and a more secure future.

Awareness of Mental Accounting Bias

1. Recognize the Different Mental Accounts

The first step in overcoming the bias of mental accounting is to recognize the different mental accounts that individuals create. This includes identifying the various categories or buckets in which money is allocated, such as savings, investments, and everyday expenses.

2. Evaluate the Rationality of Mental Accounts

Once the different mental accounts have been identified, it is important to evaluate their rationality. This involves questioning whether the allocation of money into different accounts aligns with one’s financial goals and priorities. It may be necessary to reassess and adjust the allocation if it is found to be irrational or inefficient.

3. Consider the Opportunity Cost

Another important aspect of overcoming mental accounting bias is to consider the opportunity cost. This refers to the potential benefits or returns that could be obtained by allocating money differently. By weighing the potential gains and losses of different allocations, individuals can make more informed decisions.

4. Seek Outside Perspective

Seeking outside perspective can also help in overcoming mental accounting bias. By discussing financial decisions with trusted friends, family members, or financial advisors, individuals can gain valuable insights and alternative viewpoints. This can help challenge any biases or irrationalities in mental accounting.

5. Practice Mindfulness

Mindfulness can play a significant role in overcoming mental accounting bias. By being present and aware of one’s financial decisions and thought processes, individuals can catch themselves when they are falling into biased thinking patterns. This allows for more conscious decision-making and the ability to override biases.

Overall, becoming aware of the biases associated with mental accounting is the first step in overcoming them. By recognizing the different mental accounts, evaluating their rationality, considering the opportunity cost, seeking outside perspective, and practicing mindfulness, individuals can make more rational and informed financial decisions.

Challenging Traditional Mental Accounting

Traditional mental accounting refers to the tendency of individuals to categorize and separate their financial resources into different mental accounts based on arbitrary criteria. This can lead to irrational decision-making and biased behavior.

However, it is important to challenge and question these traditional mental accounting practices in order to overcome bias and make more rational financial decisions.

1. Recognize the Arbitrary Nature of Mental Accounts

One way to challenge traditional mental accounting is to recognize the arbitrary nature of these mental accounts. Understand that the categorization of financial resources into different accounts is not based on any objective criteria, but rather on subjective perceptions and biases.

By acknowledging the arbitrary nature of mental accounts, individuals can start questioning the validity of these categorizations and consider alternative ways of organizing their finances.

2. Integrate Financial Resources

Another way to challenge traditional mental accounting is to integrate financial resources. Instead of separating money into different mental accounts, consider pooling all resources together and viewing them as a single entity.

By integrating financial resources, individuals can have a more comprehensive view of their overall financial situation and make more informed decisions based on the bigger picture.

3. Focus on Goals and Priorities

Rather than focusing on arbitrary mental accounts, it is important to shift the focus towards goals and priorities. Identify the financial goals and priorities that are most important to you, and allocate resources accordingly.

By aligning financial decisions with goals and priorities, individuals can make more rational and purposeful choices, rather than being influenced by arbitrary mental accounts.

4. Seek Professional Advice

If you find it challenging to overcome bias in mental accounting on your own, seeking professional advice can be beneficial. Financial advisors can provide objective insights and help you navigate through the complexities of mental accounting.

Professional advice can help challenge traditional mental accounting practices and provide alternative perspectives that can lead to more rational financial decision-making.

Real-Life Example of Mental Accounting

Mental accounting is a concept in behavioral economics that explains how individuals categorize and allocate their financial resources. It can have a significant impact on decision-making and financial behavior. To better understand how mental accounting works in practice, let’s consider a real-life example.

John’s Vacation Fund

Imagine John, a young professional who is saving up for a dream vacation. He has been setting aside $100 every month in a separate savings account specifically designated for this purpose. After a year, John has accumulated $1,200 in his vacation fund.

One day, John receives an unexpected bonus of $500 at work. He is thrilled with the extra money and starts thinking about how he can spend it. However, instead of adding it to his vacation fund, John decides to use the bonus to purchase a new smartphone that he has been eyeing for a while.

This decision can be explained by mental accounting. John has mentally separated his vacation fund from his general savings or income. He views the vacation fund as a separate mental account with its own purpose and rules. In his mind, the bonus money does not belong to the vacation fund and can be used for other expenses.

This example demonstrates how mental accounting can lead to biased decision-making. John could have used the bonus money to boost his vacation fund, bringing him closer to his goal. However, because he mentally separated the funds, he made a different choice that may not align with his long-term financial objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.