How Indexing Works

Indexing is a method used to track the performance of a specific market or sector. It involves creating an index, which is a representation of the overall performance of a group of stocks or other financial instruments. Indexing allows investors to gain exposure to a broad market or sector without having to buy each individual stock or instrument.

To understand how indexing works, let’s take a look at the process:

1. Selection of Constituent Stocks

The first step in creating an index is selecting the constituent stocks or financial instruments that will be included in the index. This selection is typically based on certain criteria, such as market capitalization, industry sector, or liquidity. The goal is to create a representative sample of the market or sector being tracked.

2. Weighting Methodology

Once the constituent stocks are selected, a weighting methodology is applied to determine the importance of each stock within the index. There are different weighting methods, such as market capitalization weighting, equal weighting, or fundamental weighting. Market capitalization weighting is the most common method, where stocks with higher market capitalization have a higher weight in the index.

3. Calculation of Index Value

After the constituent stocks and weighting methodology are determined, the index value is calculated. This is done by taking the weighted average of the prices or values of the constituent stocks. The index value is usually expressed as a numerical value or a percentage change from a base period.

4. Rebalancing and Maintenance

Indexes are periodically rebalanced and maintained to ensure that they remain representative of the market or sector being tracked. Rebalancing involves adjusting the constituent stocks and their weights based on changes in market conditions or other factors. Maintenance involves updating the index value on a regular basis, usually daily or in real-time.

5. Tracking and Investing

What is a Market Index?

A market index is a statistical measure that represents the performance of a specific group of stocks or other securities in a financial market. It is used to track the overall performance of the market or a specific sector or industry. Market indices are often used as benchmarks to compare the performance of individual stocks or portfolios.

Market indices are calculated using a weighted average of the prices of the constituent securities. The weights assigned to each security are typically based on factors such as market capitalization or the number of shares outstanding. The calculation of a market index takes into account the price changes of the constituent securities over a specific period of time.

Importance of Market Indices

Furthermore, market indices are used by financial institutions and analysts to track the performance of different sectors or industries. This information can be used to identify trends, assess market sentiment, and make predictions about future market movements.

Examples of Market Indices

There are numerous market indices that track various segments of the financial markets. Some of the most well-known market indices include:

| Index | Description |

|---|---|

| S&P 500 | A market capitalization-weighted index of 500 of the largest publicly traded companies in the United States. |

| Dow Jones Industrial Average | A price-weighted index of 30 large, publicly traded companies in the United States. |

| NASDAQ Composite | An index that includes all the stocks listed on the NASDAQ stock exchange, weighted by market capitalization. |

| FTSE 100 | A market capitalization-weighted index of the 100 largest companies listed on the London Stock Exchange. |

These are just a few examples of the many market indices that exist. Each index represents a different segment of the market and provides investors with valuable information about the performance of specific stocks or sectors.

How Indexing Works

Indexing is a method used to track the performance of a specific market or sector. It involves creating a portfolio of securities that represents the overall market or a specific segment of it. The portfolio is constructed in a way that mirrors the composition and weighting of the market or sector being tracked.

Indexing works by selecting a group of securities, such as stocks or bonds, that are representative of the market or sector being tracked. These securities are chosen based on various criteria, such as market capitalization, industry classification, or other factors that reflect the characteristics of the market or sector.

Once the securities are selected, they are weighted according to their importance in the market or sector. This weighting can be based on factors such as market capitalization, revenue, or other financial metrics. The securities with higher weights have a greater impact on the performance of the index.

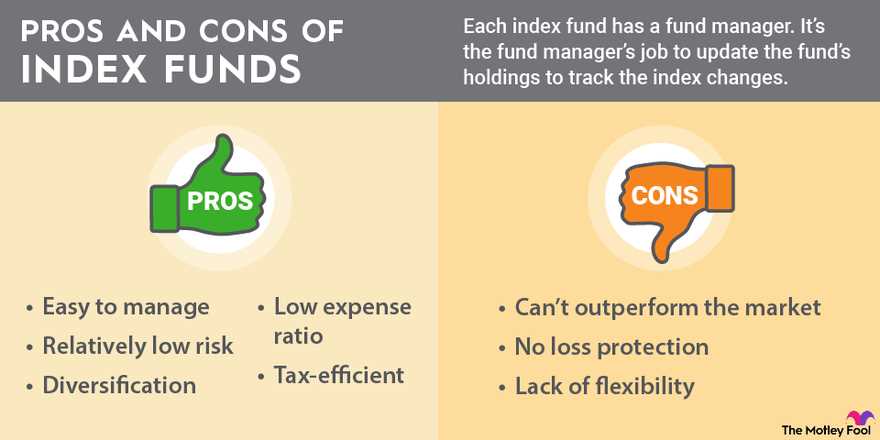

Investors can use indexing to gain exposure to a specific market or sector without having to buy individual securities. They can invest in index funds or exchange-traded funds (ETFs) that track the performance of the index. These funds aim to replicate the performance of the index by holding a portfolio of securities that mirrors its composition and weighting.

Indexing is a popular investment strategy because it offers diversification, low costs, and simplicity. By investing in an index fund or ETF, investors can gain exposure to a broad market or sector without the need for extensive research or active management. They can also benefit from the overall performance of the market or sector, rather than relying on the performance of individual securities.

Market Index: Types and Examples

A market index is a statistical measure that represents the performance of a specific group of stocks or other securities in a market. There are various types of market indexes that investors use to track the overall performance of the market or specific sectors. Here are some common types of market indexes:

1. Broad Market Index: This type of index represents the overall performance of a broad range of stocks in a particular market. Examples of broad market indexes include the S&P 500, which tracks the performance of 500 large-cap U.S. stocks, and the FTSE 100, which represents the 100 largest companies listed on the London Stock Exchange.

2. Sector Index: Sector indexes focus on specific sectors or industries within the market. These indexes provide investors with insights into the performance of a particular sector. Examples of sector indexes include the Technology Select Sector Index, which tracks the performance of technology companies in the U.S., and the Financial Select Sector Index, which represents the performance of financial companies.

3. International Index: International indexes track the performance of stocks or securities in markets outside of a specific country. These indexes allow investors to assess the performance of global markets. Examples of international indexes include the MSCI World Index, which represents developed markets globally, and the MSCI Emerging Markets Index, which tracks the performance of emerging market countries.

4. Bond Index: Bond indexes track the performance of fixed-income securities, such as government bonds or corporate bonds. These indexes provide insights into the performance of the bond market. Examples of bond indexes include the Bloomberg Barclays U.S. Aggregate Bond Index, which represents the U.S. investment-grade bond market, and the FTSE World Government Bond Index, which tracks government bonds globally.

5. Commodity Index: Commodity indexes track the performance of commodities, such as gold, oil, or agricultural products. These indexes allow investors to monitor the performance of the commodity market. Examples of commodity indexes include the S&P GSCI (Goldman Sachs Commodity Index), which tracks a broad range of commodities, and the Bloomberg Commodity Index, which represents a diversified group of commodities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.