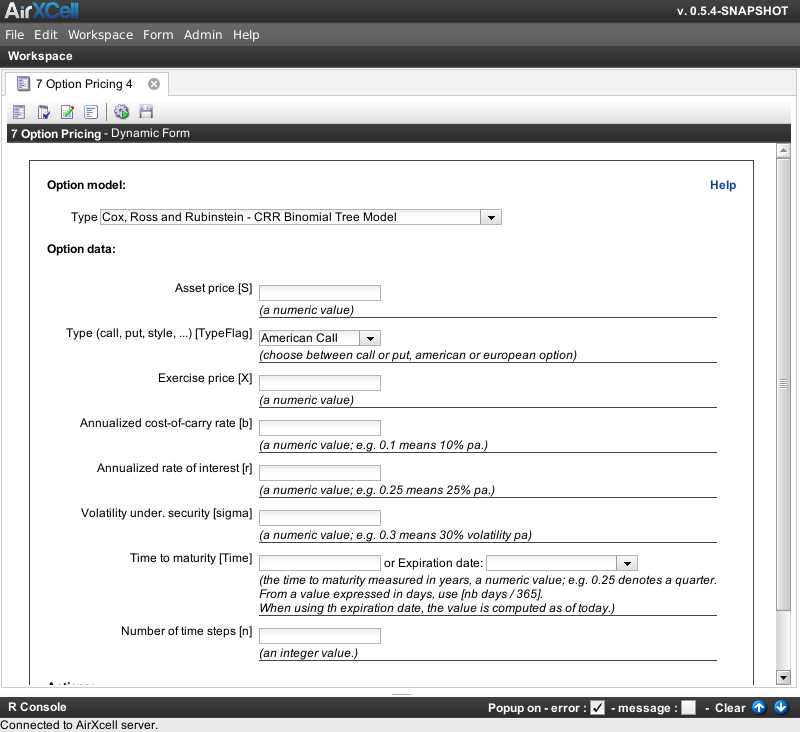

Definition and Pricing

A lookback option is a type of financial derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at the most favorable price achieved during a specified period. The key feature of a lookback option is that it allows the holder to “look back” over the entire period and choose the optimal price at which to exercise the option.

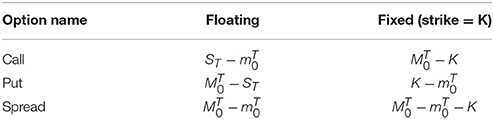

There are two main types of lookback options: fixed lookback options and floating lookback options. Fixed lookback options have a predetermined strike price, while floating lookback options have a strike price that is determined at the end of the specified period based on the most favorable price achieved.

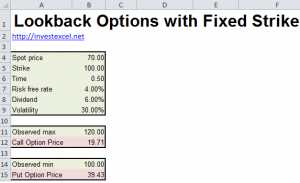

Fixed Lookback Options

A fixed lookback option allows the holder to buy or sell the underlying asset at a predetermined strike price. The strike price is set at the beginning of the specified period and remains fixed throughout the period. The holder can exercise the option at any time during the period, choosing the most favorable price achieved.

Floating Lookback Options

A floating lookback option allows the holder to buy or sell the underlying asset at the most favorable price achieved during the specified period. The strike price is not predetermined, but instead, it is determined at the end of the period based on the highest or lowest price achieved.

Floating lookback options are often used by investors who want to maximize their potential gains while limiting their downside risk. By allowing the holder to choose the most favorable price achieved, floating lookback options provide the opportunity for greater profits compared to fixed lookback options.

Examples and Case Studies

Example 1:

Let’s consider a lookback call option on a stock. The strike price of the option is $50, and the lookback period is one year. During this period, the stock price reaches a maximum of $60 and a minimum of $40. At the expiration of the option, the stock price is $55.

Example 2:

Now, let’s consider a lookback put option on a commodity. The strike price of the option is $100, and the lookback period is six months. During this period, the commodity price reaches a maximum of $120 and a minimum of $80. At the expiration of the option, the commodity price is $90.

Let’s consider a case study of a company that wants to hedge its foreign exchange risk using lookback options. The company operates globally and is exposed to fluctuations in exchange rates. It decides to purchase lookback call options on a foreign currency to protect itself against a potential appreciation of the currency.

During the lookback period, the exchange rate reaches a maximum of 1.5 and a minimum of 1.2. At the expiration of the options, the exchange rate is 1.4. As a result, the company can exercise the options and buy the foreign currency at the minimum exchange rate of 1.2, which provides a favorable rate compared to the current exchange rate of 1.4.

This case study demonstrates how lookback options can be used as a risk management tool to protect against adverse movements in exchange rates and potentially secure more favorable rates.

Overall, these examples and case studies highlight the versatility and potential benefits of lookback options in various financial scenarios. Whether it’s for hedging purposes or speculative trading, lookback options offer unique features that can be tailored to individual investment strategies.

Fixed vs Floating Lookback Options

Fixed Lookback Options:

A fixed lookback option is an option contract that allows the holder to purchase or sell an underlying asset at the lowest or highest price that the asset reached during a specified period. The strike price of the option is fixed, meaning it does not change regardless of the market conditions. This type of option provides the holder with the advantage of knowing the exact price at which they can buy or sell the asset, regardless of any fluctuations in the market.

Example:

Let’s say you hold a fixed lookback call option on a stock with a strike price of $100. The option has a lookback period of one month. During this month, the stock reaches a low of $90 and a high of $120. Since the strike price is fixed at $100, you have the right to buy the stock at $100, regardless of its current market price. This can be advantageous if the stock price increases significantly during the lookback period.

Floating Lookback Options:

A floating lookback option, on the other hand, has a strike price that is determined by the lowest or highest price that the underlying asset reached during a specified period. This means that the strike price is not fixed and can change depending on the market conditions. This type of option provides the holder with the advantage of being able to purchase or sell the asset at a more favorable price if the market moves in their favor.

Example:

Let’s say you hold a floating lookback call option on a stock with a lookback period of one month. During this month, the stock reaches a low of $90 and a high of $120. The strike price of your option is determined by the lowest price reached during the lookback period, which is $90. This means that you have the right to buy the stock at $90, even if its current market price is higher. This can be advantageous if the stock price decreases significantly during the lookback period.

Strategy and Education

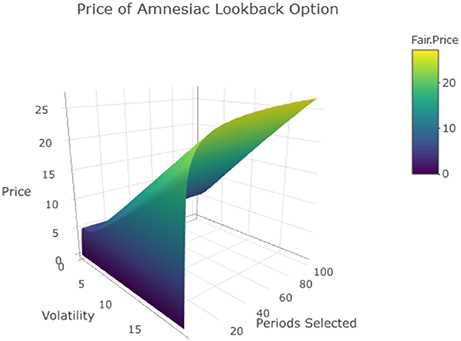

Firstly, let’s discuss the strategy behind lookback options. These options provide investors with the opportunity to benefit from the underlying asset’s highest or lowest price over a specified period. This unique feature allows investors to capitalize on market trends and volatility.

Another strategy is the “fixed strike” approach, where the strike price is set at the beginning of the lookback period. This strategy can be beneficial if you have a strong belief in the direction of the market and want to take advantage of potential price movements.

Additionally, it’s crucial to analyze historical data and market trends when considering lookback options. By studying past price movements and market conditions, you can gain valuable insights into potential future price movements and make more educated investment choices.

Lastly, it’s essential to stay updated on market news and developments that may impact the underlying asset’s price. By staying informed, you can adjust your strategy accordingly and potentially maximize your returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.