Definition of Liquidity Trap

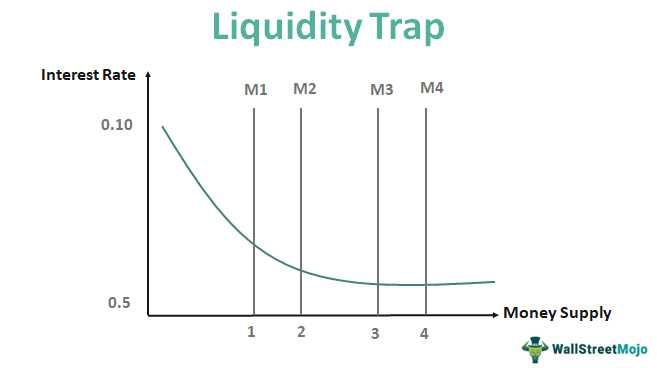

A liquidity trap is an economic situation in which interest rates are very low, and monetary policy measures, such as lowering the central bank’s interest rate, fail to stimulate economic growth and increase inflation. In a liquidity trap, people and businesses prefer to hold onto cash rather than invest or spend it, even though interest rates are low.

When an economy enters a liquidity trap, it is often a sign of a severe economic downturn or recession. The central bank tries to stimulate the economy by lowering interest rates, but because people and businesses are hesitant to borrow and spend, the lower interest rates have little impact on economic activity.

Causes of Liquidity Trap

There are several factors that can lead to a liquidity trap:

- Deflationary Expectations: When people and businesses expect prices to fall in the future, they may delay spending and investment, leading to a decrease in aggregate demand. This can create a vicious cycle of falling prices and decreasing economic activity.

- High Levels of Debt: If individuals and businesses have high levels of debt, they may prioritize debt repayment over spending or investment, even when interest rates are low. This reduces the effectiveness of monetary policy in stimulating economic growth.

- Uncertainty: During periods of economic uncertainty, individuals and businesses may be more cautious and reluctant to spend or invest, even when interest rates are low. This can create a self-reinforcing cycle of low economic activity.

In a liquidity trap, traditional monetary policy measures, such as lowering interest rates, become ineffective in stimulating economic growth. Central banks may need to explore unconventional monetary policy tools, such as quantitative easing or direct lending to businesses, to try to break free from the liquidity trap.

Causes of Liquidity Trap

A liquidity trap occurs when the central bank’s monetary policy becomes ineffective in stimulating economic growth and inflation due to extremely low interest rates and a lack of demand for credit. This situation can arise from various causes, including:

1. Zero Lower Bound

The zero lower bound refers to the point at which interest rates cannot be lowered further, typically close to zero. When interest rates are already at or near zero, the central bank loses its ability to stimulate the economy through conventional monetary policy tools, such as lowering interest rates. This can lead to a liquidity trap, as businesses and individuals are unwilling or unable to borrow and spend, even with low borrowing costs.

2. Deflationary Expectations

3. Debt Overhang

4. Uncertainty and Risk Aversion

5. Structural Issues

| Causes of Liquidity Trap |

|---|

| Zero Lower Bound |

| Deflationary Expectations |

| Debt Overhang |

| Uncertainty and Risk Aversion |

| Structural Issues |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.