What is an Index-Linked Bond?

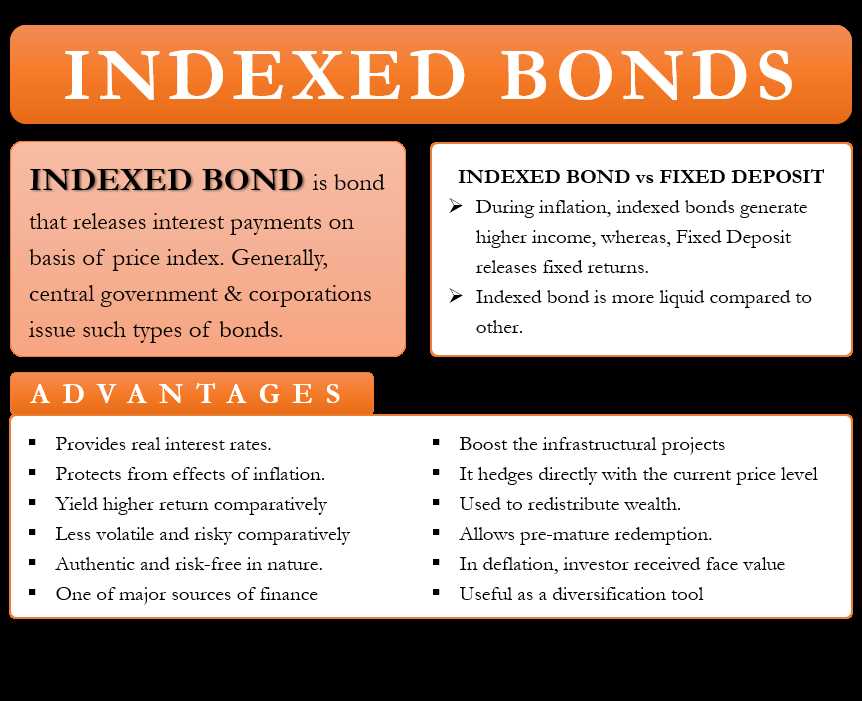

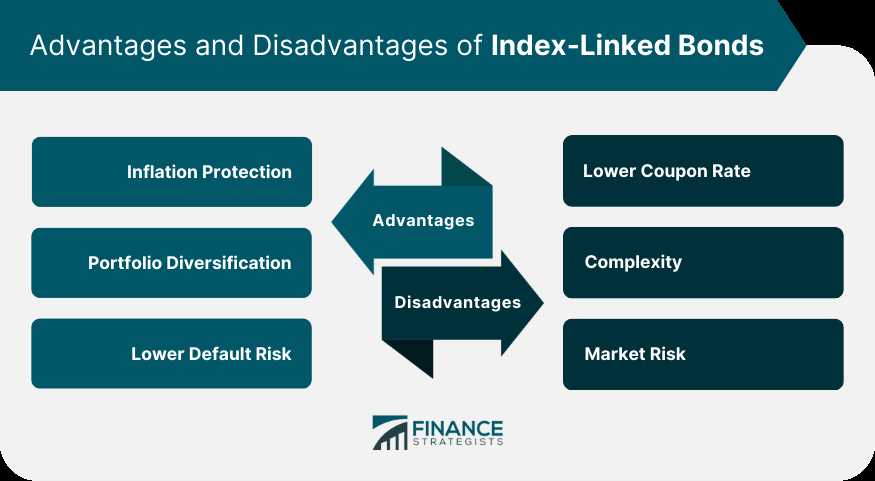

The purpose of an index-linked bond is to provide investors with a hedge against inflation. Inflation erodes the purchasing power of money over time, so by linking the bond’s payments to an inflation index, investors can ensure that their investment keeps pace with rising prices.

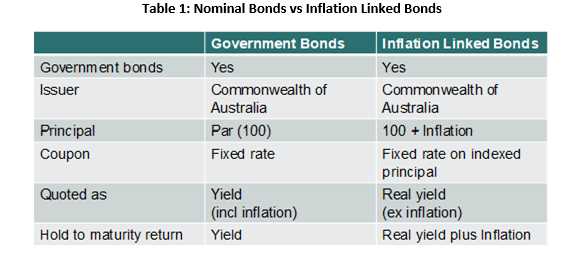

Index-linked bonds typically have a fixed coupon rate, which is the percentage of the bond’s face value that is paid out as interest each year. However, unlike traditional bonds, the interest payments on index-linked bonds are adjusted based on changes in the inflation index. If the inflation index rises, the interest payments on the bond will increase, providing investors with a higher yield. Conversely, if the inflation index falls, the interest payments will decrease.

At maturity, the principal value of an index-linked bond is also adjusted based on changes in the inflation index. This means that the bond’s face value will increase or decrease in line with changes in the inflation index. As a result, investors are protected against the erosion of the bond’s value due to inflation.

The main purpose of index-linked bonds is to provide investors with a hedge against inflation. By linking the bond’s payments to an inflation index, investors can ensure that their investment keeps pace with the rising cost of living. This makes index-linked bonds particularly attractive to investors who are concerned about the erosion of purchasing power caused by inflation.

One key feature of index-linked bonds is their periodic adjustment of principal and interest payments. This adjustment is typically made on a semi-annual basis, although the frequency may vary depending on the specific bond. The adjustment is based on the change in the inflation index over the specified period, and it ensures that the bond’s payments keep pace with inflation.

Investors in index-linked bonds also have the potential to earn a real rate of return, which is the return on investment after accounting for inflation. This can provide an additional source of income for investors, especially during periods of high inflation.

Functionality of Index-Linked Bonds

One of the key features of index-linked bonds is their ability to provide a real rate of return. Unlike traditional fixed-income securities, where the interest rate is fixed and the purchasing power of the investment can be eroded by inflation, index-linked bonds adjust the principal and interest payments to keep pace with inflation. This means that investors can expect to receive a return that is adjusted for changes in the cost of living.

Index-linked bonds typically have a fixed coupon rate, which is the interest rate paid on the bond, and a maturity date, which is the date when the bond will be repaid in full. However, the principal value of the bond is adjusted periodically based on changes in the inflation index. This adjustment ensures that the purchasing power of the investment is maintained over time.

When the inflation index increases, the principal value of the bond is adjusted upwards, which means that the investor will receive a higher repayment amount at maturity. Conversely, when the inflation index decreases, the principal value is adjusted downwards, resulting in a lower repayment amount. This adjustment mechanism helps to protect investors from the erosion of purchasing power caused by inflation.

Index-linked bonds are typically issued by governments and are considered to be low-risk investments. They are often used as a hedge against inflation and can provide a reliable source of income for investors, especially during periods of high inflation. These bonds are also attractive to investors who are seeking to diversify their portfolios and reduce the risk associated with traditional fixed-income securities.

Real-Life Example of Index-Linked Bond

To better understand how index-linked bonds work in practice, let’s take a look at a real-life example.

Suppose a government issues an index-linked bond with a face value of $1,000 and a coupon rate of 2%. The bond is linked to the Consumer Price Index (CPI), which measures inflation. The bond has a maturity of 10 years.

After one year, the CPI increases to 210, reflecting a 5% increase in inflation. As a result, the bond’s principal value is adjusted upward by 5% to $1,050. The coupon payment for the second year is then calculated based on the adjusted principal value, resulting in a coupon payment of $21.

Over the next few years, the CPI continues to rise, and the bond’s principal value is adjusted accordingly. This ensures that the bondholder’s investment keeps pace with inflation.

Now, let’s fast forward to the maturity of the bond, 10 years later. Suppose the CPI has increased to 250, reflecting a 25% increase in inflation over the bond’s term. The bond’s principal value is adjusted upward by 25% to $1,250.

At maturity, the bondholder receives the adjusted principal value of $1,250, in addition to the final coupon payment based on the adjusted principal value. This ensures that the bondholder is protected against the erosion of purchasing power caused by inflation.

Overall, index-linked bonds provide investors with a way to hedge against inflation and preserve the real value of their investment. They offer a unique investment opportunity that combines the stability of fixed income securities with the potential for inflation protection.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.