Hire Purchase Agreements

A hire purchase agreement is a type of financial arrangement that allows businesses to acquire assets without having to pay the full purchase price upfront. It is a popular option for companies looking to expand their operations or upgrade their equipment.

Under a hire purchase agreement, the business agrees to make regular payments over a specified period of time. These payments typically include both the principal amount and interest, which is calculated based on the agreed-upon interest rate.

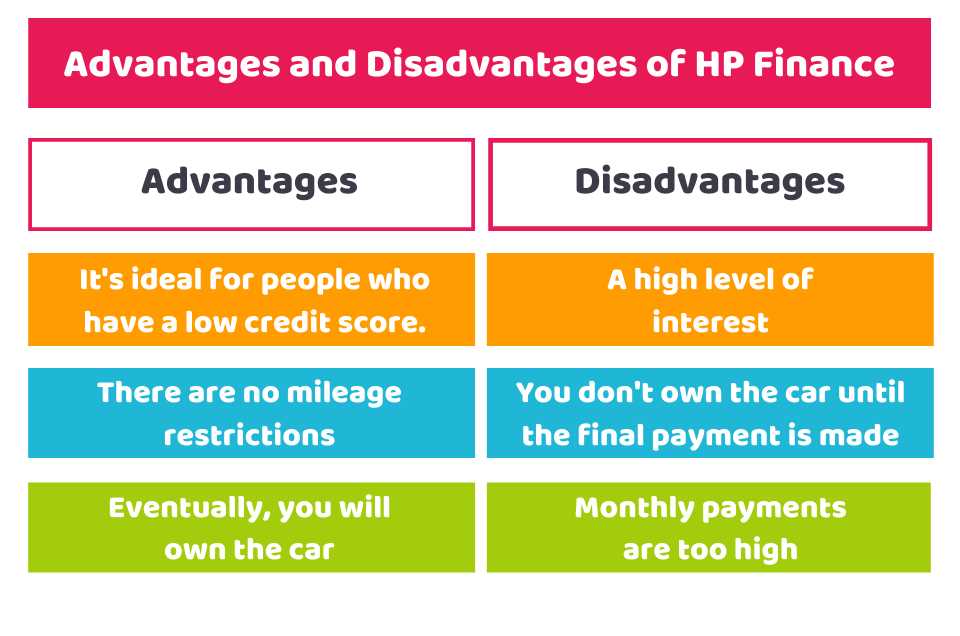

One of the main advantages of hire purchase agreements is that they provide businesses with immediate access to the assets they need, without requiring a large upfront investment. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the necessary capital to purchase assets outright.

Another advantage of hire purchase agreements is that they offer flexibility in terms of repayment options. Businesses can choose the repayment period that best suits their cash flow and financial situation. Additionally, businesses may have the option to purchase the asset at the end of the agreement, usually for a nominal fee.

It is important for businesses considering a hire purchase agreement to carefully review the terms and conditions of the agreement, including the interest rate, repayment period, and any additional fees or charges. It is also advisable to seek professional advice to ensure that the agreement is suitable for the business’s specific needs and financial situation.

All You Need to Know

One of the main advantages of hire purchase agreements is that they allow businesses to acquire assets without having to make a large upfront payment. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the necessary capital to purchase assets outright.

Another advantage of hire purchase agreements is that they offer flexibility in terms of payment options. Buyers can choose the duration of the agreement and the size of the installments based on their cash flow and financial situation.

Additionally, hire purchase agreements often come with tax benefits. In some jurisdictions, the interest and depreciation expenses associated with the asset can be deducted from the buyer’s taxable income, reducing their overall tax liability.

CORPORATE DEBT catname

What is a Hire Purchase Agreement?

A Hire Purchase Agreement is a contract between a business and a financing company, where the business agrees to pay for an asset in installments over a specified period. During this time, the financing company retains ownership of the asset until the final payment is made.

This type of agreement is commonly used for acquiring vehicles, machinery, and equipment. It allows businesses to access the assets they need without having to pay the full cost upfront, which can be beneficial for cash flow management.

How Does a Hire Purchase Agreement Work?

Once the agreement is in place, the business makes regular payments to the financing company. These payments consist of both principal and interest, and they continue until the full cost of the asset, plus any additional fees, is paid off.

Advantages of a Hire Purchase Agreement

There are several advantages to using a Hire Purchase Agreement for corporate debt financing:

| 1. | Flexible Repayment Terms |

| 2. | Preserves Cash Flow |

| 3. | Asset Ownership |

| 4. | Tax Benefits |

By opting for a Hire Purchase Agreement, businesses can enjoy these benefits while acquiring the assets they need to grow and thrive.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.