What is Grid Trading?

Grid trading is a popular strategy used by forex traders to capitalize on market volatility and generate profits. It involves placing buy and sell orders at predetermined intervals or price levels, creating a grid-like pattern on the chart.

Grid trading is often used in range-bound markets, where prices tend to oscillate between support and resistance levels. By placing orders at these levels, traders can profit from the repetitive nature of price movements.

Advantages of Grid Trading

Grid trading is a popular strategy among forex traders due to its numerous advantages. Here are some of the key benefits:

- Reduced Risk: Grid trading allows traders to spread their risk by placing multiple trades at different price levels. This helps to minimize the impact of market volatility and reduces the risk of significant losses.

- Consistent Profits: Grid trading is designed to generate consistent profits in both trending and ranging markets. By placing trades at regular intervals, traders can take advantage of price fluctuations and capture profits on both the upside and downside.

- Flexibility: Grid trading can be customized to suit individual trading preferences and risk tolerance. Traders can adjust the grid size, entry and exit points, and other parameters to align with their trading strategy.

- Automation: Grid trading strategies can be automated using trading bots or expert advisors. This allows traders to execute trades automatically based on predefined rules, saving time and effort.

- Diversification: Grid trading allows traders to diversify their portfolio by trading multiple currency pairs simultaneously. This helps to spread the risk and increase the chances of profitable trades.

- Scalability: Grid trading can be scaled up or down depending on market conditions and account size. Traders can increase or decrease the grid size and trade volume to adapt to changing market dynamics.

How to Implement Grid Trading

Implementing grid trading involves several steps that traders need to follow in order to effectively execute this strategy. Here is a step-by-step guide on how to implement grid trading:

Step 1: Define Your Grid Parameters

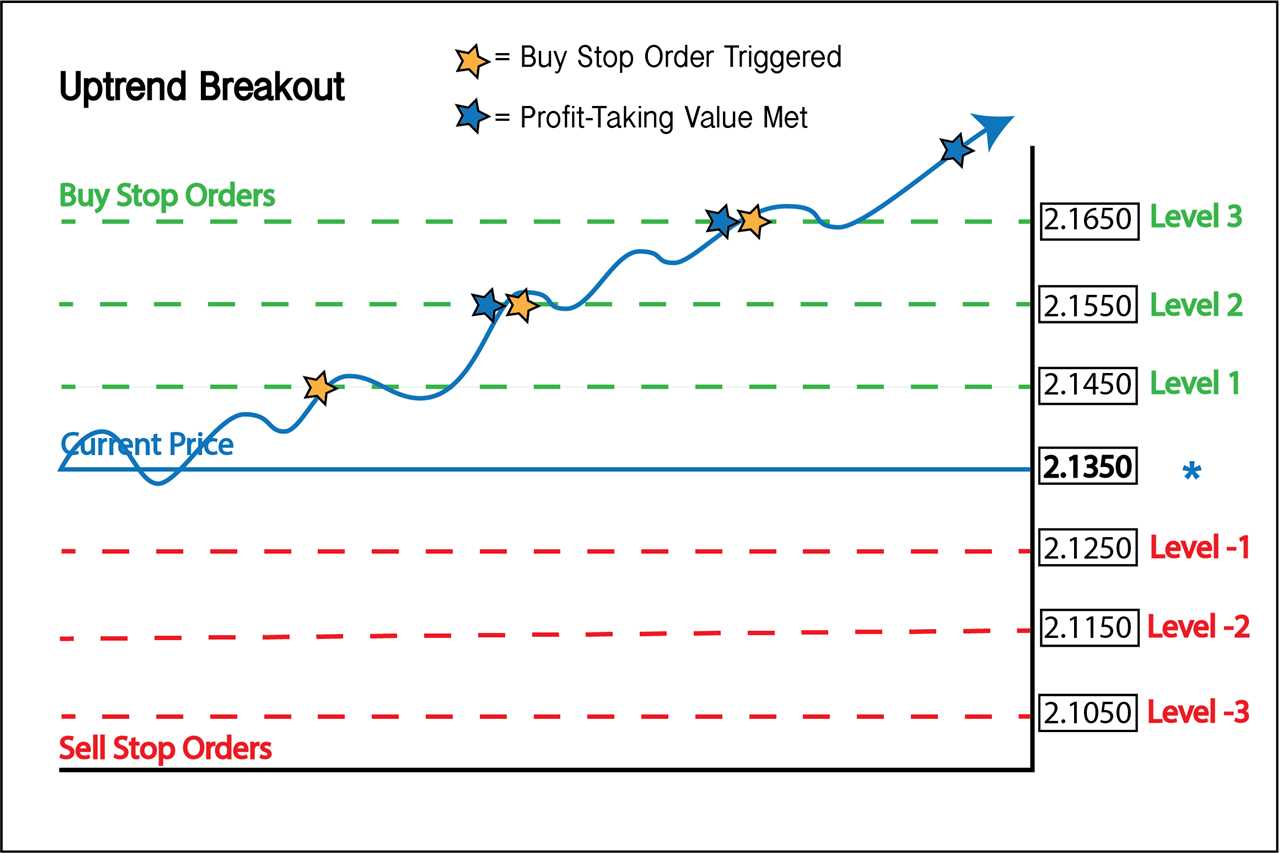

The first step in implementing grid trading is to define your grid parameters. This includes determining the size of the grid, the distance between each grid level, and the number of grid levels you want to use. These parameters will depend on your trading style, risk tolerance, and market conditions.

Step 2: Identify the Trend

Before implementing grid trading, it is important to identify the trend in the market. This can be done using technical analysis tools such as moving averages, trend lines, or indicators. Grid trading works best in ranging or sideways markets, so it is important to avoid using this strategy in strongly trending markets.

Step 3: Place Grid Orders

Once you have defined your grid parameters and identified the trend, you can start placing grid orders. Grid orders are placed at each grid level, both above and below the current market price. These orders are typically placed as limit orders, which means they will only be executed if the market reaches the specified price level.

Step 4: Manage Your Grid

Managing your grid is crucial to the success of grid trading. This involves monitoring the market and adjusting your grid levels as needed. If the market moves in your favor, you can close profitable grid levels and open new ones at higher or lower price levels. If the market moves against you, you may need to add new grid levels or adjust your existing grid levels to minimize losses.

Step 5: Set Stop Loss and Take Profit Levels

It is important to set stop loss and take profit levels for each grid level to manage risk and protect your profits. Stop loss orders should be placed below the lowest grid level for long positions and above the highest grid level for short positions. Take profit orders can be placed at predetermined price levels or based on technical analysis indicators.

Step 6: Monitor and Adjust

Grid trading requires constant monitoring and adjustment. Traders need to stay updated with market conditions, news events, and technical analysis indicators to make informed decisions about when to close or adjust their grid levels. It is important to be flexible and adapt your grid trading strategy based on changing market conditions.

By following these steps, traders can effectively implement grid trading and take advantage of its potential profitability in the forex market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.