General Agreements to Borrow: Meaning

A General Agreement to Borrow (GAB) is a financial arrangement between member countries of the International Monetary Fund (IMF) that allows them to provide temporary assistance to countries facing balance of payments problems. It is a form of international cooperation aimed at maintaining stability in the global financial system.

The GAB was established in 1962 as a response to the need for a mechanism to provide liquidity to countries facing financial difficulties. It allows member countries to borrow funds from other member countries in times of need. The borrowing country can access funds in the form of a loan, which is usually repaid within a specified period of time.

Definition, Purpose, and Functioning

The GAB is a multilateral agreement that sets out the terms and conditions for borrowing and lending among member countries. It provides a framework for countries to access financial resources quickly and efficiently in times of crisis. The purpose of the GAB is to promote international financial stability and prevent the spread of financial contagion.

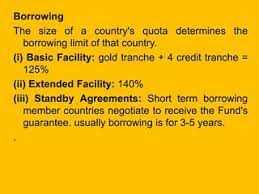

The GAB functions through a quota system, where each member country contributes a certain amount of funds to the agreement based on its economic size and financial capacity. These funds are then made available to countries in need through loans. The borrowing country is typically required to meet certain conditions, such as implementing economic reforms or policy adjustments, in order to access the funds.

Advantages and Disadvantages of GABs

However, GABs also have some disadvantages. Firstly, the borrowing country may become dependent on external assistance and fail to implement necessary reforms to address the root causes of its financial difficulties. Secondly, the terms and conditions of GAB loans may be stringent, requiring the borrowing country to adopt specific policies or undertake certain actions that may not be in its long-term interest. Lastly, GABs may create moral hazard, as countries may take excessive risks knowing that they can rely on external assistance in times of crisis.

| Pros | Cons |

|---|---|

| Provides liquidity during financial crises | Dependency on external assistance |

| Promotes international cooperation | Stringent terms and conditions |

| Prevents spread of financial contagion | Moral hazard |

Definition, Purpose, and Functioning

The General Agreements to Borrow (GAB) is a financial arrangement established by the International Monetary Fund (IMF) to provide temporary liquidity support to its member countries facing balance of payments difficulties. It serves as a supplementary source of funding for countries in need, helping them stabilize their economies and restore confidence in their financial systems.

The purpose of the GAB is to promote international monetary cooperation and maintain global financial stability. It aims to prevent and mitigate financial crises by providing access to additional resources when countries face a shortage of foreign exchange reserves. By doing so, it helps prevent the spread of financial contagion and supports the stability of the international monetary system.

The GAB operates on a quota-based system, where each participant’s contribution is determined by its quota in the IMF. The amount of funds a country can borrow under the GAB is limited to a certain percentage of its quota. This ensures that the borrowing is proportionate to the country’s financial position and reduces the risk of overborrowing.

The GAB is activated when the IMF determines that a member country is experiencing a balance of payments need that cannot be met through its existing resources. The borrowing country must meet certain conditions and commitments, such as implementing economic reforms and policies recommended by the IMF, to qualify for GAB assistance.

The GAB has played a crucial role in providing financial support to countries during times of crisis. It has been used in various instances, including the Latin American debt crisis in the 1980s and the Asian financial crisis in the late 1990s. The GAB has proven to be an effective tool in addressing liquidity needs and restoring stability in the global financial system.

General Agreements to Borrow: Pros and Cons

General Agreements to Borrow (GABs) are international financial arrangements that provide a framework for member countries to lend to each other in times of financial crisis. While GABs can be beneficial in certain situations, they also come with their own set of pros and cons.

Advantages of GABs

1. Financial Stability: GABs help promote financial stability by providing member countries with access to additional liquidity during times of crisis. This can help prevent or mitigate the effects of financial contagion and systemic risks.

2. Flexibility: GABs offer flexibility in terms of borrowing arrangements. Member countries can access funds based on their individual needs and circumstances, allowing for tailored solutions to address specific financial challenges.

3. Speedy Response: GABs enable swift responses to financial crises. The arrangements are designed to provide quick access to funds, allowing member countries to take immediate action to stabilize their economies and restore market confidence.

4. Diversification of Funding Sources: GABs provide member countries with an additional source of funding, diversifying their borrowing options. This can reduce reliance on traditional sources of financing and enhance financial resilience.

Disadvantages of GABs

1. Conditionality: GABs often come with conditions attached to borrowing, such as implementing specific economic reforms or policy measures. This can limit the sovereignty of member countries and may impose constraints on their ability to pursue their own economic policies.

2. Moral Hazard: GABs can create moral hazard by providing a safety net for member countries. Knowing that they have access to emergency funds, countries may be less incentivized to implement necessary economic reforms or take preventive measures to avoid financial crises.

3. Inequality: GABs may exacerbate inequality among member countries. Larger and more influential countries may have greater access to funds, while smaller and less influential countries may face difficulties in obtaining the necessary financial support.

4. Repayment Obligations: GABs require member countries to repay the borrowed funds with interest. This can create additional financial burdens for countries already facing economic challenges, potentially leading to a cycle of debt and dependency.

Advantages and Disadvantages of General Agreements to Borrow (GABs)

General Agreements to Borrow (GABs) are financial arrangements between member countries and the International Monetary Fund (IMF) that provide additional resources to countries facing balance of payments difficulties. While GABs can be beneficial in certain situations, they also come with their own set of advantages and disadvantages.

Advantages of GABs:

- Increased financial stability: GABs provide countries with access to additional financial resources during times of economic crisis or instability. This can help stabilize the economy and prevent further deterioration.

- Enhanced confidence: The existence of GABs can boost investor confidence in a country’s ability to manage its financial situation. This can attract foreign investment and contribute to economic growth.

- Flexible borrowing terms: GABs offer flexible borrowing terms, allowing countries to access funds on short notice and repay them over a predetermined period. This flexibility can be crucial during times of urgent need.

- Pooling of resources: GABs involve multiple countries pooling their financial resources together. This collective effort can provide a larger pool of funds, which can be more effective in addressing systemic financial crises.

- Support for policy adjustments: GABs often come with conditions that require countries to implement policy adjustments or reforms. This can help countries address underlying economic issues and promote long-term stability.

Disadvantages of GABs:

- Conditionalities: GABs typically come with conditions that require countries to implement specific economic policies or reforms. These conditions may be challenging to meet and can limit a country’s sovereignty in making its own economic decisions.

- Debt burden: Borrowing through GABs can increase a country’s debt burden, especially if the borrowed funds are not used effectively or if the country’s economic situation does not improve as expected. This can lead to long-term financial challenges.

- Dependency on external funding: Relying on GABs for financial assistance can create a dependency on external funding sources. This can make a country vulnerable to changes in global financial conditions and may limit its ability to pursue independent economic policies.

- Political considerations: The decision to provide GABs may involve political considerations, which can introduce biases and uneven distribution of resources. This can undermine the effectiveness and fairness of the GABs system.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.